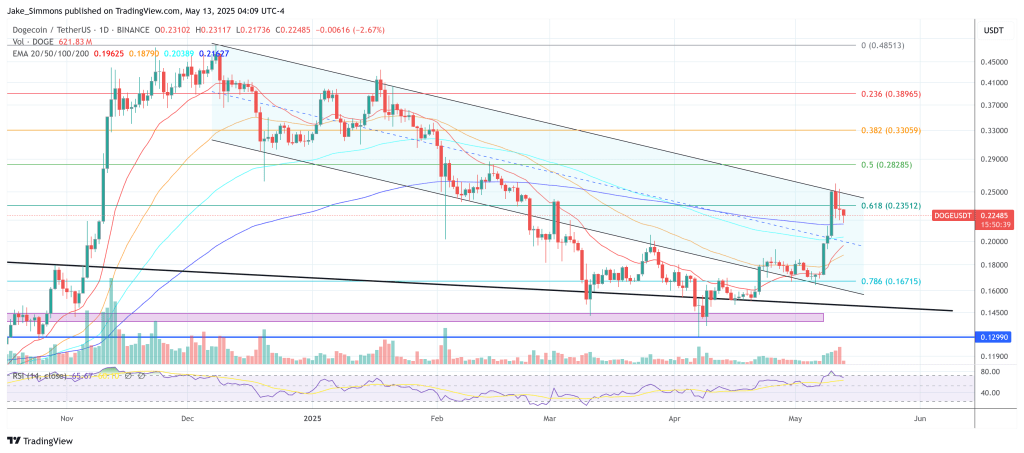

Dogecoin’s revival from the late-April trough at $0.1298 to Monday’s intraday spike at roughly $0.2597 has thrust the original meme-asset into a technically decisive arena, inspiring three top market technicians to publish fresh views.

What’s Next For Dogecoin?

Crypto analyst Ali Martinez plots a 12-hour DOGE/USD chart that frames a supply band between $0.25 and $0.27. That zone supported price in December 2024 and February 2025 three times, but flipped to resistance after late February’s breakdown, a role it has repeated in every rally since.

Martinez marks each failed thrust with black arrows and notes the most recent 12-hour close at $0.24903 sitting inside the band. In his words, “Dogecoin has reached a crucial area of resistance!” Until bulls print decisive closes above the upper boundary at $0.27, the region remains a potential turning point.

Rekt Capital zooms out to the weekly time-frame and points to a horizontal pivot at $0.22014, labelled “Pre-Halving resistance” on his DOGE/USDT chart. After reclaiming that level, price is now dipping back toward it, a move the analyst calls “that key retest of Pre-Halving resistance into new support … Retest is now in progress. Hold green and at least $0.27 would be next.”

The green support box extends roughly $0.19–$0.22 and sits atop an 18-month rising trend-line that converges near $0.15901. A weekly defence of this cluster would open the way to the next resistances Rekt Capital plots at $0.27884 and $0.33817.

Bitcoinsensus focuses on momentum, overlaying a weekly MACD on his DOGE/USDT chart. The fast line is on the verge of crossing above the signal line for the first time since late-2024. He highlights that the previous two bullish crossovers preceded rallies of ≈ +165 % (to $0.23) and ≈ +330 % (to $0.48).

Citing that pattern, the analyst writes: “DOGE BULLISH MACD CROSS … Next Price Target : $0.72.” His chart projects a parabolic path toward $0.72, while a dotted ascending baseline anchored in March 2024 still underpins the structure in the mid-$0.15 region.

Collectively the three studies leave Dogecoin at an inflection point. A clean break above $0.27 would neutralise the multi-month supply zone highlighted by Martinez and validate Rekt Capital’s next weekly objectives.

Failure to sustain that level, or a weekly close back under $0.22, would refocus attention on the trend-line and horizontal support in the high-$0.15s. For momentum traders, confirmation of the looming MACD crossover could be the trigger that sets the stage for Bitcoinsensus’ lofty $0.72 projection. For now, participants watch whether the meme-coin’s latest bark translates into another bite.

At press time, DOGE traded at $0.22485.