Data shows Dogecoin (DOGE) has seen significant long liquidations as its price has gone through a steep decline during the past day.

Dogecoin Has Retraced Some Of Its Latest Recovery

Following a breach of the $0.25 level to start the week, the trend appears to have flipped for Dogecoin again as its price has registered a plunge during the past day.

Below is a chart that shows the recent price action for the memecoin.

As is visible in the graph, Dogecoin went to as low as the $0.217 mark in this crash, but the coin has since seen a bit of a rebound as it’s now back at $0.227. Though, despite this bounce, DOGE remains almost 10% in the red over the last 24 hours.

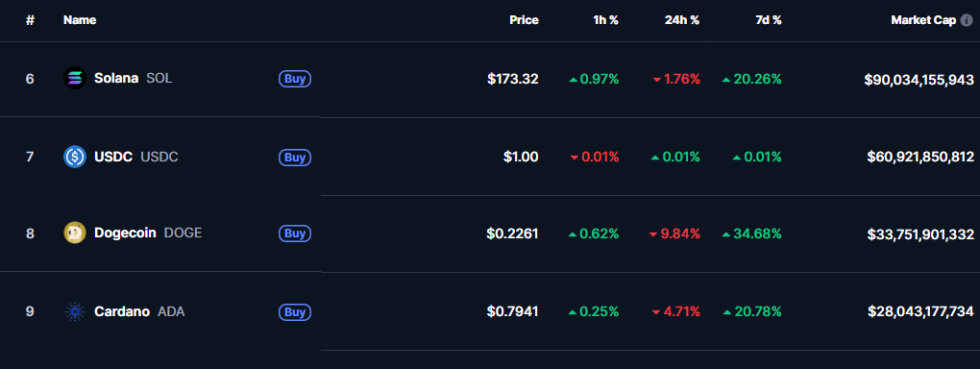

The past day has also been red for most of the other cryptocurrencies, but DOGE has still stood out as one of the worst performers among the top tokens by market cap. That said, the memecoin is still among the best when past week’s timeframe is considered instead, as its price has gone up over 34% in this window.

Speaking of the market cap, DOGE is currently the eighth-largest cryptocurrency in the sector, ahead of Cardano (ADA).

DOGE & Other Coins Have Just Seen Notable Long Liquidations

A consequence of the bearish price action across the cryptocurrency sector has been that liquidations have piled up over on the derivatives exchanges. “Liquidation” here refers to the process of forceful closure that any open contract has to go through after it has accumulated losses of a specific percentage.

Considering that Dogecoin has been more volatile than most in the past day and the fact that the memecoin generally attracts high speculative interest, it would be expected that the asset would be up there in terms of liquidations. And indeed, data from CoinGlass would confirm it.

As displayed in the above heatmap, Dogecoin has seen contracts worth $22.5 million liquidated in the last 24 hours, the fourth most in the entire sector. Out of these, more than $19 million of the positions involved were long ones, a natural consequence of the largely negative price action during this period.

While DOGE’s liquidations are significant on their own, they pale in comparison to the numbers Bitcoin ($154 million) and Ethereum ($136 million) have posted, showcasing the gap in speculative activity between the altcoins and these two cryptocurrency giants.

As a whole, the digital asset sector has seen liquidations surpassing $610 million, with around $489 million of the flush coming from the long investors alone.