Bitcoin (BTC) remained largely stable after the release of the US Consumer Price Index (CPI) for April 2025, which came in below expectations. The data suggests inflation is continuing to cool, a potentially positive sign for risk-on assets like BTC.

Bitcoin Makes Minimal Move After April CPI Data

The Bureau of Labor Statistics reported a 0.2% increase in April CPI, slightly under the 0.3% forecast. While the figure marked a rebound from the -0.1% decline recorded in March 2025, it still pointed to subdued inflationary pressures.

Year-over-year (YoY), CPI rose by 2.3% – the slowest annual increase since February 2021. Core CPI, which excludes volatile food and energy prices, rose by 0.2% in April compared to 0.1% in March. This was also below the consensus estimate of 0.3%. On a YoY basis, Core CPI remained steady at 2.8%, in line with expectations.

The lower-than-expected inflation data supports the Federal Reserve’s cautious “wait and watch” stance on interest rate cuts, bolstering the case for holding current policy until further macroeconomic clarity emerges.

Despite the positive macro backdrop, Bitcoin’s price reaction was muted. At the time of writing, BTC is trading in the low $100,000 range – approximately 5.1% below its all-time high (ATH) of $108,786 set in January 2025.

Although the price response was mild, technical analysts remain optimistic. Noted crypto analyst Titan of Crypto shared the following chart indicating a potential move to new all-time highs, driven by a strengthening weekly Relative Strength Index (RSI).

Similarly, crypto analyst Jelle commented on BTC’s resilience around the $102,000 level, suggesting this may act as a strong support zone. “Not much is left to hold BTC back now,” the analyst noted, indicating confidence in a continued rally.

BTC Exchange Reserves Depleting, Investors Accumulating

On-chain data also supports the bullish outlook. Crypto influencer Davinci Jeremie pointed out in a recent X post that Bitcoin reserves on centralized exchanges have dropped significantly and are now hovering around 2.4 million BTC – a level that could contribute to a looming supply shock.

Lower BTC reserves on crypto exchanges are likely to bolster the supply shock narrative for the flagship cryptocurrency, which may lead to a parabolic price action. Data also shows that large investors are accumulating BTC.

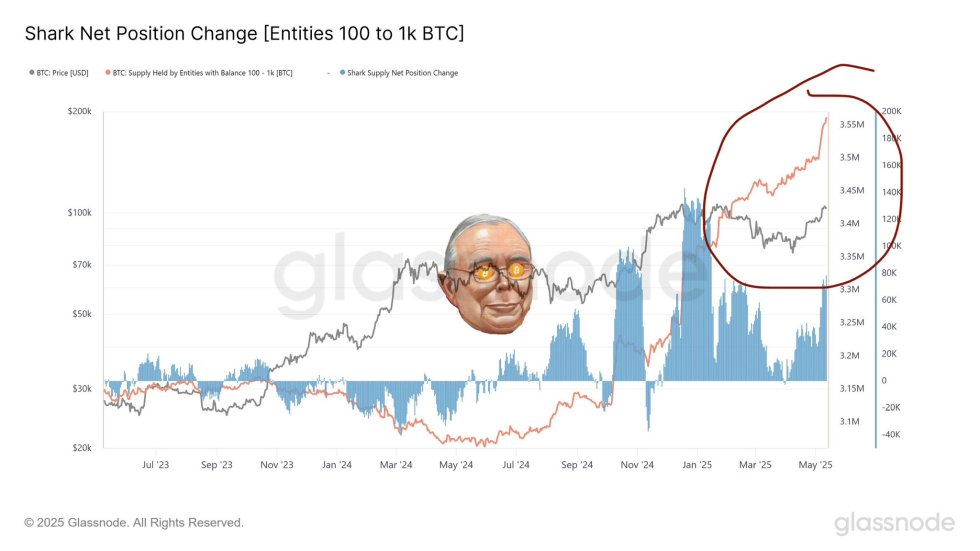

In a separate X post, crypto analyst Bitcoin Munger shared the following chart which shows that BTC sharks – wallets holding 100 to 1,000 BTC – have been accumulating BTC at a rapid pace. Currently, these entities hold more than 3.55 BTC collectively.

That said, recent data shows that open interest has not risen in tandem with the rise in BTC price, which may be a cause for concern. At press time, BTC trades at $103,311, up a modest 0.1% in the past 24 hours.