Dogecoin traders are showing a lot of interest in futures contracts, even though the coin’s price has dipped a bit. That split between price moves and betting activity is drawing attention.

Futures Interest Climbs Despite Pullback

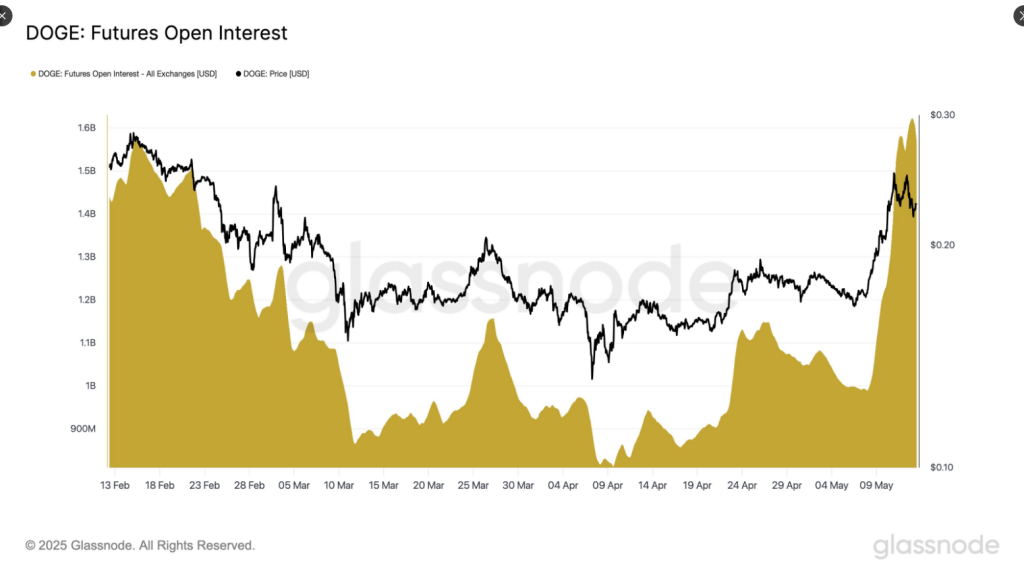

According to on‑chain data provider Glassnode, open interest in Dogecoin futures jumped from almost $990 million to $1.62 billion this week. That rise came after the price slid back from near $0.25 into the $0.22–$0.23 zone.

It’s a sign that traders are still placing big bets, even as momentum cools. Back in mid‑February, open interest fell below $900 million by April, as Dogecoin headed down from its brief rally above $0.23. This week’s surge breaks that past trend.

Despite $DOGE pulling back from its recent high, Futures Open Interest continues to rise, up +63.9% over the past week ($989M → $1.62B). This decoupling suggests persistent speculative positioning, even as price momentum fades – a setup worth monitoring: https://t.co/N343pGpptL pic.twitter.com/icOVcqDffA

— glassnode (@glassnode) May 13, 2025

Price Rally And Minor Setback

Based on reports, Dogecoin climbed from roughly $0.16 on May 6 to just over $0.24 by May 11. That’s a sharp gain in just a few days. Then the price eased back into the $0.22–$0.23 range. Traders saw higher highs and higher lows overall. They’ve held onto the belief that the upward trend is still intact.

Bullish Funding Rate Signals

Funding rates have stayed in positive territory, which shows futures traders are mostly long. Data from Coinglass on May 13, 2025, puts rates at 0.0100% on BitMEX, HTX, Gate.io and Bitget. Binance and OKX are a bit lower, at 0.0036% and 0.0034%. Those numbers mean long holders pay short sellers a small fee. That setup can boost a rally. But if the price drops, it can turn costly for those same traders.

Support Level Under Watch

Market analyst Rekt Capital pointed out that Dogecoin closed above its old pre‑halving resistance on the weekly chart. That level now sits near $0.22 and is acting as support. If DOGE holds that spot, the coin might head toward at least $0.27 next. A failure to stay above $0.22 could shake out some of the most stretched positions.

Overall, the mix of rising futures activity and a soft pullback makes for a tense scene. On one hand, there’s still a strong bullish bias. On the other, too much one‑sided positioning can invite a shakeout.

Traders will be watching weekly closes around $0.22 to see if support holds. If it does, a run at $0.27 could happen. If it doesn’t, shorts may gain the upper hand and push prices lower. Either way, volatility is likely to stay high as Dogecoin’s roller‑coaster ride continues.

Featured image from Gemini Imagen, chart from TradingView