XRP’s price has climbed to $2.61 in the last 24 hours, and has been able to keep a steady pace, registering a 22% gain over the past seven days. Traders are piling into futures contracts.

A notable performance has been in the Open interest department, which jumped by more than 40%.

Rising Futures Activity

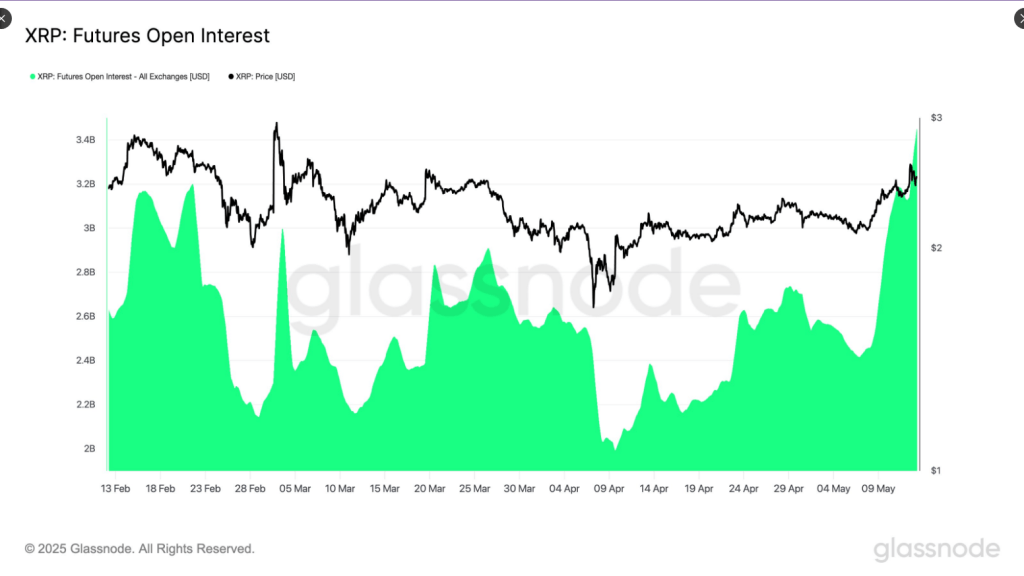

According to Glassnode data posted on May 13, futures open interest for XRP surged from $2.42 billion to $3.42 billion in just one week. That $1 billion increase represents a nearly 42% rise in active contracts.

When both price and open interest climb, it usually means new money is coming in and that traders expect more upside.

$XRP Futures Open Interest has surged by over $1B in the past week, rising from $2.42B to $3.42B (+41.6%). This sharp increase in leverage coincides with a price rally from $2.14 to $2.48, suggesting elevated speculative activity and growing directional conviction, pic.twitter.com/QbsaOM9oxE

— glassnode (@glassnode) May 13, 2025

Price Versus Market Gains

Based on reports, XRP’s one‑week gain outpaces the broader cryptocurrency market, which has risen about 12% over the same period. A near‑20% jump is no small feat when most major coins are up in the low double digits.

Traders see XRP as one of the stronger performers right now, and they are betting accordingly.

Momentum Indicators Point Up

XRP is trading higher than its 10‑, 50‑ and 200‑day moving averages. That indicates short‑term and long‑term trends are both in favor of buyers. The relative strength index is at 68, which is just short of the overbought zone.

There is still space for the rally to continue before reaching a ceiling. The moving average convergence divergence has also crossed higher, suggesting continued upward momentum.

Institutional Demand Grows

Meanwhile, the XXRP ETF has drawn inflows for five straight weeks. Last week, it added $14 million in new money, up from $10 million the week before. The fund now holds almost $100 million in assets.

Even with a 1.80% annual fee—almost twice that of some Bitcoin ETFs—investors still see value in a product tied to XRP.

Odds And Projections

Based on market‑prediction platforms like Polymarket, there is an 79% chance the US Securities and Exchange Commission will approve spot XRP ETFs soon.

According to JPMorgan analysts, these ETFs could attract as much as $8 billion in the first year—more than what Ethereum funds saw after their September 2024 launch. That kind of demand could slingshot XRP even higher.

Outlook And Risks

Rallying price action, growing open interest, and steady ETF inflows make a bullish case. Fast gains could just as easily fade away if traders lock in profits; a drop through the 50-day average would serve as a warning signal. Regulatory delays or a broader sell-off in crypto could derail the rally as well.

For now, XRP sits atop its key averages and sees fresh capital coming in. Many traders and institutions are leaning bullish. Yet anyone getting involved should watch the technical levels and keep an eye on news about spot ETF approvals.

If those pieces fall into place, XRP could be set for another leg up. But if markets cool off or regulators hit pause, the run may stall.

Featured image from Gemini Imagen, chart from TradingView