Bitcoin is showing remarkable strength as it continues its upward momentum, having surged past its all-time high to reach the $112,000 mark yesterday. The price is currently holding firmly above $110K, a critical level that now serves as support as bulls aim to extend the rally. This breakout confirms a strong bullish structure, with market sentiment leaning increasingly positive. However, despite the enthusiasm, caution is creeping in as analysts highlight the growing potential for a near-term pullback.

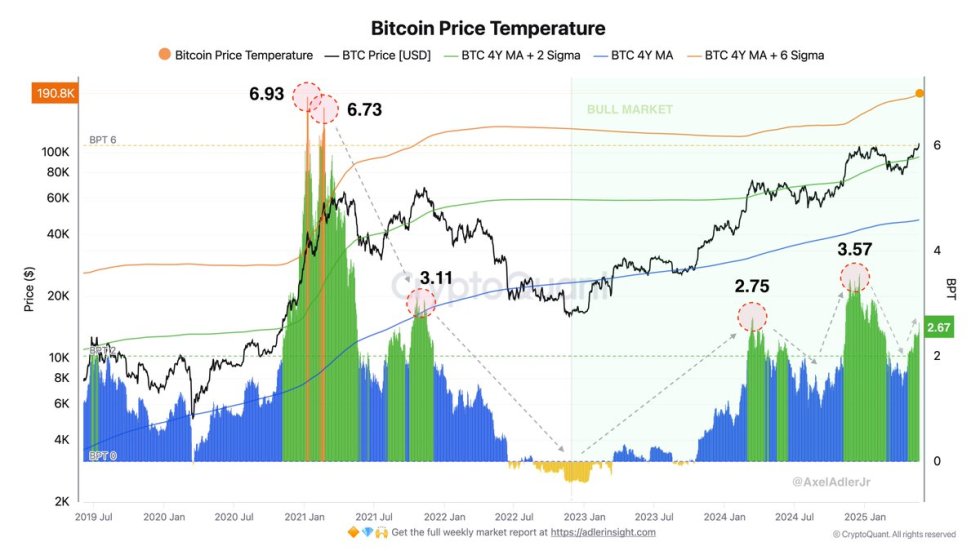

According to fresh data from CryptoQuant, the Bitcoin Price Temperature (BPT) metric—a gauge used to measure market overheating—has climbed to 2.67 points. For context, the last two cycle peaks recorded BPT values of 2.75 and 3.57, with an average cycle peak near 3.14. While Bitcoin still has room before hitting this historical average, the rising BPT indicates mounting pressure and a market that may be approaching overheated conditions.

With momentum still strong but warning signs emerging, all eyes are now on whether Bitcoin can maintain its current trajectory, or if selling pressure will trigger the next cooldown phase in what has been a powerful bull market. Will BTC defy history and push through with fresh legs?

Bitcoin Pushes Higher As Global Risks Mount

As US Treasury yields rise and recession concerns intensify, global markets are navigating a fragile macroeconomic environment. Interestingly, Bitcoin appears to be thriving in this context. After breaching its all-time high, BTC has remained strong above the $110,000 mark, showing resilience even as traditional assets falter.

This strength has ignited optimism among bulls, with many anticipating a continued rally. However, analysts warn that the $115K level must be cleared to confirm the start of a new bullish phase. Failing to hold current levels could lead to a sharp correction, especially with broader economic uncertainty in play.

Top analyst Axel Adler recently highlighted an important signal of market heat: the Bitcoin Price Temperature (BPT). According to Adler, the BPT has now reached 2.67 points. For context, the last two cycle peaks saw BPTs of 2.75 and 3.57, with the average peak sitting at 3.14. This leaves a remaining gap of just 0.47 BPT before matching the historical average.

While this doesn’t guarantee an immediate top, it signals that BTC may be approaching overheated conditions. With this in mind, traders are watching closely. Will Bitcoin’s strength persist, or is this the calm before a necessary cooldown?

BTC Daily Chart Analysis: Bulls Hold Control But Key Levels Ahead

Bitcoin is holding steady near $111,000 after breaking to new all-time highs, signaling strong bullish momentum. The daily chart shows that BTC successfully flipped the $103,600 resistance zone into support, marking a significant technical milestone. Price is well above the 34 EMA at $100,246, which has now turned upward, indicating short-term trend strength. Meanwhile, the 50, 100, and 200 SMAs continue to slope positively, adding confidence to the medium and long-term trend.

Volume has slightly decreased compared to the breakout days, suggesting a period of consolidation may follow. Still, BTC remains within a strong bullish structure, and a sustained close above $112,000 could trigger the next impulsive leg toward $115,000 or higher.

However, if bulls fail to push past that zone, we may see a healthy retracement toward $103,600 or even the $100,000 psychological level—both of which should now act as strong support. RSI and momentum indicators on lower timeframes show signs of cooling, in line with the current consolidation.

Featured image from Dall-E, chart from TradingView