According to a recent analysis from popular XRP commentator BarriC, the token’s current price makes it a tempting buy. He pointed to the fact that XRP sits at about $2.35 right now. That price is low compared with where he thinks it will go. He told followers to pick up as much as they can while the chance is there.

XRP Trading Below $3

XRP has climbed about 350% over the past year. That beat gains in some of the top altcoins in the market today. Yet many still see the move as slow. At $2.39 per coin, that view is easy to understand. Even so, BarriC calls anything under $3 a bargain.

Predictions For A Rally

Based on examination from his Twitter thread, BarriC expects XRP to hit $10 first. He then sees it pushing to $20 in the months ahead. Those moves would set a new high during what he calls the next alt season. If those figures come true, buyers who got in under $3 would see roughly a seven-fold gain at the $20 mark.

$XRP will become very expensive to buy in the next few months and the next few years

Right now, you can accumulate $XRP below $3

And somehow that’s considered a failure

When $XRP skyrockets over the next few months and hits $10-$20 per #XRP

That’s the new all time high…

— BarriC (@B_arri_C) May 17, 2025

… But Possible Correction Ahead

BarriC also warned of a pullback after a big rise. He thinks XRP could drop by about 50% once it reaches $20. That would put it back in the $5–$10 range. He sees that dip as a fresh chance to buy in. Even then, $5 is still higher than today’s $2.39.

Long Term Vision For XRP

Looking past the next cycle, BarriC outlined a bold scenario. He believes banks and big payment firms will use XRP for daily money transfers. In that case, demand could send the price all the way to $1,000 within 10 years.

When banks start using $XRP

We will know because of the insane price per $XRP

We will see prices like $100, $500, $1,000

Per #XRPThe fact that we can still accumulate $XRP at approx $2 means that banks aren’t utilising $XRP …. YET

Once that day comes

Once banks and…

— BarriC (@B_arri_C) May 3, 2025

To reach that level, XRP’s market cap would top $58 trillion. That would put it on par with major pieces of the global money system.

Technical Signals And Short-Term Outlook

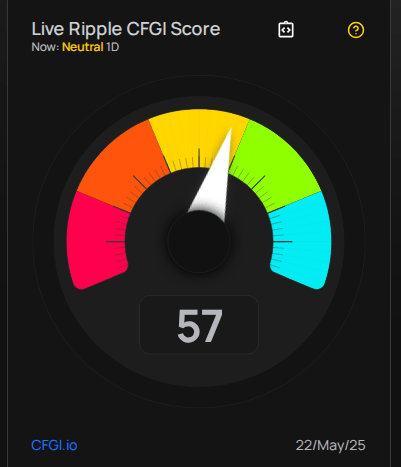

Technical indicators point to a possible drop to around $2.21 by June 22, 2025, which would be a -9.20% change from now. The current sentiment gauge reads Bullish, but the Fear & Greed Index sits at 0.

Over the past 30 days, XRP had 13 out of 30 green days and showed about 5.10% price swings. Those numbers hint at mixed views. Some traders see room to run. Others expect more choppy action before the next big move.

Market watchers will be watching Ripple’s deals with banks and payment networks. If those start to speed up, we could see more buzz around XRP’s real-world uses.

Until then, buying under $3 could look smart—or it could stay quiet for a while. Either way, investors will have to decide how much risk they want for the chance at a big payout in the years to come.

Featured image from Gemini Imagen, chart from TradingView