Bitcoin’s price has held steady around $108,100 as of Saturday afternoon after big holders shipped out a massive load of coins.

Based on reports, whales—those early adopters and big miners—sold over 500,000 BTC in the past 12 months. At today’s rates, that stash is worth north of $50 billion. Institutions grabbed almost every coin they let go. It’s a huge shift in who really owns Bitcoin.

Whales Pass The Torch

According to Bloomberg’s review of 10x Research data, wallets holding between 1,000–10,000 BTC saw their balances slip from over 4.5 million coins in January 2023 to about 4.47 million in July 2025.

At the same time, addresses with 100–1,000 BTC jumped from nearly 4 million to 4.77 million. That shift shows big players trimming back while medium‑size holders, often funds or wealthy clients, build their stacks. It’s happening quietly through in‑kind transfers and private deals that skip public exchanges.

Institutions Ramp Up Their Stakes

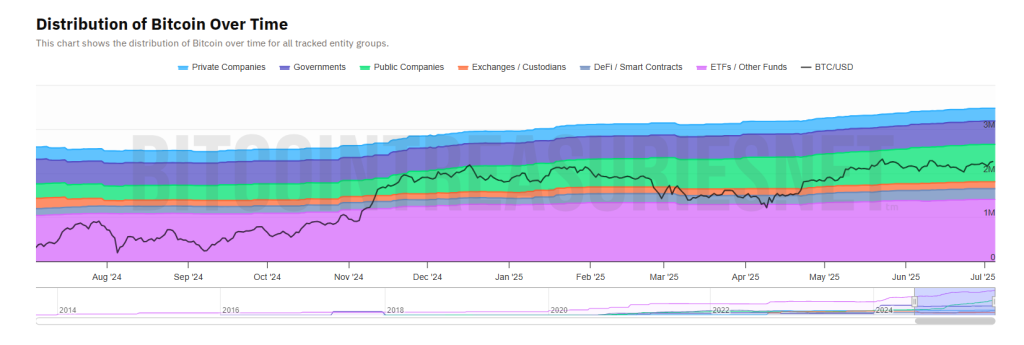

Funds, ETFs and corporate treasuries have scooped up almost every coin dropped by whales. Data from Bitcoin Treasuries shows private companies boosted their holdings from 279,374 BTC in July 2024 to 290,883 BTC today.

Public firms climbed from 325,400 BTC to 848,600 BTC. ETFs led the charge, raising their balance from 1,039,000 BTC to 1,405,480 BTC. In total, these groups added 899,198 BTC—about $96 billion—over the past year. That buying power has helped keep the market in balance as whales step back.

Shift In On-Chain Holdings

Medium-sized wallets are growing while the largest ones shrink. That trend suggests new types of investors are moving in.

Edward Chin, co‑founder of Parataxis Capital, said in‑kind transfers let coins move from anonymous holders to regulated firms without public trades. This quiet pipeline boosts on‑chain activity and brings more oversight to big Bitcoin trades.

Volatility Hits Two-Year Low

As institutional flows rise, price swings have dulled. The Deribit 30‑day volatility gauge sits at its lowest level in two years. Jeff Dorman, CIO at Arca, compared today’s Bitcoin to a steady dividend payer that might deliver annual gains in the 10–20% range.

That’s a far cry from the 1,400% surge seen in 2017. For long‑term savers, steadier returns look more attractive than wild rallies.

Meanwhile, Fred Thiel, CEO of miner MARA Holdings, said his company still holds every coin it mines. But he warned that if whale selling picks up again and institutional appetite fades, prices could lurch lower.

Featured image from Meta, chart from TradingView