Ethereum is trading at a pivotal level after a strong bullish rally pushed its price above the $3,650 mark. This surge has positioned ETH as one of the strongest performers in the current crypto market cycle, igniting optimism among investors and analysts alike. With bulls in control, many are pointing to growing momentum across altcoins as a sign that the long-anticipated altseason may finally be underway.

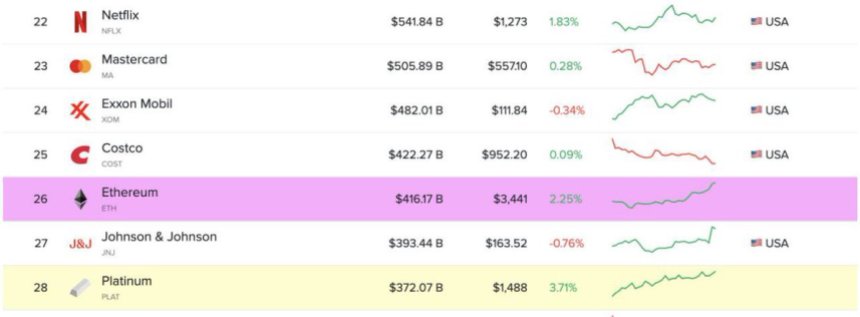

Adding to this narrative, Ethereum has now entered the list of the top 30 global assets by market capitalization, reaching a $416.17 billion market cap. This achievement reflects not only price appreciation but also a rising wave of global recognition and adoption. Institutional demand is climbing, spot ETF inflows are surging, and technical indicators remain firmly in bullish territory.

As Bitcoin consolidates after reaching new all-time highs, Ethereum’s relative strength is drawing attention. The coming days will be key in confirming whether ETH can sustain this momentum and push toward new highs, or if it will face resistance at this psychological level. For now, market sentiment remains optimistic, and Ethereum’s positioning among the world’s top assets hints at a maturing digital economy with ETH at its center.

Global Adoption Increases For Ethereum

Ethereum has officially become the 26th most valuable asset globally by market capitalization, according to data shared by top analyst Ted Pillows. With a market cap of over $416 billion, Ethereum now sits among the world’s financial giants—an impressive milestone that underscores the asset’s growing legitimacy and investor interest. Pillows added that this positioning could mark the beginning of Ethereum FOMO, as both retail and institutional investors react to rising momentum and market structure.

This surge in valuation comes on the heels of a major legislative breakthrough. The US House of Representatives passed three critical crypto bills yesterday, including the GENIUS Act and the Clarity Act. These laws aim to bring much-needed regulatory transparency to the crypto sector, further reinforcing investor confidence. The passage of these bills is viewed as a turning point in US crypto policy, setting the stage for broader institutional adoption and innovation.

Meanwhile, institutions are ramping up ETH accumulation. On-chain data reveals steady inflows into Ethereum spot ETFs, while a noticeable premium on Coinbase suggests strong demand from US-based whales. Combined with a bullish price structure and improving macro conditions, Ethereum appears to be entering an expansive phase, not only in price but also in network usage and adoption.

ETH Surges To New Highs After Breaking Major Resistance

Ethereum has continued its bullish advance, now trading at $3,619 following a clean breakout above the key resistance level at $2,852. The chart shows a clear shift in momentum, with ETH surging more than 25% over the past week, backed by strong volume and bullish structure. This marks the highest price since early 2024, and it comes as Ethereum decisively clears all major moving averages on the 3-day chart—the 50, 100, and 200 SMAs.

The 200-day SMA at $2,815 had acted as a long-standing ceiling during the past year of consolidation and correction. Now that price has reclaimed it with strength, the previous resistance could flip into strong support in the near term. The recent price action also resembles the breakout pattern seen before ETH’s last major rally toward all-time highs.

Volume has significantly increased, further validating the breakout and suggesting that institutional participation may be rising again, especially as spot Ethereum ETFs continue seeing record inflows. If ETH holds above the $3,400–$3,500 region over the coming days, a continuation toward the $4,000 psychological level could be next.

Featured image from Dall-E, chart from TradingView