The post El Salvador Plans World’s First Bitcoin Banks appeared first on Coinpedia Fintech News

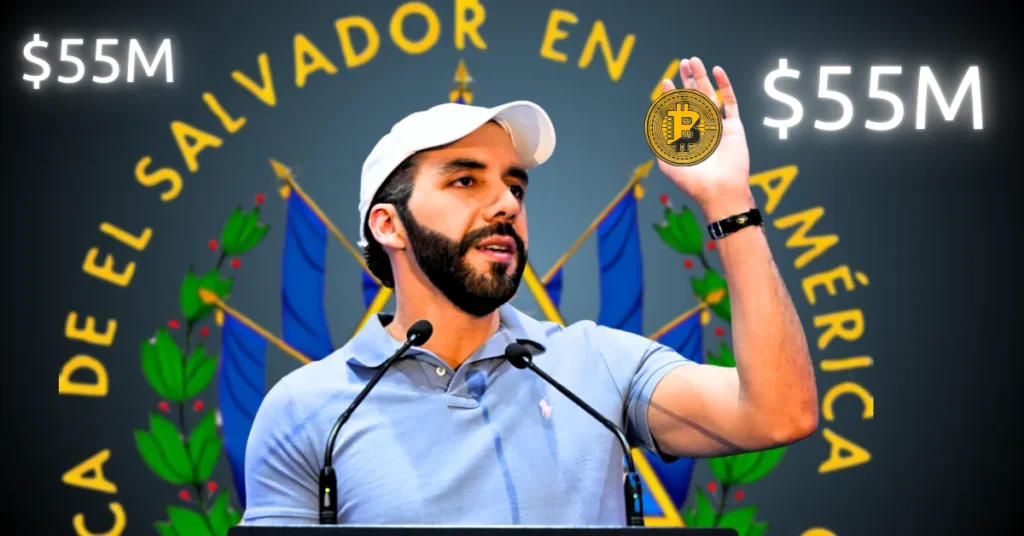

El Salvador’s bold Bitcoin experiment is taking another leap forward. The country’s official Bitcoin Office announced on X that “Bitcoin Banks” are on the way, marking what could be the first banking system in the world fully built around Bitcoin. While the announcement was brief, it signals a major step in embedding BTC into the nation’s core financial services.

The Bank for Private Investment Connection

The idea appears to align with Bukele’s Bank for Private Investment (BPI) proposal from last year. Under that model, banks would operate with minimal regulations compared to traditional institutions, enjoy greater freedom in partnering with international banks, and have flexibility in lending.

BPI requirements outlined by Bukele include at least $50 million in share capital and a minimum of two shareholders, with the option to register as digital asset managers and Bitcoin service providers. The proposal is still under review by the Technology, Tourism, and Investment Commission.

A New Era of Bitcoin Banking

Although exact details remain under wraps, speculation suggests these Bitcoin Banks may operate with services fully denominated in BTC, potentially under a new legal framework. This could mean savings accounts, loans, and payments handled entirely in Bitcoin, a move that would set El Salvador apart from every other nation in terms of crypto integration.

Max Keiser’s Bold Vision

Max Keiser, President Bukele’s top Bitcoin adviser, called the plan part of an “unstoppable” push for Bitcoin. He says Bitcoin is taking over the world’s wealth and could make traditional central banks irrelevant. Keiser and his wife, Stacy Herbert, who runs El Salvador’s Bitcoin Office, have been driving the country’s pro-Bitcoin policies since it became legal tender in 2021.

If Bitcoin Banks become a reality, they could put El Salvador at the heart of global Bitcoin innovation, drawing in crypto investors, builders, and businesses looking for a Bitcoin-friendly base. For now, the world is watching to see if this bold idea comes to life.

On the Flip side…

El Salvador’s proposal to launch Bitcoin banks has generated global buzz, but several hurdles could slow or complicate its success. Here’s a breakdown of the main challenges the plan might face:

- Lack of clear regulations – The government has yet to release a detailed framework outlining how these Bitcoin banks will operate, making the proposal vague and hard to evaluate.

- IMF resistance – The International Monetary Fund has repeatedly warned about Bitcoin’s risks, and with El Salvador tied to a $1.4 billion credit deal, pushback could influence the project’s scope.

- Bitcoin volatility – Extreme price swings in Bitcoin could affect the stability of deposits, loans, and overall bank operations.

- Low everyday use – While Bitcoin is legal tender, most Salvadorans still rely on U.S. dollars for daily transactions, limiting potential customer adoption.

- Trust concerns – Controversy over the government’s claims of buying Bitcoin, which some analysts say is just wallet shuffling, could reduce public confidence in the project.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

El Salvador plans world’s first Bitcoin-native banking system, offering BTC-denominated accounts, loans, and payments under a new financial framework announced by the Bitcoin Office.

Modeled after Bukele’s BPI proposal, these banks require $50M capital, allow digital asset management, and operate with minimal regulations compared to traditional banking systems.

While announced, the proposal remains under review by El Salvador’s Technology Commission with no confirmed launch date yet for the groundbreaking banking system.