With US inflation center stage and oil-market supply guidance due, this is a data-heavy week where macro can decide whether Bitcoin’s tight consolidation resolves into fresh highs and the broader crypto market continues to explode further.

Crypto Market Braces For Major Week

The July Consumer Price Index arrives Tuesday, August 12, at 14:30 CEST (08:30 ET). The median economist call leans toward a firmer core and a still-contained headline: Bloomberg’s survey points to a 0.3% month-over-month increase in core CPI, while several desks expect headline CPI at 0.2% m/m and 2.8% y/y after 2.7% in June.

The Cleveland Fed’s real-time nowcast is in the same ballpark on the year-over-year prints, showing ~2.7% for headline and ~3.0% for core going into the release. The schedule is official; the nuance is that a 0.3% core m/m is consistent with core holding near 3% y/y, which markets would read as sticky but not re-accelerating—until tariffs or energy change the calculus.

Producer prices follow Thursday, August 14, also at 14:30 CEST (08:30 ET). Consensus pegs PPI final demand near +0.2% m/m after a flat June; the Bureau of Labor Statistics has confirmed the timing and flagged methodology changes that take effect with this release. Taken with CPI, a 0.2% PPI would imply only modest pipeline pressure—unless services margins surprise.

Retail’s read-through for demand lands Friday, August 15, at 14:30 CEST (08:30 ET). The street is looking for +0.5% m/m on headline retail sales, with many desks also watching the control group for a steady goods-spending pulse after June’s 0.5%. One hour later, at 16:00 CEST (10:00 ET), the University of Michigan prints its preliminary August sentiment; July’s improvement into the low-60s set the base. None of these are binary for crypto, but a hot sales beat against a 0.3% core CPI would harden “higher-for-longer” rate chatter; a cooler mix would do the opposite.

Energy is the wild card. OPEC’s Monthly Oil Market Report publishes Tuesday, August 12, with July’s edition having kept 2025 demand growth steady at ~1.3 mb/d; the cadence of OPEC+ supply guidance and the IEA’s Oil Market Report on Wednesday, August 13, will feed directly into headline-inflation expectations via the gasoline channel. The exact release dates are fixed on OPEC’s calendar and the IEA data portal.

On crypto-native flows, FTX’s estate has set Friday, August 15 as the record date for its next cash distribution cycle, with disbursements expected to begin on or about September 30, 2025. The step is funded by a court-authorized $1.9 billion reduction of the disputed claims reserve (to $4.3B), and payments will route via BitGo, Kraken and Payoneer for eligible, fully onboarded claimants. Practically, that means Aug. 15 determines who’s in line; the actual liquidity arrives at quarter-end.

Ethereum’s specific catalyst is corporate-treasury optics. SharpLink Gaming (Nasdaq: SBET)—which has been publishing weekly accumulation tallies—will hold its Q2 2025 call on Friday, August 15, at 14:30 CEST (08:30 ET). The company disclosed 521,939 ETH on the balance sheet as of August 3, alongside ongoing capital raises to expand that treasury. Any change in pace, staking strategy or financing mix could move the “ETH as a balance-sheet asset” narrative.

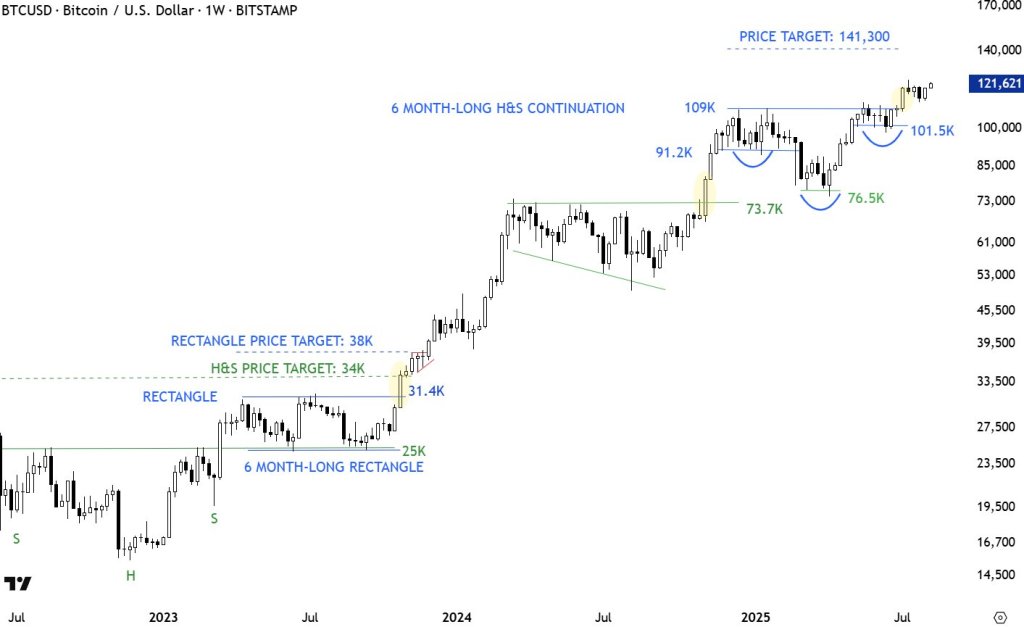

Technically, Bitcoin sits a stone’s throw from July’s record at $123,153. Aksel Kibar, CMT, characterized the past week’s pause as “a text-book pullback to the neckline,” adding that “monitoring the chart for acceleration this week. Breach of 123.2K (minor high) can resume uptrend.”

At press time, BTC traded at $121,699.