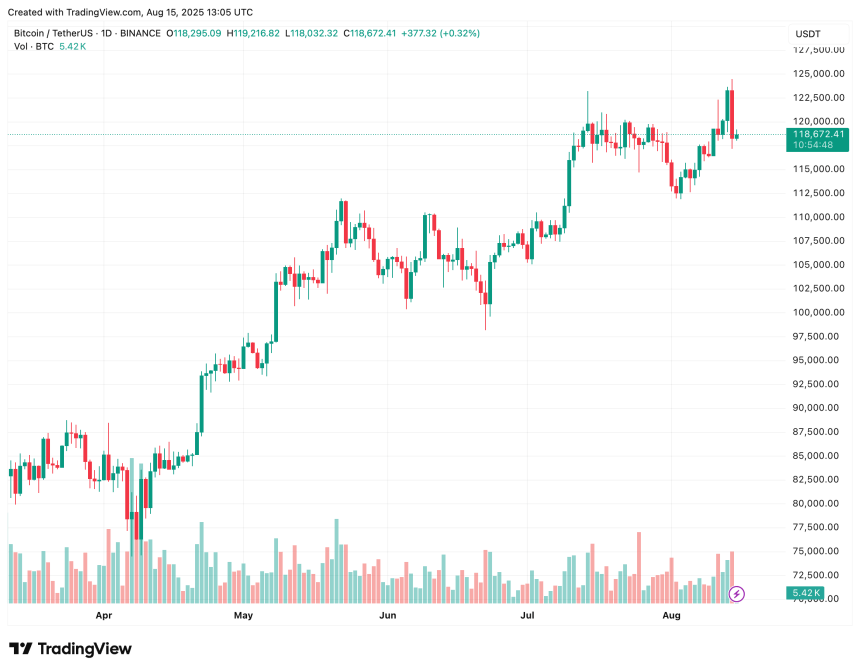

Bitcoin (BTC) staged a mild rebound from yesterday’s inflation-driven drop to $117,180, climbing back toward $119,000 at the time of writing. A declining leverage ratio suggests the top cryptocurrency’s bullish momentum could persist, keeping it in the running for a new all-time high (ATH) in the near term.

Bitcoin Leverage Ratio Falls, Bulls Rejoice

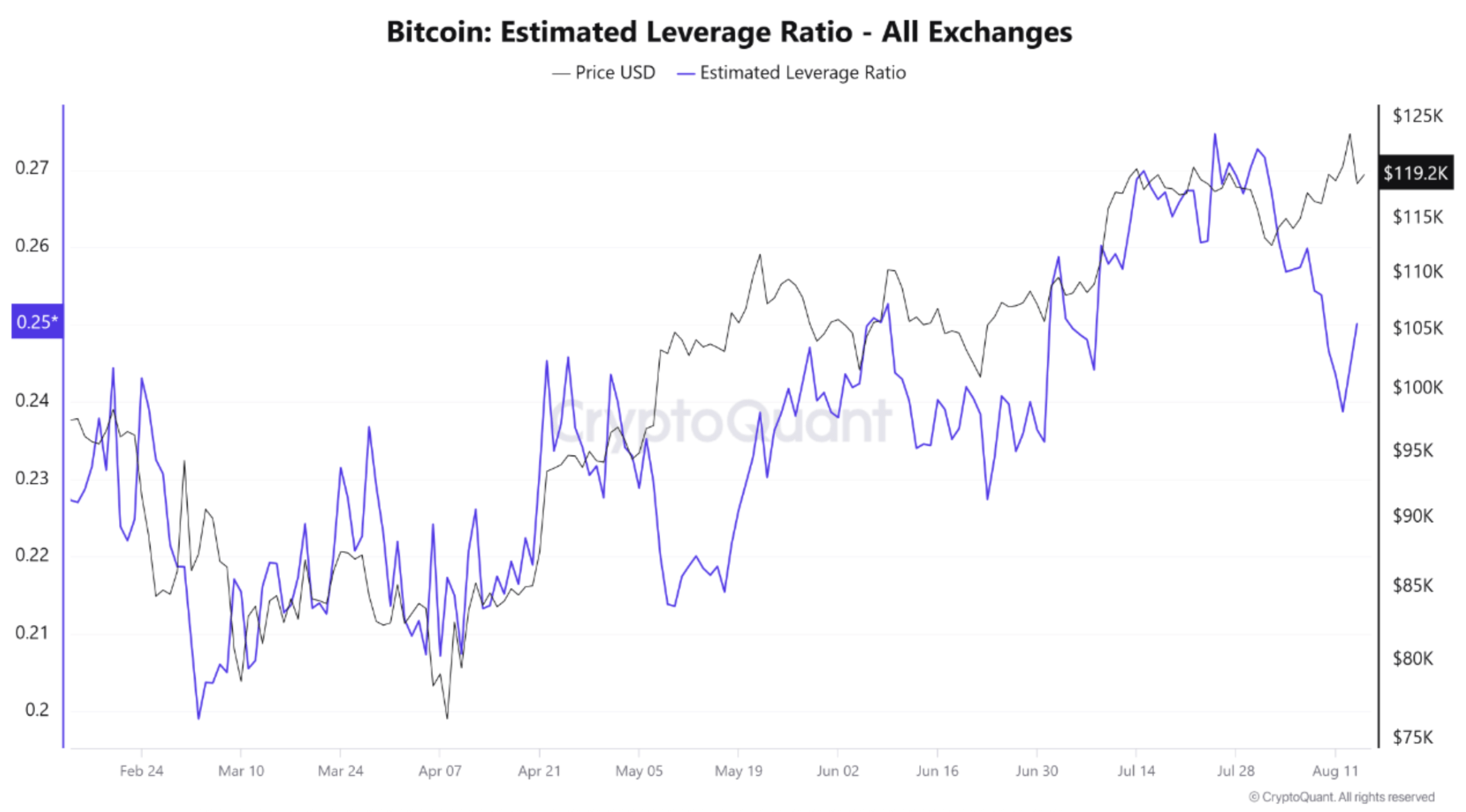

According to a CryptoQuant Quicktake post by contributor Arab Chain, Bitcoin’s leverage ratio across all cryptocurrency exchanges has sharply declined from its late-July and early-August peak of 0.27.

Notably, the ratio dropped to 0.25 in early August before a modest rebound. In contrast, the period from May to late July saw both the price and leverage ratio climb in tandem, signaling an influx of traders opening larger positions.

In contrast, this time leverage has fallen without a comparable drop in price – a sign that risk has eased since the recent uptrend. Arab Chain notes that this may be the result of high-risk positions being liquidated or traders exiting the market amid volatility.

With BTC holding around $119,000, the lower leverage ratio is a bullish sign, suggesting that the latest price gains are fueled more by genuine liquidity than speculative excess.

A continued decline in leverage could further reduce the likelihood of a sharp correction. Conversely, a sudden spike in leverage alongside a price rally would raise the risk of a pullback. The analyst added:

If leverage remains at moderate or low levels while the price remains stable, this could provide a stable base for a new uptrend. An estimated leverage ratio (ELR) holding between 0.24–0.25, accompanied by a gradual price break above 120K, could indicate a spot-supported upside and a possible extension toward the July highs, with moderate funding and slowly rising open interest.

However, a quick jump in the leverage ratio above 0.27 before or during a test of $120,000–$124,000 could signal high liquidation risk and the potential for a sharp downward “shakeout.”

On-Chain Data Points To Potential Selling Pressure

While lower leverage is encouraging for Bitcoin bulls, on-chain data – particularly rising exchange reserves and whale transfers – hints at possible selling pressure ahead.

For instance, Binance’s BTC reserves have recently surged to 579,000, raising concerns of profit-taking after Bitcoin’s recent rally to a fresh ATH. Likewise, more BTC miners are moving their holdings to Binance, potentially preparing to sell.

Adding to the caution, some analysts warn of a possible pullback to $110,000 to fill outstanding fair value gaps. At press time, BTC trades at $118,672, down 0.1% in the past 24 hours.