Bitcoin looks set for a pause. Prices climbed to a fresh high, and now the market is showing signs of short-term cooling as some investors lock in profits.

Price Pullback And Recent Rally

Bitcoin was trading at $115,550 when this report was written, about 6% shy of its all-time high of $124,201 reached on Wednesday.

The top crypto asset was up roughly 10% in the nine days leading up to that peak. That quick run-up helped push prices higher, but it also left some traders looking for a breather.

Analysts say the recent rally quickly fizzled out without fresh macro drivers to keep it going.

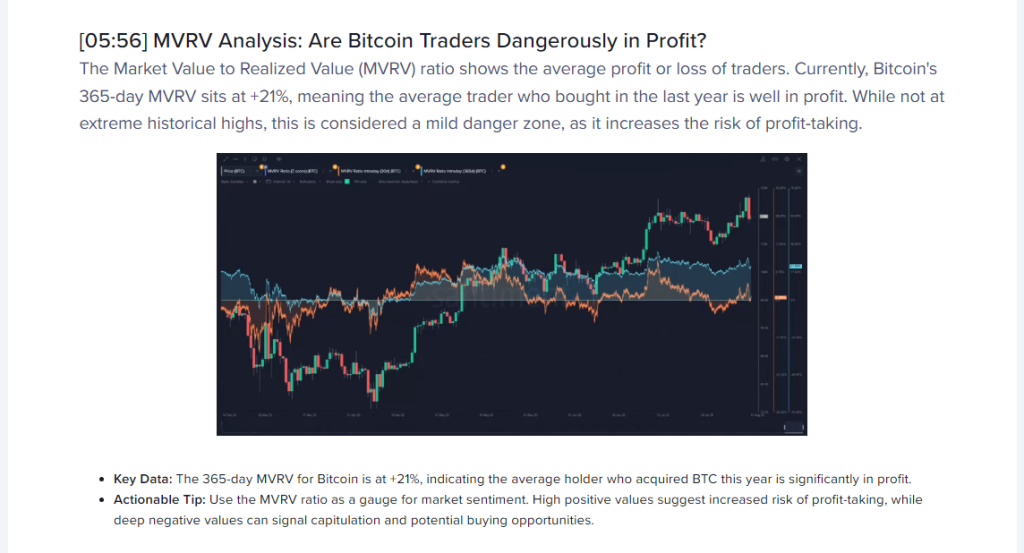

MVRV Signals Some Caution

According to Santiment, the Market Value to Realized Value (MVRV) ratio sits at +21%. That means the average holder who bought over the past year is in profit, and many could be tempted to sell.

That figure isn’t an extreme reading. But it is enough to raise the odds of profit-taking, which can slow or stall further gains.

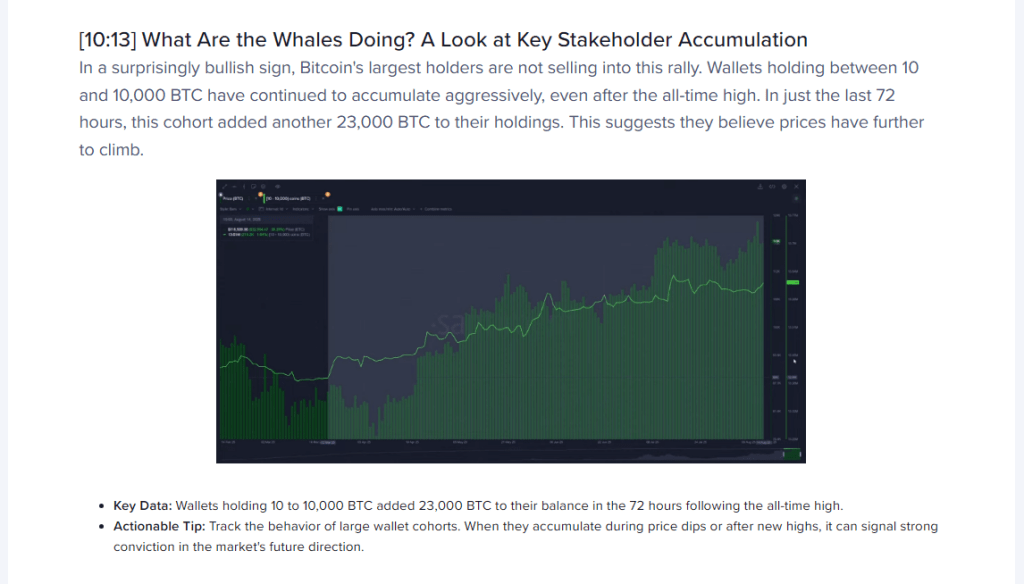

Profit Taking Vs. Whale Accumulation

There’s tension in the market right now. Based on reports, about $2 billion in short positions would be at risk if Bitcoin returned to the $124,000 region. That creates a squeeze scenario on a big upside move.

At the same time, Santiment notes that wallets holding between 10 and 10,000 BTC have continued to add to their holdings even after the new high. So while many smaller players may take profits, larger holders appear confident and are stacking more coins.

Macro Watch: Fed Cut In Focus

Investors are also watching the US Federal Reserve. The Fed’s rate cut decision set for Sept. 17 is on many traders’ calendars.

The CME FedWatch Tool puts the chance of a cut at about 83%. That expected move is one reason some market participants are sitting tight and waiting, rather than pushing prices higher right away.

What Traders Are Watching Next

Markets look to be in a consolidation phase, with traders adopting a wait-and-watch stance. If economic news or the Fed decision surprises, price action could pick up fast.

But without a new catalyst, sideways action seems more likely in the near term. Based on reports, the combination of modest MVRV pressure, piled-up shorts, and steady whale buying paints a mixed picture — risk now, possible fuel later.

Meanwhile, short-term choppiness is plausible. Some investors will take profits. Others — especially larger wallets — are still buying.

Watch the Fed date and any sudden shifts in short positions; they could decide which way the next move goes.

Featured image from Meta, chart from TradingView