SoFi will roll out a Bitcoin-powered international money transfer service inside its consumer app, becoming—per Lightspark CEO David Marcus—“the first US bank to use Bitcoin and Universal Money Addresses (UMA) to offer 24/7, realtime, cheap global payments.” The integration uses the Bitcoin Lightning Network as the cross-border settlement rail and will debut later this year, with Mexico as the first corridor.

First US Bank Plugged Into Bitcoin Lightning

In its announcement on August 19, SoFi said members will be able to send funds abroad directly from the SoFi app “with lower fees and faster delivery compared to traditional remittance service providers.” Technically, dollars are converted to Bitcoin in real time, routed over Lightning, and reconverted instantly on the other side to local currency that lands in a recipient’s bank account—without users needing a third-party app. SoFi added that total costs will be “below the current national average,” with exchange rates and fees shown up front. The feature will be available through SoFi Checking & Savings, offered by SoFi Bank, N.A., Member FDIC, with a waitlist already open.

“SoFi is one of the most innovative and forward-thinking financial platforms in the US today,” Lightspark’s Marcus said in the release. “Digital banks are embracing UMA because it’s fast, cheap, and secure, and it uses the only open payments network that exists, Bitcoin.” SoFi CEO Anthony Noto framed the move in terms of everyday utility: “For many SoFi members who regularly send money to loved ones internationally, the ability to quickly transfer money at low cost isn’t just a convenience, it’s a meaningful improvement to their everyday financial lives.”

Marcus amplified the launch on X, calling it a “very important milestone,” and underscoring the strategic rationale for banks: “Bitcoin’s neutrality, openness, and decentralization makes it a very compelling choice for banks as the replacement for antiquated correspondent banking vs. other centralized options. No one wants to king-make another closed, corp controlled payment network again. Open will win.” In a separate post, he urged observers to “truly digest the significance of major banks in the US, Latin America, Europe—and soon everywhere—using Bitcoin as neutral TCP/IP packets for money.”

The announcement positions SoFi within a broader shift by large consumer platforms toward Lightning-based settlement. Lightspark previously disclosed partnerships aimed at bringing Lightning and UMA to Revolut in the UK and EEA and to Brazil’s Nubank, one of the world’s largest digital banks, signaling a multi-region build-out of an “open Money Grid.” Against that backdrop, SoFi’s US bank charter makes this rollout notable in the regulated banking context.

Whether SoFi is the first US bank to integrate Lightning may depend on definitions and scope. Lightspark’s press release describes SoFi as “one of the first US-banks to offer a blockchain-powered remittances service,” whereas Marcus’ posts characterize it as the first US bank using both Bitcoin and UMA to deliver always-on, inexpensive global payments.

What is uncontested is the architecture: UMA addressing on the front end, Lightning for cross-border routing, fiat in and fiat out—with SoFi aiming for lower-than-average remittance costs and round-the-clock availability inside a mainstream banking app.

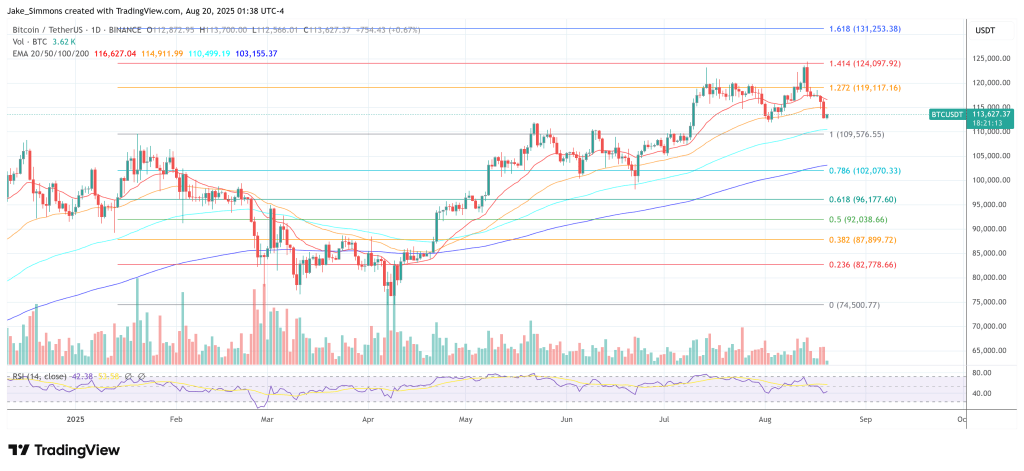

At press time, BTC traded at $113,627.