The post LDO Price Aims 200% as Lido Finance Strengthens On-Chain Fundamentals appeared first on Coinpedia Fintech News

The LDO price today sits near $1.32 after advancing to $1.53 by mid-August. While momentum still shows strength after the slight pull-back.

When writing, the short-term volatility continues to pressure the token, with sellers trying hard to take control at critical resistance levels.

Nevertheless, on the broader LDO price chart, the token still maintains a bullish long-term trajectory supported by positive fundamentals.

On-Chain Metrics Reinforce Optimism for Lido Finance

Beyond price action, the on-chain metrics highlight why confidence in Lido Finance is rising among investors and experts.

As is clearly evident in the project’s TVL, which surged to $42 billion earlier this quarter before retreating slightly to $37.88 billion, still maintaining a higher-high structure.

This sharp increase clearly underscores the growing trust among users and institutional participants alike.

The data also highlights the network’s Revenue stats, which show steady growth this quarter and reflect improving fundamentals.

At the time of writing, Lido’s revenue reached $148,000, which is a notable climb compared to recent quarters. Together, these metrics form a strong foundation for a sustainable recovery, boosting sentiment around the LDO price forecast.

Derivatives Data Signals Bullish Sentiment

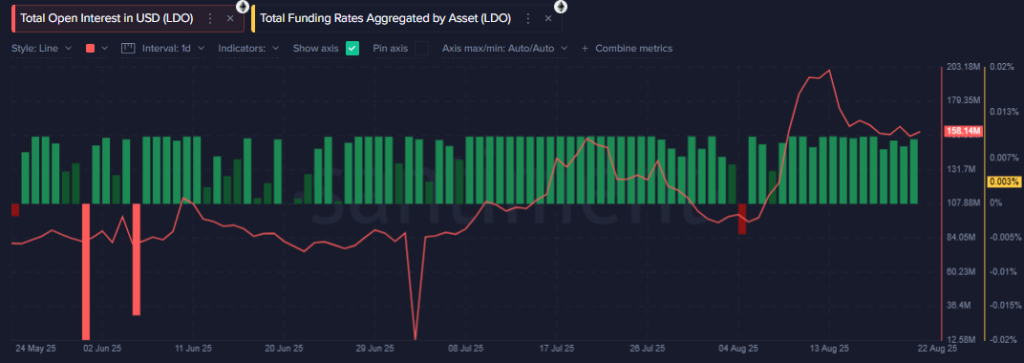

In addition to on-chain developments, the derivatives market data further reinforces this bullish optimism. As Funding rates remained mostly positive this quarter, with the latest reading at 0.003%, this suggests a bullish bias among leveraged traders.

Moreover, open interest has surged to $158.14 million, up from a quarterly low of near $18 million.

Such momentum reflects increasing market activity, often seen ahead of stronger directional moves, and could shape the near-term trajectory of LDO/USD.

Technical Structure Suggests Key Breakout Zone

From a technical standpoint, the daily time frame LDO price chart shows that the token has recently tested a resistance aligning with the upper border of a multi-month descending wedge.

After the rejection, the token has retraced toward its 20-day EMA, while still holding above the 50-day EMA, which strongly reflects a sign of persistent bullish demand.

If buyers manage to reclaim and sustain above the $1.50 resistance, a decisive breakout could follow. Such a move would likely pave the way for a potential rally toward $4, a level closely watched by traders eyeing the next bullish phase.