The post Polygon (POL) Price Prediction Today – 1st September 2025 appeared first on Coinpedia Fintech News

Polygon (POL), once known as MATIC, is finally waking up after months of quiet trading. Polygon price today jumped nearly 5% to trade around $0.27, sparking excitement in the market. While rising adoption and network demand are fueling this move, the real excitement comes from analysts who see this rally as just the start.

Some are now eyeing a bold target of $1.30 for the POL token.

Polygon Network Activity Spike

One of the biggest drivers is the clear growth in activity on the Polygon blockchain. Active addresses are up 25%, climbing from 447,000 to 665,000, while daily transactions have grown nearly 8% to 4 million. This shows that more users are actively relying on the Polygon network.

USDT Upgrade Brings Efficiency

Another reason for the bullish momentum is Polygon’s upgrade of its PoS USDT to the new USDT0 standard. This move improved transaction efficiency and increased its dominance in stablecoin activity, making the network more attractive for users and investors.

Growth as a Stablecoin Hub

Polygon is also positioning itself as a stablecoin hub in Singapore and Asia more broadly. Data shows strong growth in XSGD stablecoin transfers on the network, with volumes hitting $66 million, $88 million, $74 million, and $94 million in the last four months, reflecting steady growth in usage.

Polygon’s Trading Volume Spike 110%

Lastly, market activity around the token itself has been impressive. Polygon’s trading volume has spiked by more than 110% in just the last 24 hours. Such a sharp rise in trading often signals strong investor interest and can directly push prices higher.

Polygon Price Prediction: Can It Bounce Back?

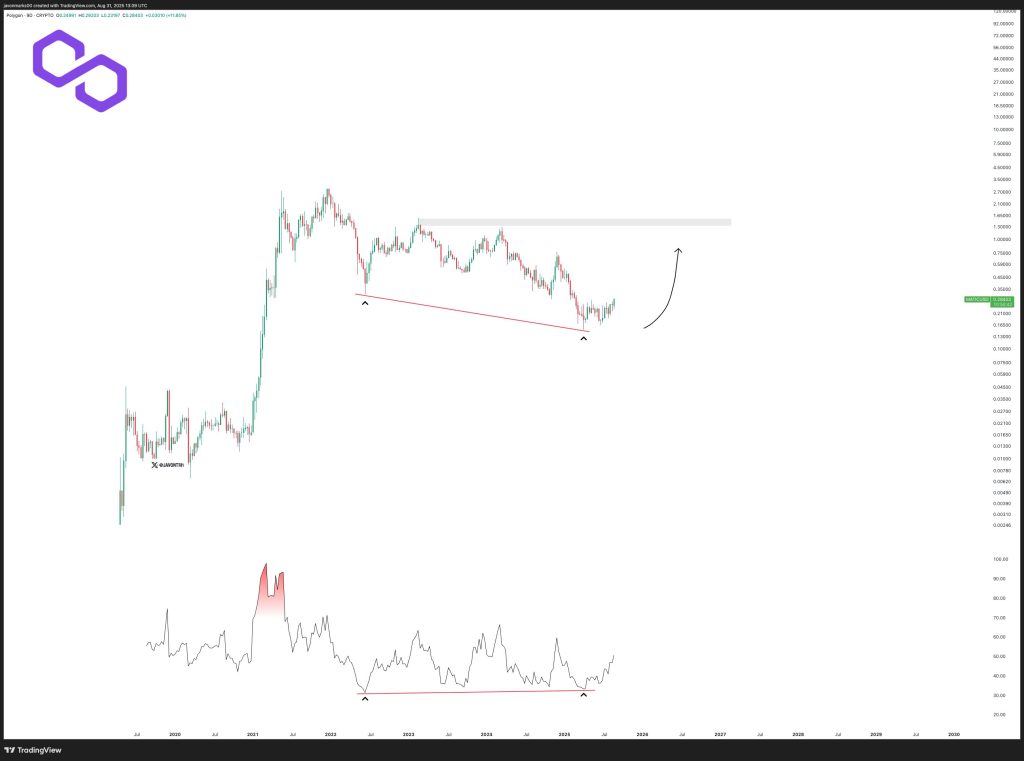

Polygon has been stuck in a long downtrend since its 2021 highs. Even when the wider crypto market rallied, POL kept sliding lower, making it feel like the token had spent the bull run in its own bear market.

Analyst Venturefounder says the first real sign of strength would be a move to $0.38, while the key breakout point sits at $0.71. Crossing that level, he believes, would mark the start of a true bull market for Polygon.

Adding to the optimism, analyst Javon Marks points out a strong bullish divergence, a signal that selling pressure is weakening and a reversal may be close. Based on this setup, he suggests POL could climb back to around $1.30, which would mean a 354% gain from current levels.

Meanwhile, the Relative Strength Index (RSI) climbed to 42, indicating strengthening momentum.