The post Broad Crypto ETF Greenlit: BTC, ETH, XRP, SOL, LINK Among First to Qualify appeared first on Coinpedia Fintech News

A new investment fund covering a range of digital coins has just received approval. Big names like bitcoin, ether, ripple, solana, and chainlink lead the pack. The move could signal big changes for easy access to multiple tokens. Details on what this fund means and which assets are included are coming up.

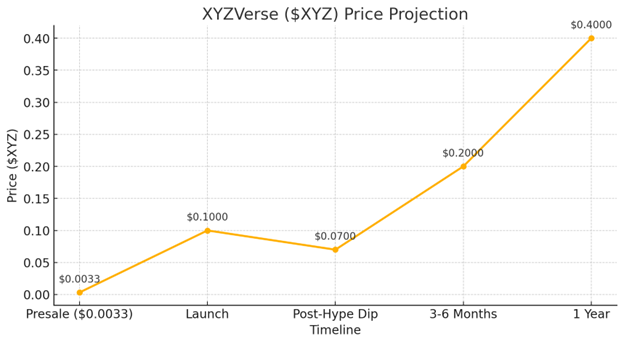

Price Prediction for XYZVerse ($XYZ): Is a 30x Jump Possible?

XYZVerse has entered the meme coin market at a time when community-driven tokens continue to dominate speculative trading. The rise of meme coins like PEPE, Dogwifhat, and Bonk proves that strong branding, viral marketing, and community engagement can drive massive gains.

The broader market sentiment also plays a key role in XYZVerse’s potential. As the altcoin season is about to start, lower-cap meme coins are seeing increased investor interest. Given that XYZVerse is still in presale, it could benefit from this wave if it secures strategic exchange listings and maintains community hype post-launch.

Key Strengths of XYZVerse in the Current Market:

- Strong branding with sports and influencer partnerships, broadening its appeal

- Deflationary mechanics (17.13% token burn) to reduce supply pressure

- Liquidity allocation (15%) to support stability after launch

- Community incentives (10%) fostering engagement and holding

Price Prediction for $XYZ

- Current Presale Price: $0.005

- Projected Post-Presale Target: $0.10 (as per project’s estimates)

- Potential ATH (First 1-2 Weeks Post-Launch): $0.15 – $0.25 (if demand surges and listings drive FOMO)

- Long-Term Potential (6-12 Months): $0.20 – $0.40 (if the project secures major partnerships and listings)

Buy $XYZ Early for Maximum Gains

Realistic Expectations: Will XYZ Hit $0.10?

A 30x jump from presale to $0.10 is possible but depends on:

- Strong Exchange Listings – If XYZVerse lands on major CEX platforms like KuCoin, OKX, or Binance, its price could skyrocket on launch day.

- Sustained Community Growth – Meme coins need viral momentum. If XYZVerse delivers on its sports influencer partnerships, it could drive massive social media engagement.

- Market Conditions – If Bitcoin and altcoins remain bullish, speculation-driven assets like XYZVerse tend to benefit.

Is a 3000% Surge Possible for $XYZ?

XYZVerse has the ingredients for a strong launch, but its long-term success depends on execution. If the team delivers strong marketing, high-profile listings, and real community engagement, the $0.10+ target, which is around 3000% from the current price, could be achievable.

Invest in $XYZ Before It Surges

Bitcoin overview and current cycle assessment

Bitcoin is a digital currency launched in 2009 by the pseudonymous creator Satoshi Nakamoto. It uses blockchain to record transactions across many independent computers. The ledger removes the need for banks and lets users transfer value directly. Miners check each transfer by solving math tasks; new coins enter circulation through these rewards. A coded limit of 21 million coins and a halving event about every 4 years manage supply.

Supply discipline can appeal to participants who seek assets not tied to central bank policy. Growing adoption by companies, funds and payment apps broadens use cases beyond trading. In the present market cycle, price has already moved through several boom-bust phases and now trades below its last record high while network activity and institutional interest continue. This mix of moderate valuation and ongoing engagement may support attention from investors who accept price swings.

Ethereum technology and price outlook 2024 to 2030

Ethereum is a Proof of Stake blockchain that supports smart contracts and many applications. Decentralized exchanges, lending markets, and games run on it, with Ether used for gas fees. The network moved from Proof of Work to Proof of Stake in 2022 during the Merge. Sharding aims to split data across smaller chains to lift scale. Layer 2 networks such as Arbitrum and Polygon process transactions off chain and settle back on Ethereum to cut cost. The ERC20 standard enabled a broad token economy for governance and utility. Started in 2013 by Vitalik Buterin and launched in 2015, Ether now serves for transfers, staking rewards, and collateral.

Price models that compare earlier cycles with the coming BTC halving point to a top near 6580.53 USD in 2024 and a floor near 2700.31 USD in 2025. On the same basis the projected yearly ranges are 2025 2700 to 5900, 2026 3200 to 7100, 2027 3450 to 7800, 2028 3700 to 8400, 2029 3900 to 9100, 2030 4200 to 9800. Interest in established smart contract platforms is steady this cycle, and liquidity on major venues stays high, so many traders keep Ethereum on watch.

XRP Overview and Current Market Context

XRP runs on the XRP Ledger, a public chain built for quick low fee transfers. Transactions settle in seconds and are irreversible. The network is decentralized, so no single party can block or change data. Jed McCaleb, Arthur Britto, and David Schwartz launched the asset in 2012 with a fixed supply of 100,000,000,000 units. They granted 80,000,000,000 units to Ripple, once named OpenCoin, to grow the ecosystem. Ripple locked 55,000,000,000 units in escrow for timed release and added market liquidity.

Its main goal is to link payment systems across borders without bank accounts. Low fees and fast speed fit micro and large value moves. The ledger also allows token creation and simple smart functions. In the present market cycle XRP trades near the upper half of its multiyear range and keeps a top ten market cap. Daily volume stays stable across major exchanges. Some traders view the steady release from escrow and new payment trials as supportive. Others watch legal developments and rival networks before adding exposure.

Solana and SOL Coin in the Current Market

Solana began in 2020. It uses a design that pairs proof of stake with a timing tool named proof of history. This setup allows high transaction counts per second while keeping low fees. Developers can write smart contracts in Rust, C, and C++, adding entry points for many teams. SOL powers the system. Holders pay fees, stake to support validators, and gain access to tokens, games, and other dapps. The coin also acts as a unit for program execution.

Recent data shows rising network use through stablecoin transfers, nonfungible token mints, and new dapps. Total value locked has moved upward after a decline in the prior cycle, pointing to renewed builder activity. The release of upgrades such as local fee markets and compressed NFTs aims to ease congestion and cut storage costs. In the present market cycle, SOL trades below its peak but above last year’s lows, suggesting interest from both retail and institutional desks. Liquidity depth and expanding real-world integrations support ongoing attention toward the asset.

Chainlink LINK: Oracle Network Connecting Blockchains to Real-World Data

Chainlink is a decentralized oracle system that lets smart contracts read outside data. Node operators pull data from APIs and other feeds. They send the info to the blockchain using a reputation score to lower error risk. The process has three steps: data fetch, data check, and data send. On-chain code handles the request, off-chain code gathers the data, and an aggregation contract picks the final output. LINK is the token that pays nodes, backs staking, and aligns incentives. The set-up aims to keep data feeds live and hard to tamper.

The network is active on many chains and secures price feeds for lending apps, games, and more. Its move toward staking can deepen token lock-up and tighten supply. Growth of DeFi, NFTs, and real-world asset projects could widen demand for oracle calls, which may lift fee use. Market charts show LINK has followed wider crypto swings but holds strong daily volume and broad exchange support. In the present cycle traders see it as a tool play rather than a pure store of value. Its outlook hinges on smart contract adoption rates, new oracle rivals, and progress on staking phases, so appeal stays linked to clear utility metrics.

Conclusion

BTC, ETH, XRP, and SOL remain good after the ETF launch in the 2025 bull run; yet first all-sport memecoin XYZVerse targets 20,000% gains, blending sports memes.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse