Binance has once again captured the spotlight, pushing to new all-time highs just hours ago with its native token reaching $963. The rally reflects both market optimism and the platform’s expanding dominance in the crypto ecosystem. Top analyst Darkfost shared insights that highlight a key driver behind this surge: the explosive growth of ERC-20 stablecoin reserves on Binance.

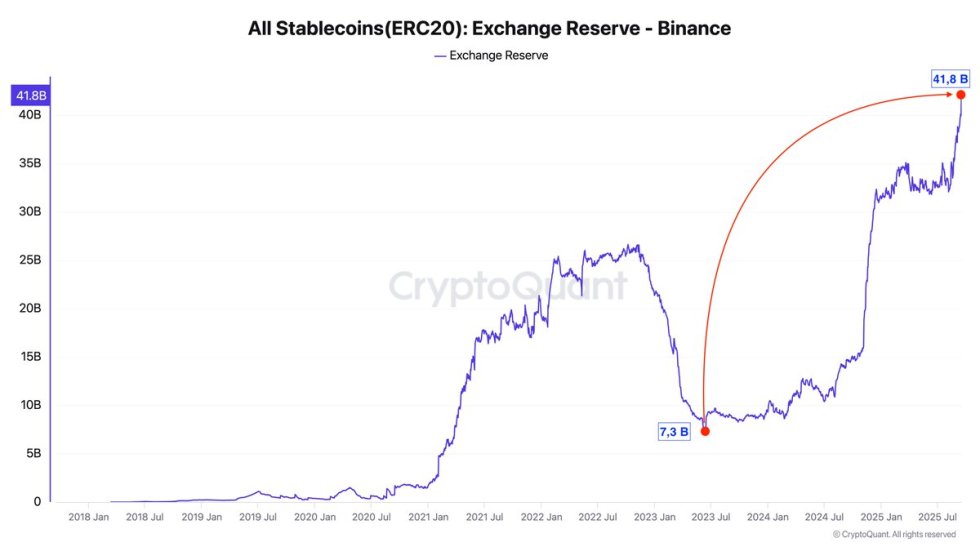

According to the data, Binance’s ERC-20 stablecoin holdings have reached an unprecedented $40 billion, a milestone that underscores the platform’s role as the primary liquidity hub for crypto traders worldwide. To put this in perspective, on January 8, 2023, reserves stood at only $7.3 billion. In less than two years, reserves have expanded by 475%, climbing to nearly $42 billion today.

This sharp growth has been fueled by the ongoing bull run, as investors continue transferring funds to Binance in preparation for trading opportunities. Stablecoins serve as the foundation of liquidity, enabling rapid market positioning and highlighting the exchange’s pivotal role in crypto flows. With reserves still trending upward, Binance shows no signs of slowing.

Binance Stablecoin Inflows Signal Rising Market Activity

Darkfost explains that on the eve of the FOMC meeting, speculation across markets has intensified, with Binance standing at the center of this activity. In just one day, over $2 billion in stablecoins were added to the exchange’s reserves, pushing its total ERC-20 holdings close to $42 billion. Such a surge highlights the heightened anticipation surrounding the Fed’s upcoming interest rate decision and its potential impact on market volatility.

As the number one exchange by trading volumes, Binance has become the preferred entry point for institutional and retail investors alike. By transferring stablecoins onto the platform, participants ensure they can position themselves quickly and efficiently once the Fed announces its decision. This inflow is not only a sign of speculative positioning but also a reflection of growing demand from platform users, which requires Binance to maintain a robust supply of stablecoins to accommodate trading activity.

These developments suggest that market participants are bracing for significant volatility, particularly if the Fed delivers an unexpected move. A 25bps cut would likely be viewed as a healthy pivot, supporting the uptrend, while a deeper 50bps cut could unsettle markets. Either way, Binance’s swelling stablecoin reserves point to a surge in market activity immediately following the decision.

BNB Price Analysis: Testing New All-Time Highs

BNB has been on an impressive rally, with the chart showing a strong breakout that carried the token to the $963 level, setting new all-time highs. Over the past months, the price has maintained a steady uptrend, supported by key moving averages. The 50-day SMA is sharply rising and providing immediate support around $847, while the 100-day and 200-day SMAs at $768 and $693 further confirm the bullish structure.

The breakout from the consolidation seen in July and early August set the stage for this surge, as BNB gathered momentum once it decisively cleared resistance near $820. From that point, buyers consistently defended higher lows, keeping the trend intact. The latest push above $950 highlights strong market demand, but it also puts BNB in overextended territory, with the possibility of short-term corrections if profit-taking accelerates.

For bulls, the next critical test is the psychological $1,000 mark. Breaking and holding above this level could open the door to further price discovery, while failing to hold above $950 could see BNB retest support zones near $900–$880. Overall, BNB remains firmly bullish, but volatility should be expected as it trades near uncharted territory.

Featured image from Dall-E, chart from TradingView