Bitcoin is trading around $115K today as the market braces for the Federal Reserve’s interest rate decision, a moment expected to define the coming weeks. The atmosphere is tense, with bulls preparing for a surge if the Fed opts for a 25bps cut, which many analysts view as a constructive and bullish signal. However, uncertainty remains high, as broader volatility continues to drive the market without a clear trend until the announcement provides direction.

For now, Bitcoin holds steady near critical levels, but price action shows hesitation as traders avoid aggressive positioning before clarity emerges. A smaller rate cut could reinforce the narrative of a gradual and healthy pivot, while a larger-than-expected move could trigger risk-off behavior across markets.

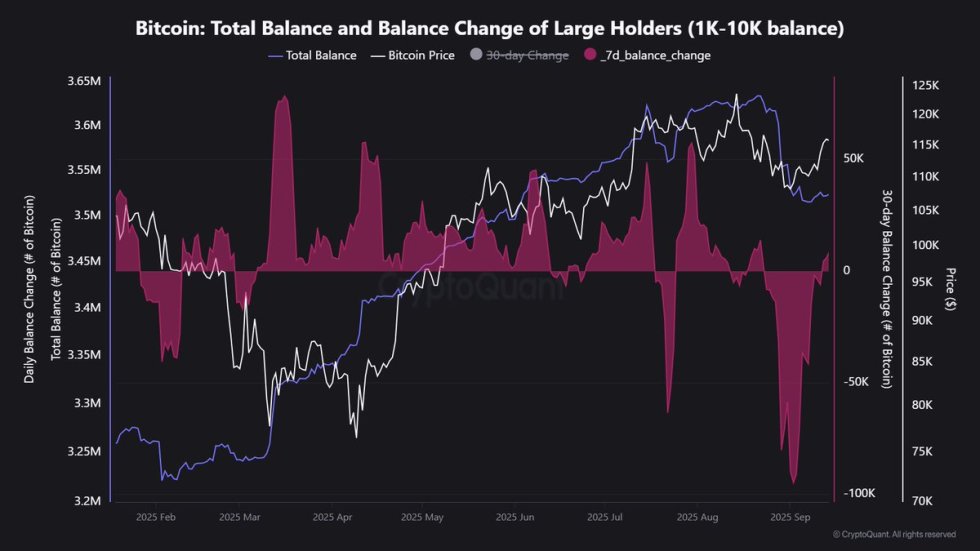

Adding to the cautious mood, top analyst Maartunn has highlighted concerns about onchain developments. According to his insights, whale holdings have dropped significantly in recent days, with large players reducing exposure ahead of the Fed’s decision. This decline signals that some institutional and high-net-worth investors may be adopting a defensive stance, preparing for potential turbulence.

Whale Holdings Signal Market Shift

Maartunn shared striking data revealing that total Bitcoin held by whales dropped from 3.628M BTC on August 22 to 3.52M BTC by September 8. This represents a decline of 108K BTC in just 17 days, a shift that cannot be overlooked in the context of Bitcoin’s current consolidation near $115K.

Such a reduction in whale holdings often reflects caution among the market’s largest players. Whales reducing exposure may signal profit-taking after Bitcoin’s recent surge, or preparation for volatility tied to macroeconomic uncertainty. With the Federal Reserve’s interest rate decision scheduled today, this positioning appears strategic. Large investors are historically sensitive to Fed outcomes, as rate adjustments directly influence risk appetite and liquidity conditions across financial markets.

If the Fed opts for a 25bps cut, it may provide a bullish backdrop, encouraging whales to reaccumulate on dips. Conversely, a deeper cut—or any unexpected tone in Powell’s remarks—could spark turbulence, validating whales’ defensive behavior.

Looking ahead, the coming weeks may prove decisive. Should whales resume accumulation, it would confirm confidence in Bitcoin’s longer-term trajectory. But if the outflow trend continues, the market could face deeper corrections before its next leg higher.

Bitcoin Testing Resistance At $120K

The 3-day Bitcoin chart highlights a period of consolidation just below the $120K–$123K resistance zone, with BTC currently trading at $116,493. After the strong rally from March lows, the price established a series of higher lows, showing sustained bullish structure. The moving averages provide additional confirmation: the 50-day SMA is trending well above the 100-day and 200-day SMAs, reflecting strong medium-term momentum.

Despite this positive structure, the $120K level remains the decisive barrier. Each time Bitcoin approaches this region, selling pressure emerges, creating short-term rejections. However, buyers are defending above $114K, preventing deeper corrections and keeping the trend intact. This suggests accumulation ahead of a possible breakout.

If Bitcoin can close above $123K, the next upside target lies near $130K–$135K, levels that could trigger another wave of institutional inflows. On the downside, a break below $110K would weaken the structure, potentially dragging price toward the $102K–$105K support range aligned with the 200-day SMA.

Featured image from Dall-E, chart from TradingView