The post ASTER Price Analysis: 4-Hour Chart Shows Buyers Eyeing $3 Target appeared first on Coinpedia Fintech News

The ASTER price has been on the move in October, with the token rebounding strongly after testing crucial support levels. On the 4-hour chart, ASTER has shifted from bearish lows to a constructive trend, supported by ecosystem upgrades, growing adoption, and increased visibility through sponsorships.

ASTER Price Action and Market Trend

After dropping to $1.49 in early October, ASTER staged a remarkable comeback, climbing as high as $2.27, which was a near 50% jump within a short span.

The price has since corrected slightly, consolidating around $2.07. Currently, ASTER remains range-bound after marking an ATH, yet continues to show bullish undertones inside the range, which suggests bulls are raging inside the range.

The ASTER price chart highlights $1.49 as a strong support floor, while resistance sits at $2.43, its all-time high. Technical indicators, such as the 20-EMA, suggest that momentum is leaning back toward buyers. However, the intraday pullback near the key supply region and almost 15 days of sideways movement signal that bulls may be regrouping before attempting another clear breakout.

That said, one thing seems certain is its September rally, which was magnificent, and now experts are seeing October as a month of rally, nicknamed as “Uptober”. This boosts people’s expectations as they want to see an extension of this rally this month.

Ecosystem Developments Fueling Momentum

As the word “Upward” suggests, bullish growth appears to be supported by the first week, and the recent strength in the ASTER price cannot be separated from this either.

This week, it remained in the highlights from its broader ecosystem growth. ASTER gained visibility as one of the sponsors of the BNB Singapore event hosted by BNB Chain, which helped the project gain limelight and credibility by associating with a well-known brand like BNB, thereby extending its reach in the crypto community.

Alongside sponsorship efforts, ASTER rolled out a platform update on October 2, introducing a bilateral (double-sided) view of Open Interest (OI). This move increases transparency and accuracy for traders, building long-term credibility.

While it may appear minor, such upgrades enhance user confidence and strengthen the asset’s appeal.

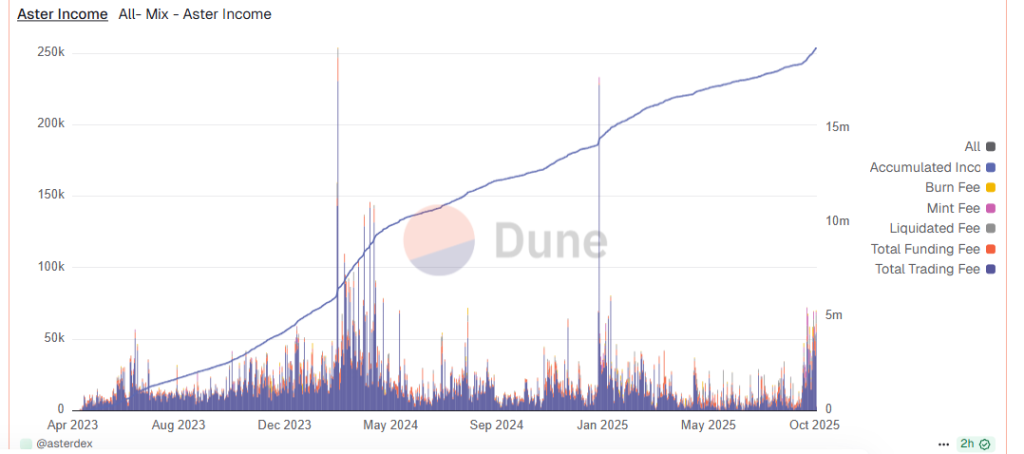

Adding to this momentum, ASTER’s income has grown significantly, with $19.2 million accumulated from trading fees, funding fees, minting, liquidations, and burns.

The rise in on-chain income, paired with record-high levels of perpetuals open interest across the market, underscores the growing traction of ASTER crypto.

ASTER Price Forecast: What’s Next?

With ASTER consolidating above the $2.00 support, bullish traders are eyeing the next major resistance at $2.27, followed by the all-time high at $2.43. A successful breakout above this zone could open the path toward $3.00 in the near term.

On the other hand, a drop below $2.00 could weaken momentum, dragging the token back toward $1.75–$1.60. However, the broader ASTER price forecast remains positive as long as the $1.49 bottom holds.

If demand continues to climb, the bulls may attempt to push higher, with $5.00 as a longer-term target before year-end. The ASTER price USD outlook is therefore tied to whether buyers can maintain control at current consolidation levels.