The post Uptober Sentiment Sends BNB Price Flying Above $1,100, Pundits Say This Under $1 Competitor Is Next In Line appeared first on Coinpedia Fintech News

The BNB price has hit a new ATH of $1,100 with the start of “Uptober” showing incredible promise. According to CoinMarketCap data, the BNB price surged more than 8%, crossing the $1,100 milestone for the first time. This latest move solidifies the BNB price as one of the best-performing altcoins in Uptober. It posted nearly 30% gains over the past month.

Daily trading volume for the token also jumped by 30% to over $4.1 billion, signaling robust demand as Uptober sentiment drives capital inflows into primary tokens. The BNB price currently trades around $1,141, having bounced from key support levels near $1,000.

With Uptober boosting investor optimism, the BNB price rally highlights how quickly momentum can shift in the crypto market. However, pundits note that while the BNB price thrives, this under-$1 competitor, Paydax Protocol (PDP), promises a better shot at a higher ROI in the bullish month of Uptober.

Pundits Tip Paydax Protocol (PDP) To Follow BNB Price’s ATH Momentum

While the BNB price’s new ATH dominates headlines, pundits argue that Paydax Protocol (PDP) is “next in line” for a breakout in Uptober thanks to its DeFi banking model, RWA tokenization, and strong community-driven growth.

For centuries, traditional banks have maintained control over finances, limiting individual freedom and hindering innovation. Cryptocurrencies have demonstrated that individuals can possess their finances independently of banks.

However, despite this advancement in digital assets, challenges remain. This new platform is paving the way to replace outdated systems with a clear and decentralized AI-based DeFi lending platform.

Paydax Protocol has launched the first AI-driven decentralized finance (DeFi) lending and staking platform, integrating over 100 cryptocurrencies with tangible assets.

Put Your Capital To Work With DeFi Power

This platform presents numerous lending opportunities for participants. Rather than allowing stablecoins to remain dormant, they can use Paydax Protocol’s peer-to-peer DeFi lending pools to finance these collateralized loans.

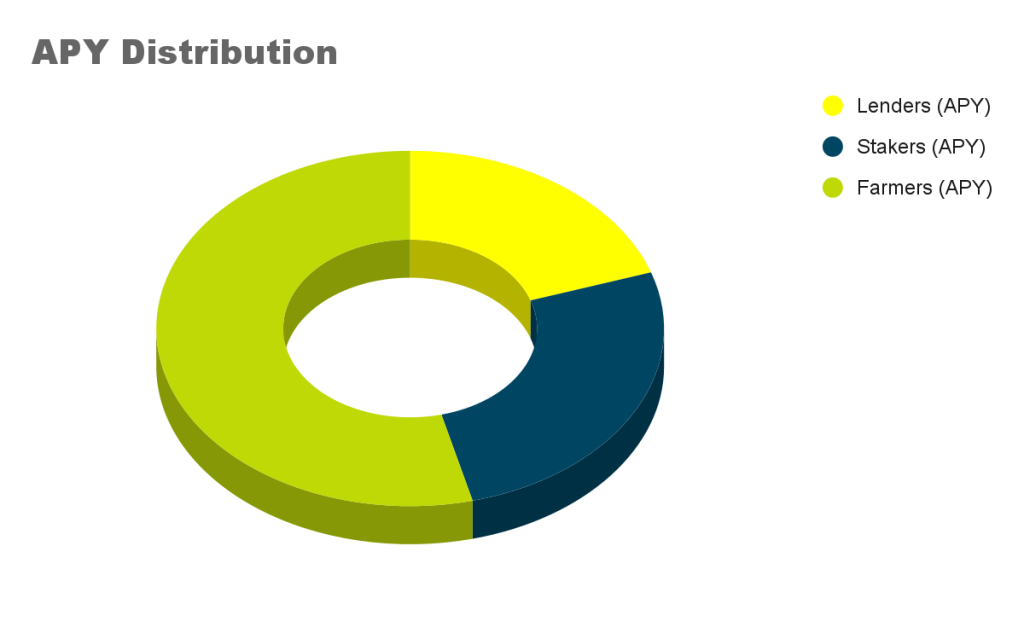

With AI improving capital allocation across over 100 cryptocurrencies and tokenized assets, lenders have the chance to achieve returns of up to 15% APY. This is considerably higher than what a conventional savings account or bank product can provide.

Most DeFi lending platforms, such as Compound, rely on variable interest rates that fluctuate in response to market demand. In contrast, Paydax Protocol (PDP) adopts a different strategy by providing a consistent fixed APR ranging from 5% to 7%.

PDP: The Heartbeat of the Paydax Ecosystem

At the center of the Paydax Protocol lies its native token, PDP. Every transaction, feature, and safeguard on the platform relies on it. PDP is the foundation of the ecosystem.

- Staking: Ensures security and liquidity through stable pools.

- Governance: Empowers holders to decide protocol upgrades and fee structures.

- Compliance: Enhances trust as validators use PDP and AI tools to screen borrowers.

- Rewards & Access: Unlocks premium features, optimized loan terms, and contribution-based incentives.

PDP Token Emerges as Uptober’s Hidden Gem for Early Investors

While major coins grab headlines with price surges, seasoned investors are quietly turning to PDP as Uptober’s hidden gem. This is a low-cost, high-upside opportunity poised to outperform in the next rally.

Paydax Protocol (PDP) is currently in presale for $0.015, with early investors receiving an 80% bonus by using the promo code PD80BONUS. With several stages of presale ahead, attractive fixed returns, and significant listings on the horizon, this is your opportunity to get involved before widespread acceptance occurs.

While established platforms like Aave already boast multi-billion-dollar market caps, Paydax Protocol (PDP) is just beginning its journey. With an Assure Defi audited smart contract, reliable partnerships, and planned listings on top exchanges, it is poised to emerge as one of the next significant names in DeFi lending. This is your opportunity to influence what’s coming next.

Join the Paydax Protocol (PDP) presale Today:

- Website: https://pdprotocol.com/

- Telegram: https://t.me/PaydaxCommunity

- X (Twitter): https://x.com/Paydaxofficial

- Whitepaper: https://paydax.gitbook.io/paydax-whitepaper