The post Chainlink Price Poised for a Major Upswing as CCIP and RWA Collaborations Accelerate Adoption appeared first on Coinpedia Fintech News

The Chainlink token’s price reflects the network’s growing reputation because it turned out to be a crucial infrastructure layer in the decentralized ecosystem that seems like a “ Digital Backbone”. As a decentralized oracle network, Chainlink delivers reliable data feeds to countless blockchain applications, making it an indispensable component of the Web3 landscape.

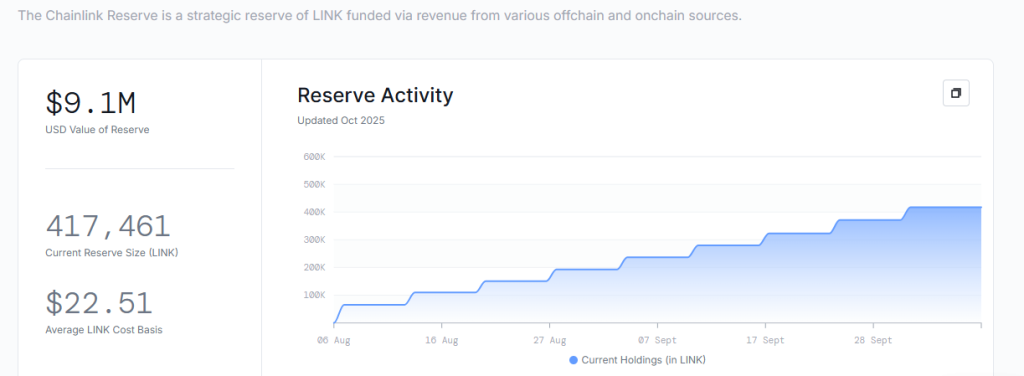

Recently, its influence has surged due to continuous technological advancements and large-scale integrations. Even its onchain data speaks optimistically about it, especially the Chainlink Reserve metric. This suggests an imminent upside odds in its token price, given its growth, which could break the current consolidating price action it’s displaying on price charts.

CCIP Gains Momentum with New Collaborations

One of the major catalysts behind the LINK price USD rally is Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This technology is rapidly becoming the industry’s standard for cross-chain connectivity.

The latest announcement revealed that JovayNetwork will integrate Chainlink CCIP as its canonical cross-chain infrastructure from day one. These kinds of announcements are solidifying Chainlink’s dominance in interoperability greatly.

Additionally, the project’s foray into real-world assets (RWAs) also continues to gain traction. A fresh collaboration with OpenEden and Plume Network aims to tokenize compliant RWAs using Chainlink’s CCIP. The partnership will enable USDO to become the first bridged asset on Plume’s blockchain.

These are the latest additions to Chainlink, but the project has been achieving significant milestones, with numerous partnerships and collaborations announced since the beginning of 2025.

Strengthening Ties with Traditional Finance

Adding to the excitement, Chainlink’s growing connection with traditional financial infrastructure appears stronger than ever. At the end of Q3, they confirmed their partnerships. Now, they have started sharing what they want to do next, announcing that they are adopting blockchains and oracle networks as a key next step for their new blockchain-based ledger.

Now, in that direction, they shared a workflow diagram shared by Chainlink showcasing its Cross-Chain Reference (CRE) framework integrated with SWIFT’s payment processor, labeled as a “winning entry.”

This development strongly suggests deeper institutional involvement that could elevate the Chainlink price forecast narrative in the months ahead.

Unprecedented On-Chain Activity and Adoption

According to Chainlink Metrics, the ecosystem now secures a staggering $25.84 trillion worth of transactions facilitated through its oracles. This number underscores the immense trust and scale Chainlink has achieved across multiple chains and industries. The growing adoption rate not only enhances utility but also fuels bullish sentiment in the Chainlink price chart.

Further reinforcing market optimism, the Chainlink Reserve, established as a strategic fund backed by both on-chain and off-chain revenue, has seen explosive growth. From holding just a single LINK in August, it now boasts over 417,000 LINK tokens, valued around $9.1 million.

This rapid accumulation reflects investor and institutional confidence in Chainlink crypto’s long-term sustainability.

Chainlink Price Prediction: Is Three-Digit LINK Within Reach?

With consistent ecosystem growth, strategic integrations, and unmatched oracle dominance, the Chainlink price could soon break past its two-digit phase. Analysts in the crypto space anticipate that sustained adoption and institutional involvement might push LINK into three-digit territory sooner than expected, more precisely beyond $100 mark.