The post XRP Price Outlook 2025: Can Ripple Reach $5 Amid Rising Supply and ETF Inflows? appeared first on Coinpedia Fintech News

The XRP price has continued to trade in a narrowing price action that’s getting tighter, demonstrating resilience despite a rising circulating supply and growing market caution. With six XRP ETF products already live, based on data from the Block platform tracker, and more expected before the end of the month, institutional participation and demand for XRP could surge, also raising hopes for potential upside towards $5.

Institutional Growth Offsets Supply Pressure

Over the last couple of months, the XRP price has faced significantly heavy resistance from bears that has capped its momentum, despite multiple bullish developments. Yet, the price didn’t retract much because institutional interest remains notably strong.

This is supported by Ripple’s expanding ecosystem and the growing adoption of its native stablecoin, RLUSD. Per Defillama, the RLUSD stablecoin’s circulating marked cap has alos increased to $788.51 million.

Additionally, an ETF tracker indicate that six XRP ETF products are already operational, with more awaiting approval. This is signaling heightened investor exposure and liquidity opportunities for the asset.

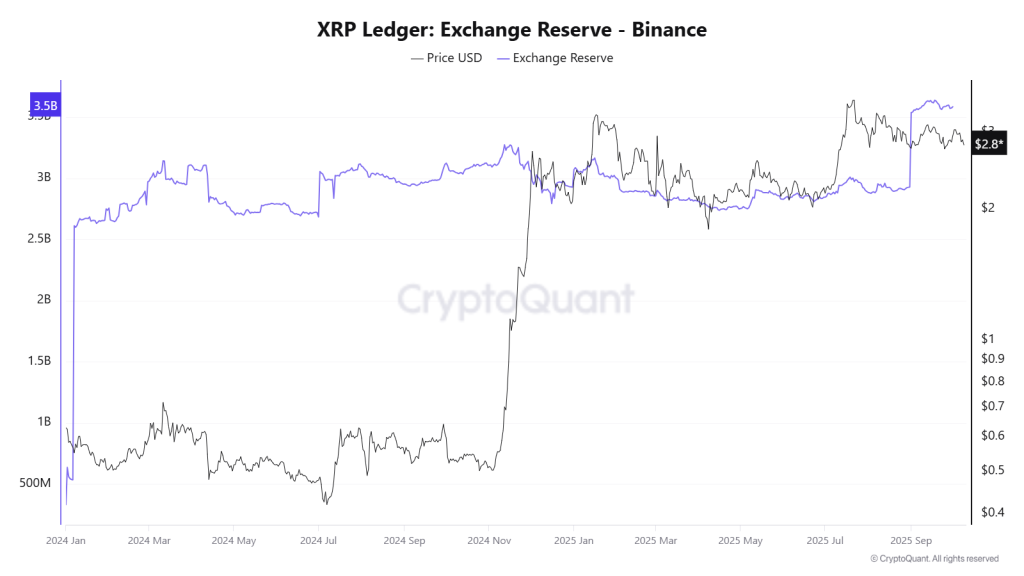

However, the persistent increase in exchange supply, which recently hit 3.5 billion tokens from a three-month low of 2.85 billion, has acted as a ceiling for Ripple price chart performance.

In most cases, such supply growth triggers sell pressure, but XRP has displayed remarkable strength. As its solid fundamentals and structured business model are helping maintain stability even amid rising token circulation.

Escrow Releases Drive Circulating Supply Dynamics

Unlike most assets where supply growth is mostly tied to profit-taking when demand lacks, but XRP’s unique supply mechanics stem from its escrow-based system.

Roughly 35 Billion of the total XRP supply remains locked, which release upto 1 Billion each month through smart contracts. These scheduled releases steadily increase the circulating supply, shaping short-term market sentiment.

While this monthly release enhances the selling potential, upcoming XRP ETF inflows could serve as a significant balancing force. As these products open doors for broader institutional participation, they are expected to absorb much of the new supply entering the market.

Simply put, the current expansion in supply might soon meet equally strong demand from ETF-driven investors.

Technical Setup Favors Long-Term Accumulation

From a technical perspective, the XRP price in USD is consolidating within a pattern commonly known as a descending triangle, aligning with broader market FUD.

The key support range between $2.70 and $2.75 has become a critical battleground for buyers and sellers. So far, buyers appear committed, holding the line despite increasing supply pressures.

If this support remains intact, a rebound could materialize, which would likely see the token propelling toward $5 by the end of 2025.

On the other hand, Ripple price prediction suggests that a breakdown below the support range could expose it to further downside, indicating weaker demand relative to the elevating exchange supply.

In essence, XRP’s long-term prospects depend heavily on how effectively upcoming ETFs and institutional inflows counterbalance its scheduled supply increases.

The next few weeks may prove decisive in determining whether XRP’s consolidation phase transforms into a sustained rally or fades into extended accumulation.

FAQs

Analysts suggest a rebound from current support levels could propel XRP toward $5 by the end of 2025, contingent on holding key technical levels and strong ETF inflows

XRP ETFs increase institutional participation and liquidity, creating new demand that can potentially absorb the token’s scheduled supply releases and support its price.

XRP shows resilience despite supply growth, backed by a structured business model, a growing stablecoin (RLUSD), and institutional ETF products that may fuel long-term demand.