The Ethereum price has had one of the most interesting price actions so far in 2025, dropping to as low as $1,500 early on in the year. The “king of altcoins” has since gone on to forge a new all-time high at $4,946, while outperforming most large-cap crypto assets along the way.

As a result of the market-wide downturn, the Ethereum price has caused pain among investors, falling by double digits to around $3,750 on Friday, October 10. However, this latest spike in volatility has led to the question — does ETH still have some fuel left in the tank, or is the altcoin done in this cycle?

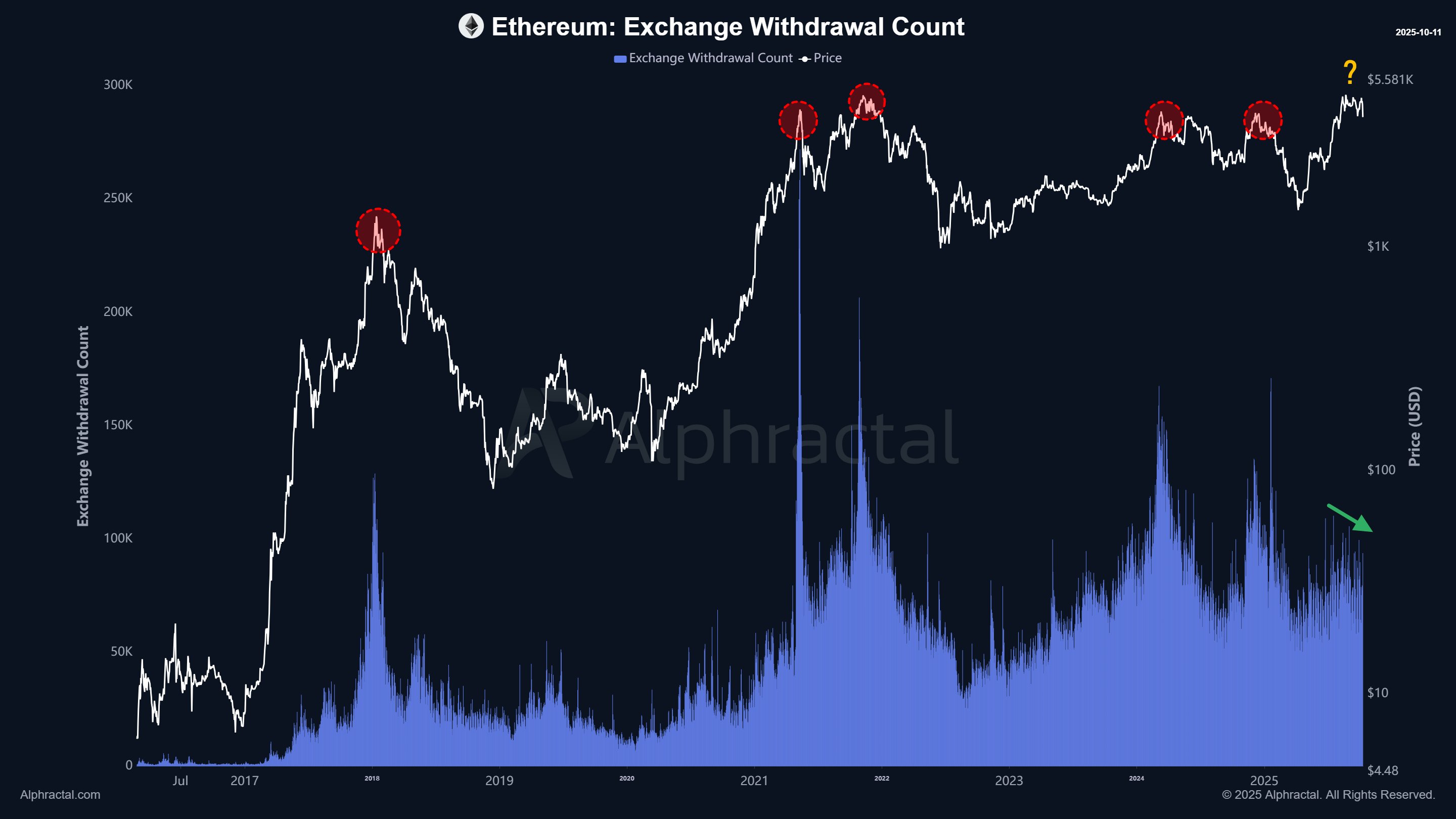

ETH Exchange Withdrawal Count In Downtrend: Alphractal

In a recent post on X, market analytics firm Alphractal shared an interesting on-chain insight into the current outlook for the Ethereum price. According to the blockchain platform, the price of ETH doesn’t appear to have reached its peak in the current cycle.

This price evaluation is based on the Exchange Withdrawal Count metric, which measures the number of crypto withdrawals made from an exchange over a certain period. This indicator offers insight into the volume of a cryptocurrency (Ethereum, in this case) leaving a centralized exchange.

Alphractal revealed that the spikes in the Exchange Withdrawal Count have often coincided with Ethereum price tops. This means that investors tend to withdraw their assets from exchanges as the price of ETH surges to new highs in the previous bull runs.

However, Alphractal highlighted a deviation from this historical pattern following Ethereum’s latest run to a new all-time high. According to the on-chain firm, the Exchange Withdrawal Count has been on a steady decline—rather than a rise—as the Ethereum price moves towards a fresh high.

Ultimately, Alphractal suggested that this deviation from the usual trend could be a signal that the Ethereum price has not yet hit its peak in this cycle. Nevertheless, the on-chain firm noted that the second-largest cryptocurrency could also be about to witness a historical exception, especially when you consider the recent price downturn.

Ethereum Price At A Glance

As of this writing, the price of ETH sits just above $3,700, reflecting a 3% decline in the past 24 hours. According to data from CoinGecko, the altcoin’s value is down by more than 16% in the last seven days.