Quick Facts:

1️⃣ Despite $19B in recent liquidations, CryptoQuant and Glassnode report growing signs of market recovery.

2️⃣ The analysts highlight a surge in $USDT supply, major whale buys and consistent ETF inflows as bullish signals for the crypto sector’s strength.

3️⃣ Such findings bode well for Bitcoin Hyper, a Layer-2 (L2) solution that’s getting set to make Bitcoin faster, cheaper, and more scalable.

Despite $19B in recent crypto liquidations, institutional and long-term investors continue to scoop up sizable amounts of crypto.

Reports from CryptoQuant and Glassnode cite a sharp rise in $USDT supply, steady whale buying, and consistent ETF inflows as positive signs for the market’s future trajectory.

Naturally, this is fantastic news for L2 solutions like Bitcoin Hyper ($HYPER), which is close to raising over $24M on presale.

As more money moves into $BTC, demand for faster, cheaper, and more scalable L2 infrastructure becomes increasingly apparent.

BTC Dropped to $101K After Trump Tariff News

The $19B in liquidations, which took place in just 24 hours on Friday, followed US President Donald Trump’s announcement of a 100% tariff on Chinese imports.

It sparked risk-off sentiment across financial markets worldwide, including crypto. $BTC nosedived to $101K briefly, though it has since stabilized at around $113K.

During the violent crypto sell-off, more than 1K wallets on Hyperliquid were liquidated. Per Lookonchain, over $1.23B in trader capital was erased on the platform alone.

But despite the market chaos, CryptoQuant and Glassnode suggest that the crypto sector might be more stable than it appears.

$USDT Market Cap Spiked by $14.9B in 60 Days

A new report by CryptoQuant – ‘Deleveraging Aftershock’ – notes that stablecoin liquidity is expanding rapidly. It highlights $USDT’s market cap increasing by $14.9B in just 60 days, marking the fastest growth since January and potentially supporting a market rebound.

The on-chain data analysts also found that the 1-year change in whale holdings moved above its long-term average on October 8 – another bullish signal for $BTC’s structural strength.

Glassnode, on the other hand, found that spot trading volumes, ETF inflows, and on-chain transfer activity remain strong. This indicates that institutional demand and liquidity are still intact.

‘In sum, the deleveraging marks a significant but necessary reset for the Bitcoin market. Excess leverage has been cleared, speculative positioning reduced, and short-term sentiment recalibrated,’ – Glassnode.

With on-chain metrics pointing to renewed stability, Bitcoin Hyper is nearly here to help drive Bitcoin to new heights as the market enters a new phase of recovery.

Bitcoin Hyper to Address Bitcoin’s Largest Limitations

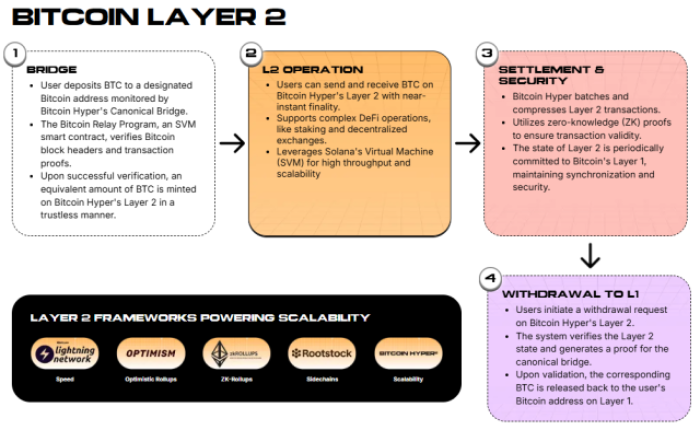

As soon as it goes live this quarter, Bitcoin Hyper will help solve the Bitcoin network’s biggest headaches.

The L2 network will leverage the Solana Virtual Machine (SVM) to make the chain faster, cheaper, and thus more user-friendly for everyday traders.

At the time of writing, Bitcoin is 98.23% slower than Solana. It can only process 13.88 transactions per second (tps), whereas Solana can facilitate 790 tps.

Bitcoin’s transaction finality is 281 times slower than Solana’s. It takes roughly one hour to confirm, compared to Solana’s lightning-fast 12.8 seconds.

To top it off, Bitcoin’s average transaction fee is currently $0.54, whereas Solana’s is just $0.0031.

It’s no surprise, then, that Bitcoin Hyper is utilizing Solana’s high-performance architecture to make Bitcoin more scalable and cost-efficient for everyday use.

But it’s not the L2’s only advantage. Bitcoin Hyper is getting set to introduce a Canonical Bridge to connect the Bitcoin mainnet with the Hyper network. Check out our Bitcoin Hyper review for more information.

It’ll enable wrapped $BTC to be moved across ecosystems so that you can deploy the asset across DeFi protocols, NFTs, dApps, and even the best meme coins.

In turn, the bridge will bring new functionality to the chain that is typically limited to ones like Ethereum and Solana. It could bring in an entirely new user base.

One aspect Bitcoin Hyper won’t be changing, however, is Bitcoin’s security. All transactions will remain as secure and tamper-resistant as on the mainnet. It’s the most secure and battle-tested network in crypto history, after all.

HYPER Presale Rapidly Raises Over $23.8M

The project’s native token – $HYPER – reflects strong demand for the L2 ecosystem. Since going live on presale on May 16, 2025, it has already raised over $23.8M.

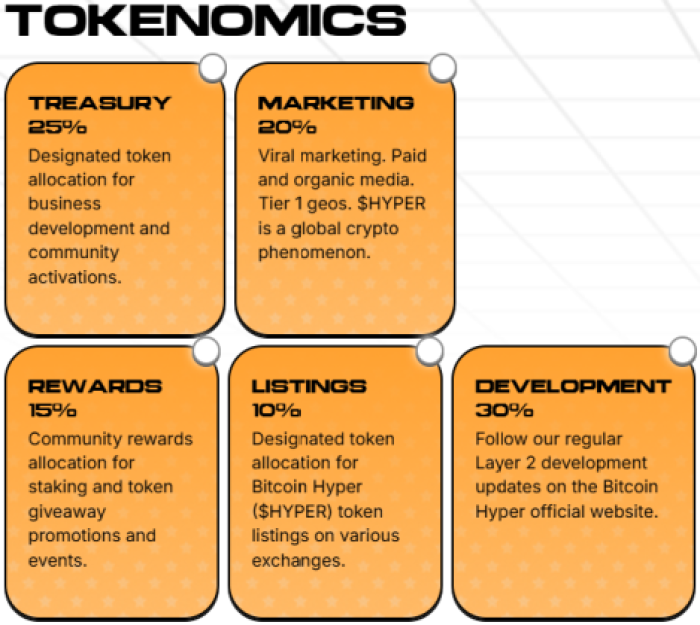

It attracts investor attention over ensuring continued ecosystem visibility and growth – 20% of its total token supply is set aside for marketing and an additional 30% for development.

This means that, by purchasing $HYPER on presale (currently available for just $0.013115), you contribute to the project’s expansion and sustainability.

But that’s not all. $HYPER unlocks various benefits in the Bitcoin Hyper ecosystem, including governance rights, 50% APY staking rewards, and cheaper gas fees.

Once launched on some of the best crypto exchanges and the L2 debuts, our Bitcoin Hyper price prediction foresees $HYPER breaking $0.32 this year.

If you join the presale at today’s price and our prediction comes to fruition, you’ll achieve an ROI exceeding 2,340% – and that’s without factoring in the possible staking income.

Buy $HYPER now for possible 2,340%+ gains.

Disclaimer: We’re not financial advisors, so always DYOR and never invest more than you’re willing to lose. Crypto can be highly volatile.

Authored by Leah Waters, Bitcoinist – https://bitcoinist.com/analysts-foresee-market-recovery-hyper-nears-24m