A well-known crypto commentator has set off fresh debate by laying out a dramatic buy plan for Cardano (ADA), while market data points to a more cautious near-term picture.

Analyst Lays Out Wild Upside Targets

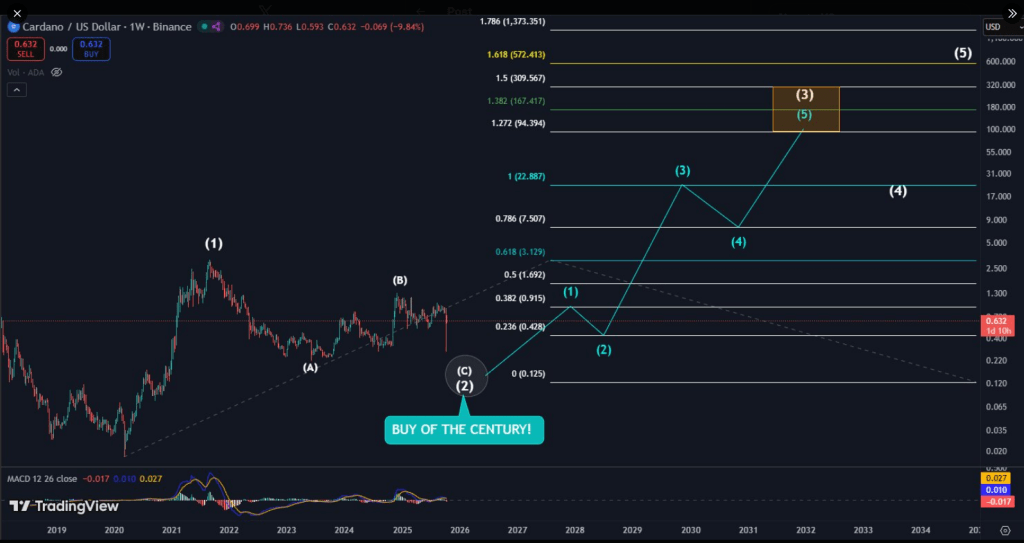

According to Mr. Brownstone, Cardano could offer a once-in-a-lifetime buying chance if price action follows a specific pattern. He highlighted sniper entry points and sketched a five-wave move that would, on his chart, lift ADA into three-digit territory.

At the time reports were filed, ADA had risen 4% in 24 hours and was trading around $0.67. That followed a pullback of more than 20% over the prior two weeks and a flash crash low near $0.27 on Binance on October 10.

Wave Forecasts That Aim Very High

Based on the analyst’s wave count, ADA would first rebound to about $0.91 before slipping back to roughly $0.42. The third wave in his sequence is shown at $22.89. That number represents a 3,34% gain from the then-current price.

$ADA

BUY OF THE CENTURY!

The opportunity of Cardano could be life changing!

Q1 2026 could provide one of the best investments this century, by acquiring $ADA under $0.20

If this decline occurs, I expect price targets for the following years:

Intermediate wave (3) =… pic.twitter.com/KgsTp6lapR

— Mr Brownstone (@GunsRoses1987) October 18, 2025

A corrective move to $7.5 would come after that, with a later target of $167 at the 1.38 Fibonacci extension. The chart’s most extreme path points to the 1.61 extension at $572 — a projection that Mr. Brownstone ties to long-term cycles, with a possible arrival year of 2034, which is about nine years away from now.

According to his view, one last deep dip near $0.20 would set the stage for the entire structure. He suggests that a fall to about $0.20 — roughly a 70% drop from the market price at the time of his forecast — could happen in the first quarter of 2026.

Derivatives Show Lower Confidence

But market signals point in a different direction today. Reports have disclosed that futures Open Interest for ADA fell to over $112 million, the lowest year-to-date and levels not seen since November 2024, based on Coinglass data.

Open Interest dropping usually means fewer new positions are being taken. At the same time, short bets rose and trader participation waned. ADA had corrected nearly 7% in the previous week and was hovering around $0.65 at the time of writing.

Big Targets, Big Questions

Taken together, the picture is mixed. The analyst’s scenario offers huge upside numbers: $22.89, $167.4, and the eyebrow-raising $572.4. But those figures rest on a strict wave interpretation and the assumption of fresh, strong buying after a dramatic low near $0.20.

Market breadth and derivatives data do not yet support that kind of conviction. Participation is lower and short interest is higher, which usually points to weaker near-term momentum.

Reports have shown both sides: a vivid long-term plan and data that favors caution right now. Traders and investors will need to weigh the math of wave counts against real trading flows and the possibility that prices could stay subdued for some time.

Featured image from Gemini, chart from TradingView