The post Bitcoin Price Holds Above $108K Despite Sharp Drop in Futures Open Interest—What’s Next? appeared first on Coinpedia Fintech News

After weeks of sharp swings, the broader crypto market appears to be entering a phase of cautious stability. Bitcoin price continues to trade resiliently above the $100,000 mark, while Ethereum and major altcoins remain range-bound amid cooling market momentum.

Investor sentiment has shifted from extreme optimism to measured consolidation as traders reassess their positions following months of aggressive leverage and speculation. On-chain data shows steady accumulation among long-term holders, even as speculative activity in derivatives markets begins to unwind.

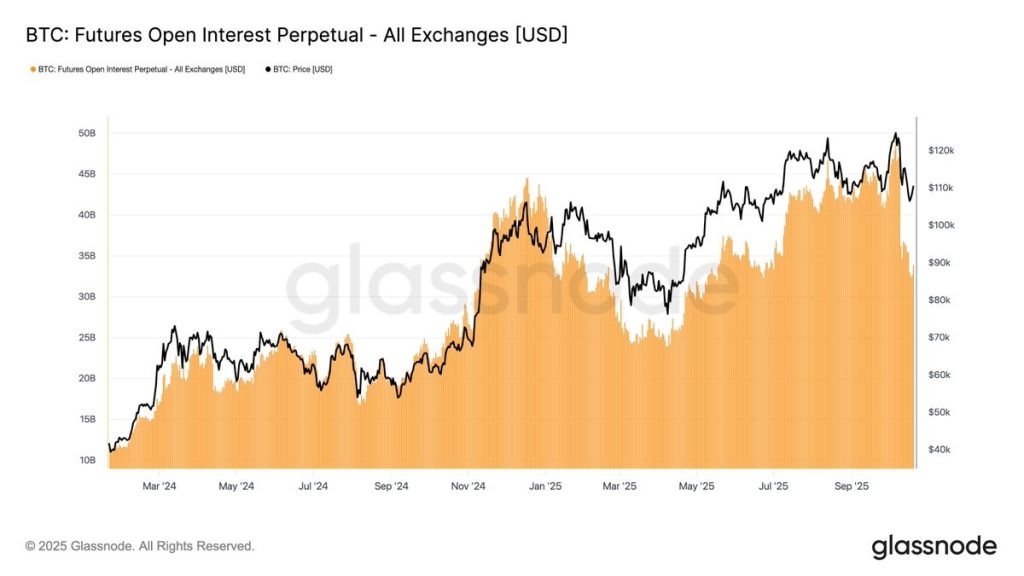

Against this backdrop, one key metric—Bitcoin Futures Open Interest (OI)—has caught analysts’ attention, signaling a potential leverage flush that could influence BTC’s next move.

Bitcoin Futures Open Interest Plunges 20%

Throughout 2025, Bitcoin’s open interest has shown a strong correlation with price action — expanding during rallies and contracting during corrections. Earlier peaks in January and July saw similar patterns: when OI crossed the $45–47 billion range, leverage-driven rallies eventually cooled off, leading to minor pullbacks before the next breakout.

According to the latest Glassnode data, Bitcoin’s futures open interest across major exchanges has dropped from nearly $45 billion to $35 billion, marking a significant 20% decline in just a few weeks.

This contraction comes even as Bitcoin’s spot price remains stable, suggesting traders are reducing leverage rather than exiting the market entirely. Historically, such declines in OI have occurred during periods of profit-taking or liquidations.

Healthy Market Cooling, Not Panic

Despite reduced futures activity, Bitcoin’s spot price structure remains strong. The asset has maintained a support zone between $95,000 and $100,000, suggesting that long-term holders and institutions continue to accumulate during periods of leverage flush.

This is a healthy sign for the market—rather than a panic-driven sell-off, this phase reflects risk reduction and profit realization, key ingredients for sustainable growth. If open interest stabilizes near $30–35 billion, it could mark the beginning of a base-building phase before Bitcoin targets $115,000–$120,000 once again.

On-Chain & Derivatives Data Confirm Consolidation

Additional metrics support this consolidation narrative:

- Futures Open Interest: Down ~20%, confirming reduced speculative leverage.

- Funding Rates: Returning to neutral levels, signaling balance between long and short positions.

- Volatility Index: Flattening after recent spikes, showing early signs of market stabilization.

- Exchange Balances: Bitcoin reserves remain low, reflecting long-term holder confidence.

Together, these trends highlight a cooling but fundamentally strong market environment—the kind that often precedes large directional moves.

Price Outlook: Short-Term Caution, Long-Term Strength

In the short term, Bitcoin is expected to consolidate between $95,000 and $110,000, with occasional volatility driven by futures repositioning. A breakout above $112,000–$115,000 could ignite the next bullish wave toward $120,000–$125,000, while a drop below $95,000 would likely invite strong spot buying interest. Long-term outlook remains bullish, supported by ETF inflows, institutional accumulation, and declining exchange supply—all pointing toward growing structural demand for Bitcoin.