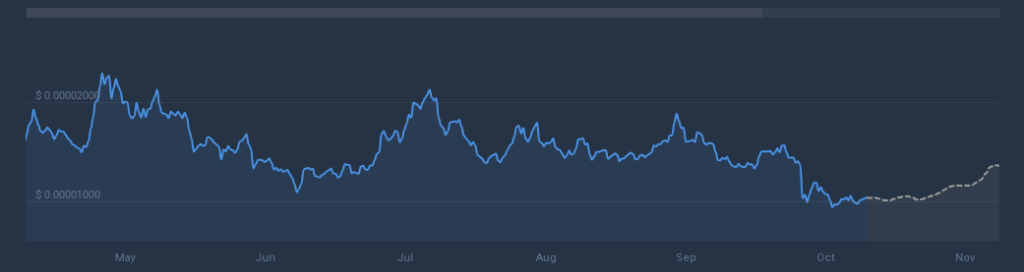

Shiba Inu (SHIB) continues to trade in a tight band, and that has kept many investors on edge. Based on reports, the token is down 45% year-to-date and 15% over the last 30 days.

The memecoin’s price action has left holders wondering when — or if — a strong rebound will arrive. Volume and price swings have cooled, and market mood is leaning toward fear with the Fear & Greed Index at 30.

Analyst Forecasts Late Surge

According to MMB Trader, the stretch of quiet price action is not the end story for SHIB. He described the token as a “dead and sleeping coin” that often surprises late in a cycle.

The key level to watch, he said, sits near $0.00001740. That line traces back to a trend that began after the March 2024 peak of $0.00004567.

If SHIB breaks above that trendline and then holds it on a retest, the trader argued, the price structure would shift toward bullish.

Three Breakout Targets

Reports have disclosed three specific upside targets tied to that scenario. The first target is $0.00003364 — a rise of 235% from the current price of $0.00001003.

The next target is $0.000055480, which would represent about 450% growth from today’s level. The most ambitious point in this view is $0.00007730, equal to roughly a 670% gain.

Some analysts have a similar upside figure, calling for a move to $0.000081 if a sustained breakout happens.

Mixed Signals From Models And Indicators

Other forecasts are more modest. Based on CoinCodex data, SHIB is expected to reach $0.00001183 by November 23, 2025, a rise of 16% from the current price.

Technical indicators in some services are showing Bearish sentiment now. Over the last 30 days SHIB posted 16/30 green days, or 53%, with price volatility around 8.91%. These details show activity is present, but it has not yet produced a clear directional push.

Risk And Market Context

Trading this token remains risky. Millions of holders are exposed while the market waits for a clear catalyst. A breakout above the trendline would likely be followed by a retest, which traders often use to confirm whether the move has real strength.

If the retest fails, the price could fall back into its prior range. That scenario is as possible as a breakout, given the current low volatility and reduced volume.

Possible Rebound

Based on reports and analyst calls, a late and rapid recovery for Shiba Inu is possible, but far from certain. The market is split between cautious models that predict single-digit gains and chart-based calls that map out several hundred percent rallies.

For now, the trendline near $0.00001740 will be watched closely, and any decisive move above it would change the outlook quickly.

Featured image from Unsplash, chart from TradingView