The SUI price has had quite a disappointing performance in 2025, despite having started the year with a red-hot streak. The cryptocurrency’s price rode this new year’s momentum to a new all-time high of $5.35 as early as January 4, 2025.

However, the SUI price currently sits more than 53% away from this record price, putting the altcoin’s struggles into perspective. According to a popular analyst on the social media platform X, the price of SUI could be gearing up for a run-up to a new all-time high.

SUI To Surge 260% If It Breaks Out Of This Pattern

In a recent post on X, market pundit Ali Martinez put forward a $9 target for the SUI price over the next few months. The crypto analyst identified four reasons why the altcoin’s price could be on its way to a new all-time high.

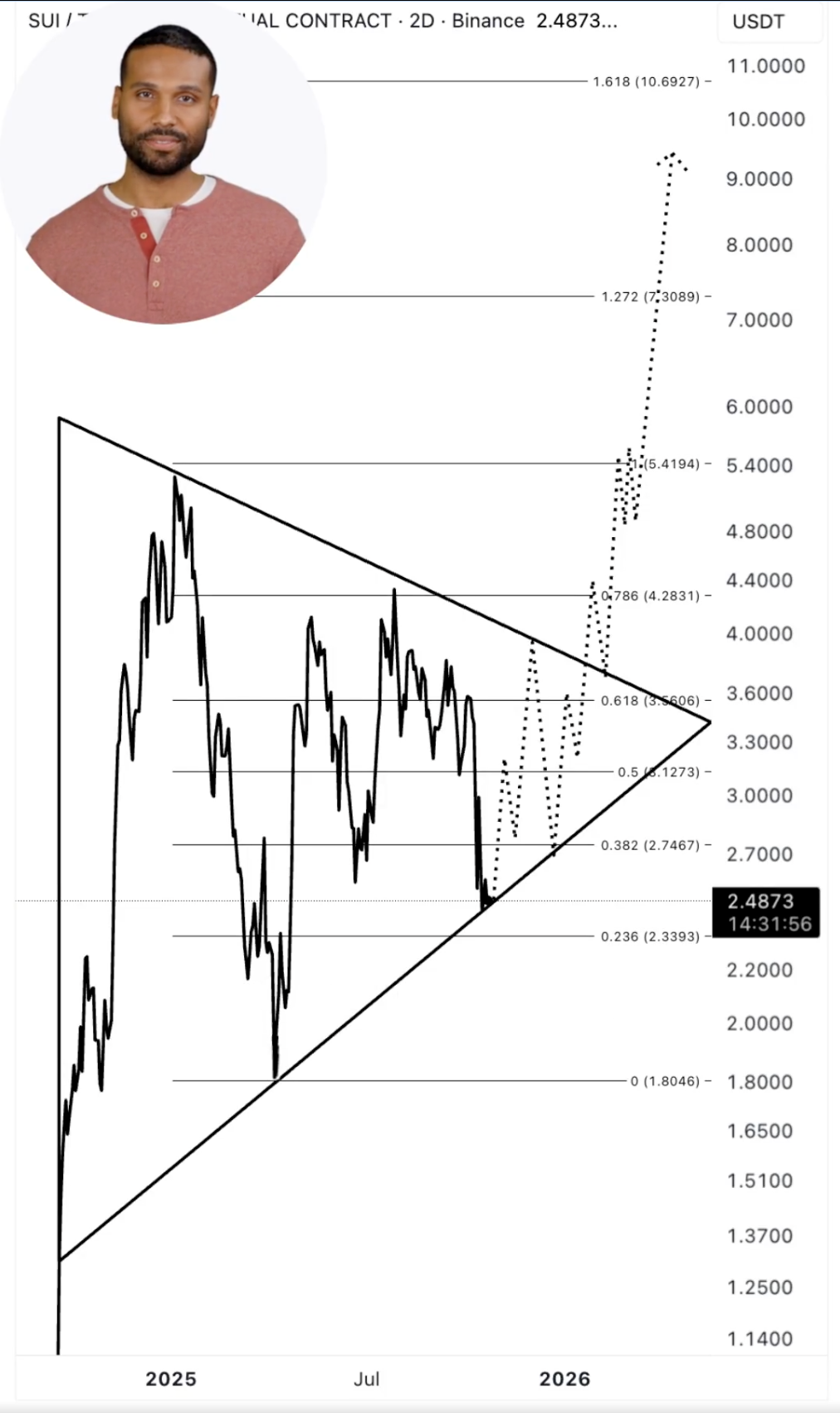

Firstly, Martinez highlighted the current technical setup of the SUI token, which is trading within a symmetrical triangle on the 2-day timeframe. For context, the symmetrical triangle is a technical analysis pattern characterized by a diagonal falling upper trendline and a rising lower trendline.

The asset’s price typically narrows and moves towards the apex of the triangle pattern, either breaching the upper trendline for a breakout or the lower trendline for a breakdown. In essence, this symmetrical triangle formation often serves as a continuation or reversal pattern depending on the direction of the price break.

Given that this technical pattern tends to be a continuation signal, Martinez expects the SUI price to break above the upper trendline, resuming its initial upward movement before entering the triangle. According to the analyst, the token could go as high as $9 if there is a sustained close above this upper boundary at the $3.6 mark

As of this writing, the SUI price stands at around $2.51, reflecting an over 1% jump in the past day. And a move to around $9 would represent an over 260% surge from the current price point.

On-Chain Catalysts For SUI Price

To support this bullish technical structure, Martinez also highlighted three positive on-chain developments in recent weeks. Firstly, the crypto analyst mentioned that the total value locked (TVL) on SUI just hit a new all-time high of $2.6 billion, indicating strong capital inflow on the blockchain.

Meanwhile, the volume of decentralized exchange (DEX) activity on SUI has also been on the rise, reaching a new record high $20.33 billion in October. According to Martinez, this recent spike was driven by real network activity, and not just incentives.

The third on-chain development highlighted is the stablecoin market cap on SUI, which has now climbed to $1.15 billion. Martinez noted that this surge in stablecoin volume underscores the network’s steady growth and strong demand. Ultimately, these positive on-chain fundamentals add to the bullish case of the SUI price.