The post Crypto Market Live: Bitcoin (BTC) Poised for Major Volatility as Price Targets $120,000 This Week appeared first on Coinpedia Fintech News

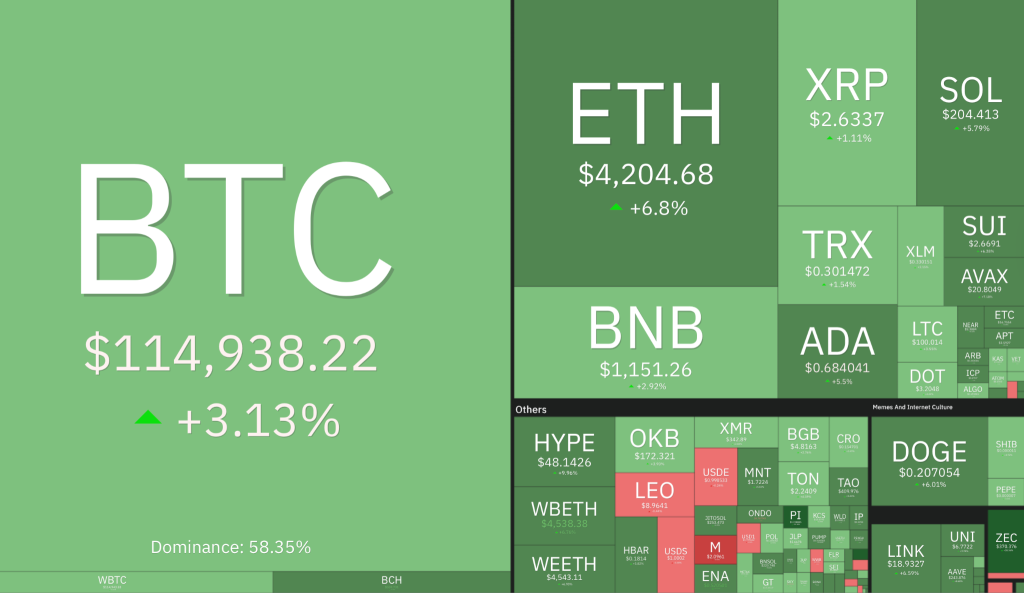

The crypto market kicked off the week with a surge in volatility, setting the stage for potential breakout moves across major digital assets. Bitcoin (BTC) price remains the center of attention as it consolidates near the $110,000 mark, hinting at a possible push toward $120,000 amid renewed investor optimism and strong inflows. Ethereum (ETH) price continues to trail behind but shows signs of recovery as on-chain activity and staking demand gradually increase.

Meanwhile, altcoins such as Binance Coin (BNB), Solana (SOL), and XRP are experiencing mixed momentum, with traders closely monitoring capital rotation among the top 10 tokens. Cardano (ADA), Dogecoin (DOGE), and Toncoin (TON) are displaying choppy price movements as market sentiment fluctuates between risk-on and profit-taking phases. Polygon (MATIC) and Avalanche (AVAX) also remain range-bound but could benefit from renewed DeFi and layer-2 interest if Bitcoin sustains its dominance.

With total crypto market capitalisation hovering above the $4 trillion threshold and volatility indexes rising, analysts expect a decisive move soon. As global liquidity trends, ETF inflows, and macroeconomic cues from the U.S. drive sentiment, this week could determine whether Bitcoin and its peers enter another leg of the bull cycle—or face a sharp correction before the next big rally.

A Huge Week Ahead: Key Macro Events to Drive Market Volatility

The coming days are shaping up to be one of the most eventful weeks for global markets, and the crypto space is no exception. The Federal Reserve’s Interest Rate Decision (FOMC) on Wednesday will be the week’s biggest catalyst, with investors closely watching whether the Fed maintains its current stance or signals a policy shift. Any hint of rate cuts or dovish commentary could spark a sharp rally across risk assets, including Bitcoin and top altcoins, as liquidity expectations improve.

Immediately following the FOMC decision, Fed Chair Jerome Powell’s press conference is expected to inject further volatility. Markets will dissect every statement for clues about the Fed’s inflation outlook and potential monetary easing timelines, key factors that could determine whether Bitcoin breaks above its $120,000 resistance zone or faces renewed pressure.

Adding to the drama, Thursday’s meeting between President Donald Trump and President Xi Jinping could have major implications for global trade and economic stability. A positive tone may fuel market optimism, while renewed tensions could push investors back toward safe-haven assets like Bitcoin and gold.

With these pivotal events lined up, analysts warn that volatility could surge across all major asset classes—making this a make-or-break week for the crypto market’s short-term trajectory.

Market Outlook: Will Bitcoin Lead the Next Breakout or Face a Sharp Pullback?

As global markets gear up for a wave of crucial economic events, the crypto market stands at a pivotal juncture. Bitcoin’s (BTC) current consolidation above the $110,000 level has kept investors hopeful for a breakout toward $120,000—but the next move will likely depend on how markets react to this week’s macro triggers.

If the Federal Reserve signals a dovish stance or hints at future rate cuts, liquidity could pour back into risk assets. Such a scenario would likely fuel a strong upward move in Bitcoin, potentially propelling altcoins like Ethereum (ETH), Solana (SOL), and Binance Coin (BNB) to new short-term highs. Historically, periods of easing monetary policy have acted as a tailwind for digital assets, and traders are watching for a similar setup this week.

On the flip side, a hawkish Fed tone or unexpected tension between the U.S. and China could trigger a risk-off reaction, leading to sharp intraday corrections. Bitcoin could retest its $105,000 support zone, while top altcoins may experience steeper declines amid profit-taking and reduced market liquidity.

Overall, this week’s combination of macro decisions and geopolitical developments is likely to set the tone for the rest of the quarter. Whether the market chooses breakout or breakdown, one thing is certain—volatility is coming, and traders should be prepared for fast-moving price swings across the entire crypto spectrum.