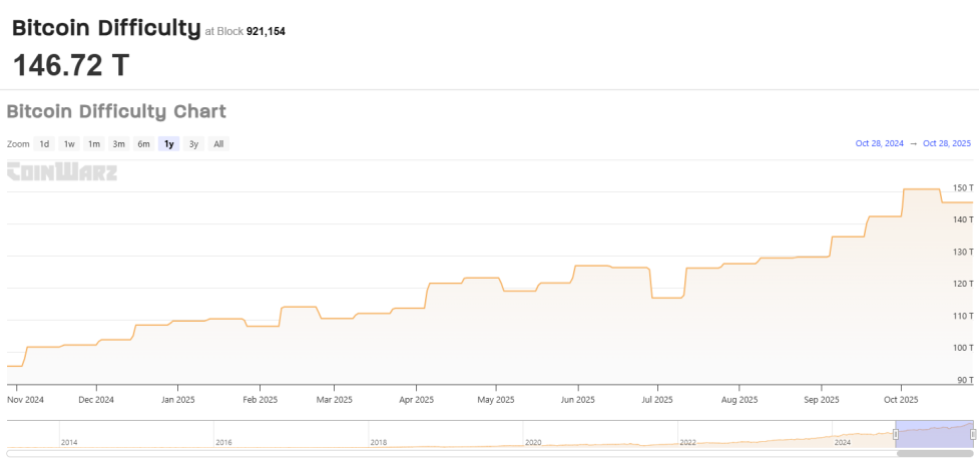

On-chain data shows the Bitcoin mining Difficulty is set to go through a sharp jump in the coming adjustment and reach a new all-time high (ATH).

Bitcoin Mining Difficulty Will Go Up Over 6% In The Next Adjustment

According to data from CoinWarz, Bitcoin mining Difficulty is heading toward a positive adjustment on Wednesday. The “Difficulty” here refers to a metric built into the BTC blockchain that controls how hard miners find it to mine blocks on the network.

The Difficulty is entirely controlled by the code Satoshi wrote in all those years ago, meaning that no third party has any say in how its value changes. The chain automatically adjusts the metric about every two weeks based on a simple rule that the pseudonymous Bitcoin creator established: block time must stay constant around 10 minutes per block.

Whenever miners mine blocks in an average time faster than this, the network responds with an increase in the Difficulty. The jump is always just enough to slow the miners back down to the standard rate. Similarly, the validators being slower than needed forces the chain to ease things up.

The next Difficulty adjustment is expected to occur on October 29th. Below are the details regarding this event.

As is visible, the average block time since the last Bitcoin Difficulty adjustment has stood at 9.42 minutes, which is 0.58 minutes faster than the standard time. To correct for this, the network will raise its Difficulty by more than 6% on Wednesday. This is quite a significant jump, one that will result in a new record for the indicator at around 155.8 trillion hashes. At present, the metric’s value is 146.7 trillion hashes.

Before the last adjustment, the Bitcoin mining Difficulty had been following a sustained uptrend, rising for seven consecutive adjustments in a row.

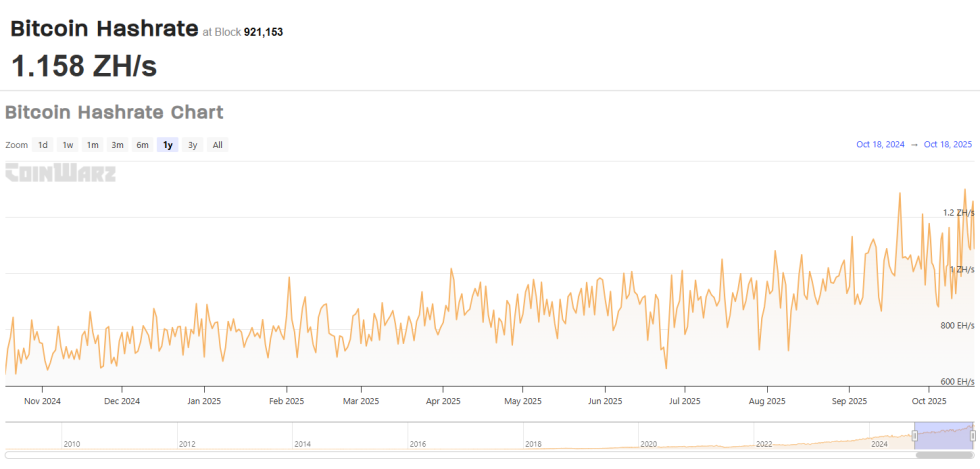

The reason behind the uptrend in the metric lay in the aggressive expansion that miners had been participating in. As the chart below shows, the Hashrate, an indicator tracking the total amount of computing power deployed by the chain validators, has shot up recently.

Around the beginning of October, the Bitcoin Hashrate saw a pullback, suggesting some miners disconnected from the network. This drop in computing power is why the validators couldn’t keep pace anymore, and the Difficulty broke its streak of upward adjustments.

As it has turned out, however, the slowdown in the Hashrate was only temporary, as miners have again been aggressive in their upgrades, forcing the network to take the Difficulty to yet another new ATH.

BTC Price

Bitcoin recovered above $116,000 on Monday, but the coin has since faced a retrace as it’s now back at $114,400.