Grayscale Investments kicked off trading of a new Solana-focused ETF on Wednesday, adding a staking feature that passes network rewards to investors.

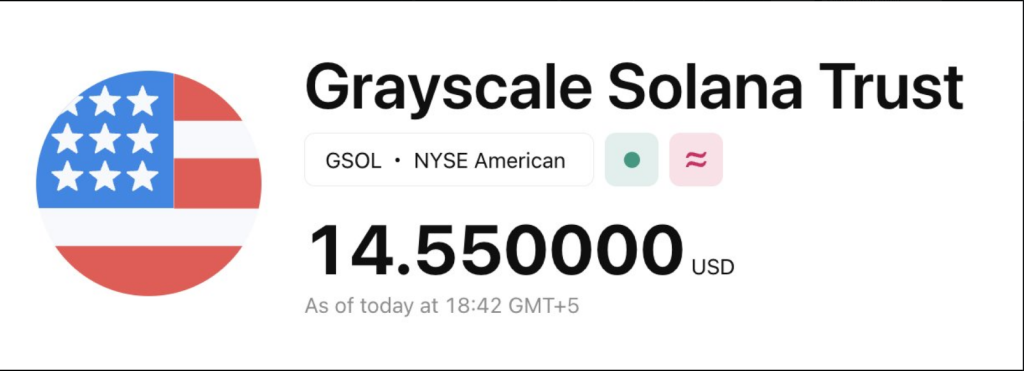

The fund, now listed on NYSE Arca as the Grayscale Solana Trust ETF (GSOL), was converted from a closed-end vehicle that first launched in 2021.

From Closed-End Trust To ETF

According to Grayscale, the move makes the firm one of the largest Solana exchange-traded product managers in the US by assets under management.

The converted ETF lets ordinary brokerage accounts hold SOL exposure while receiving staking rewards tied to the network.

Inkoo Kang, Grayscale’s Senior Vice President of ETFs, said the launch shows the firm’s belief that digital assets should sit alongside stocks and bonds in modern portfolios.

Introducing Grayscale Solana Trust ETF (Ticker: $GSOL), offering investors exposure to @Solana $SOL, one of the fastest-growing digital assets. $GSOL features:

Convenient Solana exposure paired with staking benefits.

Exposure to a high-speed, low-cost blockchain.… pic.twitter.com/TgVNlhqBPO

— Grayscale (@Grayscale) October 29, 2025

Competition Increased This Week

Based on reports, Grayscale is not alone. Bitwise rolled out its own Solana ETF on the New York Stock Exchange one day earlier. Canary also listed Litecoin and HBAR ETFs on Nasdaq on Tuesday.

Those moves came amid strong interest from asset managers to offer regulated crypto funds that give investors straightforward access to tokens without direct custody.

JUST IN: $GSOL, the first Grayscale Solana Trust ETF with staking, goes live on @NYSE Arca, offering U.S. investors spot @Solana exposure and staking rewards under newly approved SEC listing standards. pic.twitter.com/eTzVP9Kb1X

— SolanaFloor (@SolanaFloor) October 29, 2025

Regulatory Timing And Guidance

These ETF launches happened while the US government was partially shut down and some SEC staff were furloughed.

The Securities and Exchange Commission issued guidance permitting firms to file S-1 registration statements without a delaying amendment, which lets certain funds take effect automatically within 20 days of filing.

The SEC had also approved updated listing standards for commodity-based trust shares shortly before the staffing disruption, a step that helped speed up approvals for dozens of pending crypto ETF applications.

What This Means For Solana Holders

Solana remains among the top tokens by market cap, ranking sixth, according to CoinGecko. Kristin Smith, president of the Solana Policy Institute, said staking-enabled funds offer more than simple price exposure; participants can help secure the network, support developer work, and earn rewards.

That mix of potential yield and participation creates a new option for investors who want both token exposure and the chance to receive staking returns.

Based on reports, the new listings did not include full details on fee levels, which validators will be used for staking, or how staking rewards will be split after expenses.

Those operational questions matter to investors weighing net returns and counterparty risk. Trading on NYSE Arca does mean easier access through brokerages, but the finer points of how staking is run will shape how attractive GSOL becomes versus other Solana products.

Featured image from Gemini, chart from TradingView