The post TAO Price Prediction 2025: Will Bittensor’s ETP Launch and Halving Push TAO Toward $678? appeared first on Coinpedia Fintech News

The TAO price prediction 2025 outlook aims for $678 target before the year concludes. This optimism stems from Bittensor’s momentum building ahead of its halving and the launch of a new staked ETP.

Currently, the TAO price today is approaching $425, marking six consecutive days of gains. Traders are eyeing a sustained breakout once it sustains above $450 with a daily close. Also, the latest ETP news is why optimism is higher, as growing institutional interest amplifies market optimism.

ETP Launch Adds Institutional Catalyst to TAO’s Uptrend

The late October Bittensor rally coincides with a major development as Deutsche Digital Assets and Safello are set to debut a staked TAO Exchange Traded Product (ETP) on the SIX Swiss Exchange in November.

The product, titled STAO, will provide investors with exposure to both TAO’s price performance and staking rewards, while maintaining an expense ratio of 1.49%.

This launch marks a significant milestone for TAO crypto, signaling its growing presence in regulated financial markets. As institutional access expands, investor confidence may strengthen further, potentially boosting TAO price forecast discussions for 2025.

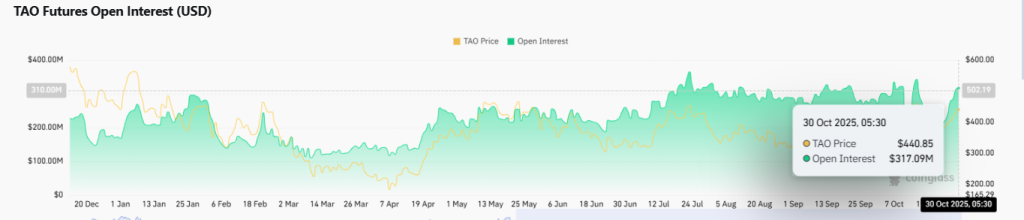

Meanwhile, derivatives data reinforces this narrative. According to CoinGlass, TAO futures Open Interest rose from $312 million to $317 million in intraday indicating growing leveraged participation. Furthermore, the funding rate flipped positive from -0.0018% to 0.0048%, underscoring bullish conviction among traders betting on higher prices.

Halving Countdown Adds Supply-Side Tailwind

Adding to the bullish momentum, TAO price chart dynamics are increasingly influenced by the upcoming Bittensor halving, expected in roughly 44 days. The event will cut daily TAO emissions from 7,200 to 3,600, tightening supply and potentially driving prices higher if demand continues to build.

Historically, halving events across major blockchain networks have reduced sell-side pressure and introduced scarcity, setting the stage for post-halving rallies. For TAO crypto, this reduced issuance rate could magnify the impact of growing institutional interest and investor inflows following the ETP debut.

This combination of fundamental and macro factors positions TAO price USD for an extended uptrend through 2025, provided broader market sentiment remains supportive.

Technical Structure Points Toward Range-Wide Expansion

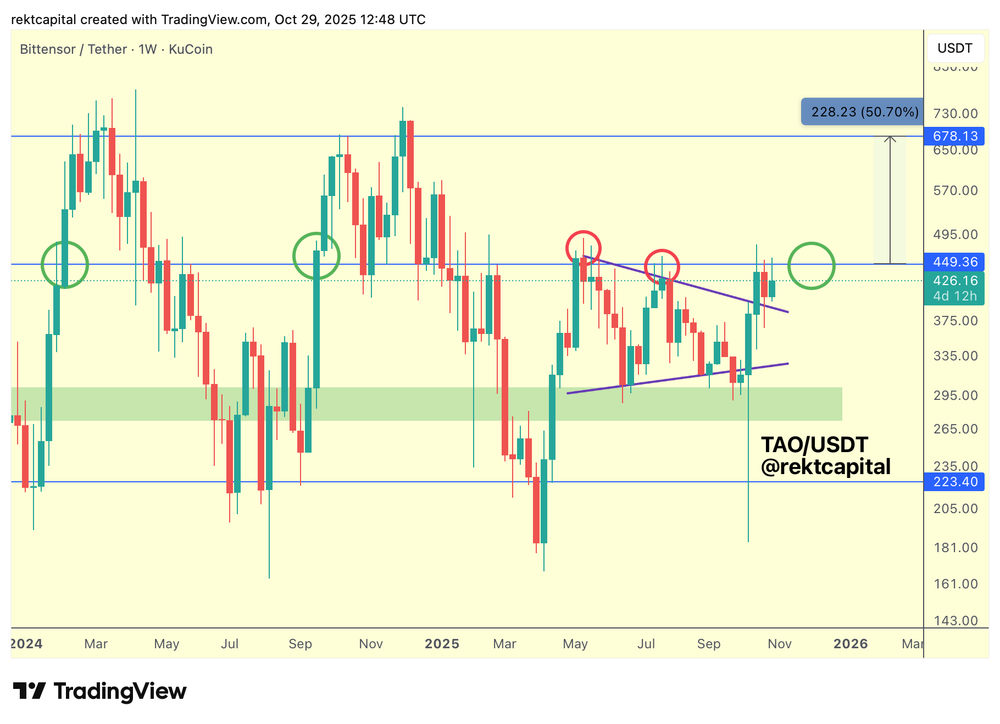

Technically, TAO price has been trading within a wedging structure, recently reclaiming strength after deviating into a green demand region, according to Rekt Capital.

That retest helped reestablish momentum, leading price toward the wedge’s upper boundary near $449.36, which is now acting as resistance.

If TAO secures a weekly close above $449.36, it could reclaim this level as support and re-enter its macro range defined between $449.36 and $678.13.

Rekt Capital also mentions that the historical data shows that confirmed closes above this zone have typically preceded rallies covering nearly 50% of the macro range.

Moreover, the shallower pullbacks observed after each rejection indicate a tightening of supply and rising demand, a sign of strength in the market structure. Sustaining this pattern could open the pathway toward TAO price prediction 2025 targets around $678, potentially even higher if bullish catalysts align post-halving.