The post Tether Buys $98M in Bitcoin as Traders Turn Bearish—A Major Market Divergence Unfolds appeared first on Coinpedia Fintech News

Bitcoin’s price is struggling to stay above $100,000, as traders turn cautious and selling pressure builds across major exchanges. The broader crypto market also shows signs of weakness, with most assets trading flat or slightly lower. Yet, even as traders pull back, Tether—the world’s largest stablecoin issuer—has quietly made a notable move in the background, sparking fresh curiosity about what could be coming next for Bitcoin.

Tether Quietly Accumulates Over 960 BTC Worth $98 Million

While traders remain on edge, Tether, the issuer of the world’s largest stablecoin USDT, has quietly accumulated more Bitcoin. The company recently added over 960 BTC worth approximately $98 million, continuing its long-term strategy of converting a portion of its net profits into Bitcoin.

With this latest purchase, Tether strengthens its position as one of the biggest corporate holders of BTC, alongside firms like MicroStrategy. This move reflects growing institutional confidence in Bitcoin’s long-term potential, even during periods of weak market sentiment. Tether’s ongoing accumulation could act as a subtle vote of confidence—suggesting that large players may be preparing for a stronger recovery once the current consolidation phase ends.

Bearish Sentiment Dominates Short-Term Trading

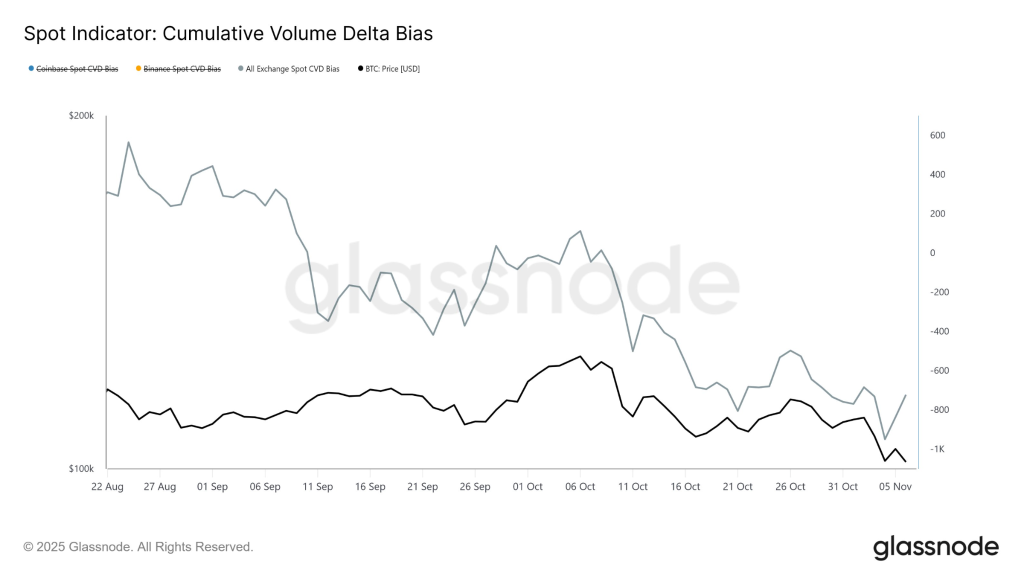

Despite occasional price rebounds, short-term sentiment among Bitcoin traders remains largely bearish. Data shows that the Spot Cumulative Volume Delta (CVD) has trended lower across major exchanges, signaling sustained sell pressure and limited aggressive spot buying. This means that more traders are selling into rallies than buying dips.

Many short-term speculators are likely being cautious due to recent volatility and uncertainty in the macro environment, including interest rate concerns and slower institutional inflows. However, while retail sentiment appears defensive, this environment often creates opportunities for larger investors to accumulate quietly—a trend that aligns with Tether’s latest move and could set the stage for a potential shift in momentum.

Smart Money vs. Market Sentiment

The current setup in the Bitcoin market highlights a clear divergence between smart money and retail traders. While most traders are hesitant or taking profits, Tether’s latest Bitcoin purchase signals a longer-term, confident outlook. Historically, such divergences have often marked important inflection points—when institutional accumulation occurs quietly before a larger market move.

If Bitcoin manages to hold its key support zones and buying activity from entities like Tether continues, sentiment could turn bullish again. For now, the market stands at a crossroads: retail traders are cautious, yet institutional actions suggest confidence in Bitcoin’s future, creating a tension that could soon resolve into a decisive move.