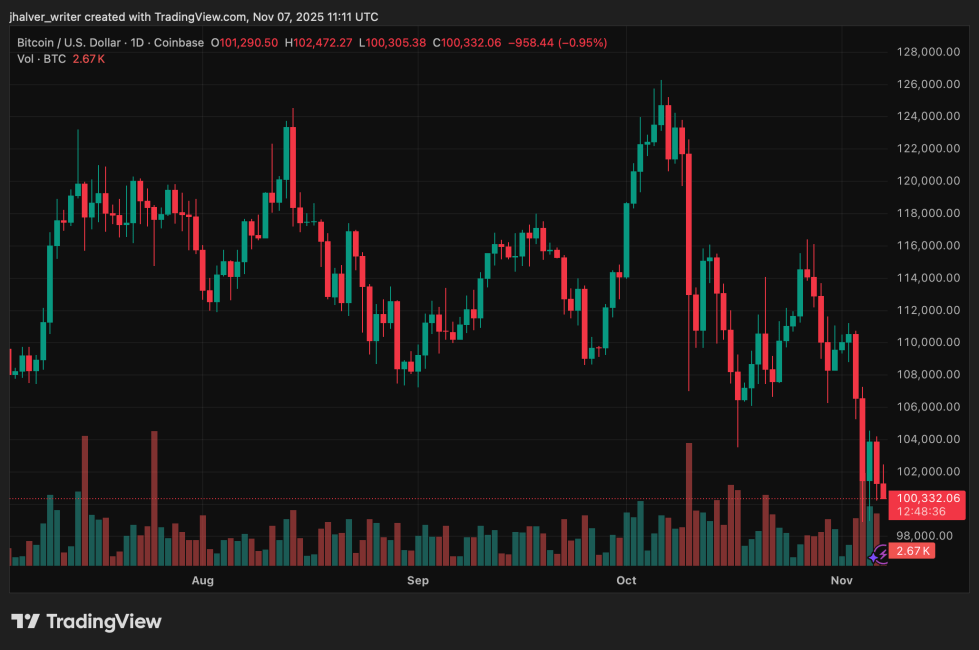

Bitcoin (BTC) continues to consolidate around the $100,000–$102,000 zone as global markets remain cautious following the hawkish comments from the U.S. Federal Reserve.

Related Reading: Is A Ripple IPO Coming? Garlinghouse Shares New Insights

Despite short-term weakness, analysts remain divided, with institutional forecasts ranging from $120,000 to $170,000 for 2025.

Macro Pressure Keeps Bitcoin in Tight Range

Currently, Bitcoin is trading around $100,900, down 2.01% in the last 24 hours, extending its 8.2% weekly decline.

The broader crypto market capitalization slipped to $3.37 trillion as Ethereum fell below $3,400 and altcoins posted mixed results. Analysts attribute the muted action to tight liquidity and risk-off sentiment, with BTC trapped between key support at $100,500 and resistance at $102,500.

According to CoinSwitch Markets Desk, maintaining levels above $100,500 keeps sentiment “constructive,” but a breakout above $102,500 is needed to target $104,000–$105,000.

Whale activity, however, suggests accumulation. Wallets holding 1,000–10,000 BTC added nearly 30,000 BTC last week, signaling growing confidence among large holders.

Diverging Institutional Bitcoin Forecasts Add to Uncertainty

Institutional analysts remain split on Bitcoin’s next move. JPMorgan values BTC at $170,000, comparing its risk-adjusted volatility to gold, while Bitwise CIO Matt Hougan and MicroStrategy’s Michael Saylor forecast a $150,000 year-end target driven by ETF inflows and institutional rotation.

In contrast, Galaxy Digital cut its 2025 forecast to $120,000 after whales sold 400,000 BTC in October, warning that Bitcoin’s “maturity era” may lead to slower but steadier growth.

Meanwhile, Cathie Wood of ARK Invest has trimmed her 2030 price target from $1.5 million to $1.2 million, citing stablecoin adoption in emerging markets like Venezuela and Argentina, where citizens are increasingly using USDT to hedge against inflation.

Market Sentiment and Corporate Impact

Market sentiment remains fragile, with RSI readings below 40 suggesting an oversold phase. Veteran analyst Tom Lee believes current macro challenges could “turn into opportunities,” predicting a turnaround once U.S. inflation eases.

Adding to the mix, Block Inc., led by Jack Dorsey, reported $1.97 billion in Bitcoin-related revenue for Q3 2025, nearly one-third of its total earnings, despite a broader earnings miss that sent shares down over 10%.

Related Reading: Will Michael Saylor’s $64 Billion Bitcoin Stack Get Liquidated At $74,000? Here’s The Truth

For now, Bitcoin’s resilience above $100,000 offers cautious optimism. A decisive close above $105,000 could confirm a trend reversal; however, until then, BTC’s consolidation reflects a market at the crossroads of macroeconomic headwinds and institutional conviction.

Cover image from ChatGPT, BTCUSD chart from Tradingview