Data shows Bitcoin spot exchange-traded funds (ETFs) are down $3.29 billion from their all-time high (ATH) after the latest wave of outflows.

Bitcoin Spot ETFs Are Experiencing Their Second-Largest Drawdown Ever

In a new post on X, CryptoQuant community analyst Maartunn has talked about how the holdings attached to the US Bitcoin spot ETFs are currently looking. Spot ETFs refer to investment vehicles that allow an investor to gain exposure to an underlying asset’s price movements without having to directly own said asset.

In the context of cryptocurrencies, this means that the ETF holder never has to interact with a digital asset exchange or make any transactions on the blockchain; the fund buys and holds the coin on their behalf. Spot ETFs are a relatively recent phenomenon in the sector, having received approval from the US Securities and Exchange Commission (SEC) only in January of last year.

Despite them being new, these investment vehicles have grown into one of the cornerstones of the market, tapping into the demand from traditional investors who were previously reluctant to trade on-chain. Given the relevance of the spot ETFs, the trend in their holdings can be worth keeping an eye on, as it may reflect the sentiment among institutional entities. One way to do so is by measuring where these funds stand relative to their ATH.

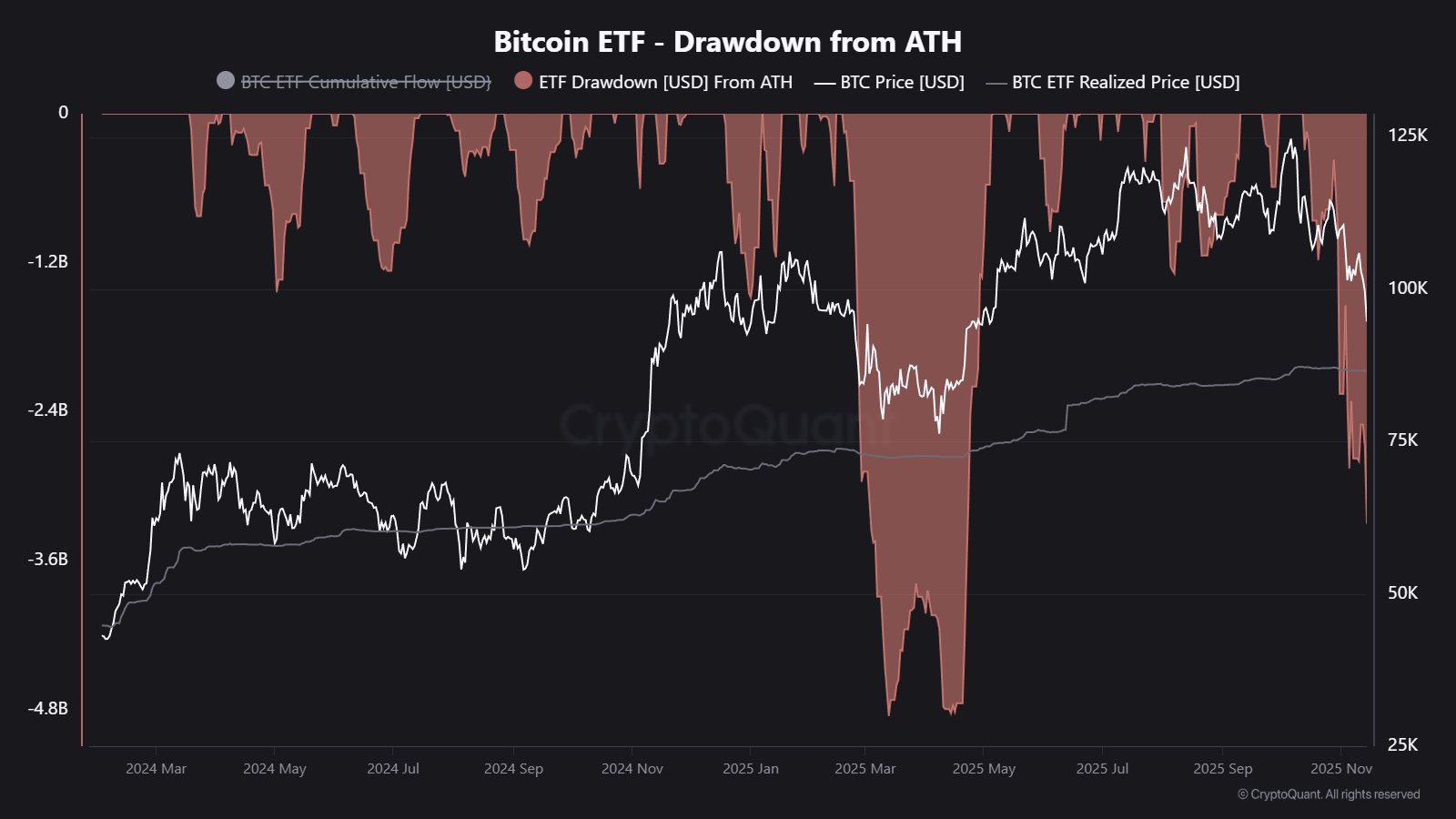

Below is the chart shared by Maartunn that shows how the drawdown from the ATH currently looks for the Bitcoin spot ETFs:

From the graph, it’s visible that the Bitcoin spot ETFs saw their USD holdings reach an ATH in October, but since then, they have been facing a sustained drawdown. Last month, the drawdown was still limited, but the outflows accompanying the price crash have meant ETF holdings are now significantly down compared to the peak.

More specifically, spot ETF holdings are currently down a whopping $3.29 billion, the second-largest drawdown since last year’s launch. The only phase during which the metric’s value was higher was the bearish period between February and April. Back then, ETFs saw a peak drawdown of $4.8 billion. The latest decline in ETF holdings is still notably below this mark, so it only remains to be seen whether the drawdown will deepen in the near future.

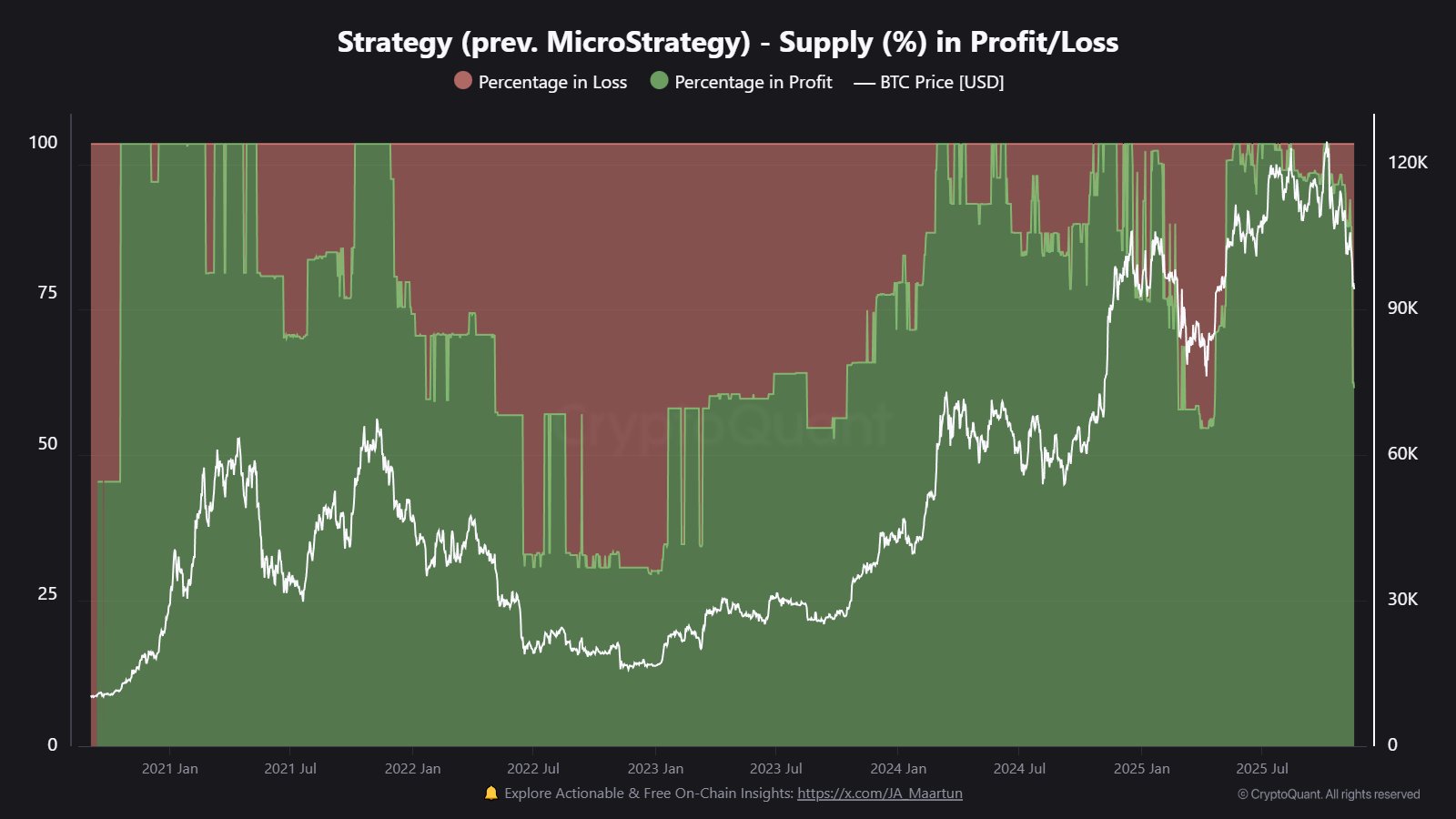

In some other news, Strategy made a large purchase on Monday, but the continued decline in the Bitcoin price has already pushed the treasury firm’s new acquisition significantly into the red. According to CryptoQuant, the combination of this move and the price drop has resulted in about 40% of the company’s reserves now sitting underwater.

BTC Price

Bitcoin slipped under $90,000 just earlier, but the coin has since bounced back to $91,500.