Bitcoin’s recent price swings have picked up pace, and market watchers say that option markets may again be calling the shots. Over the past two months volatility has climbed, shifting how traders and investors respond to big moves in BTC.

Volatility Numbers Reignite Focus

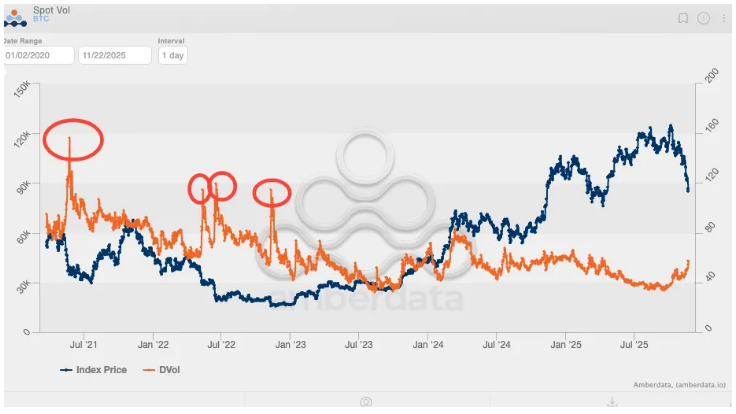

According to Jeff Park, implied volatility had stayed below 80% since US Bitcoin ETFs were approved, But it is now creeping back toward about 60%. That rise matters because option flows can amplify moves — both up and down — when traders reposition quickly.

Park pointed to January 2021 as a clear example, when an options-driven surge helped push Bitcoin to a cycle high of $69,000 in November of that year. In other words, swings driven by derivatives are capable of producing outsized trends.

Price Drops And Clearing Of Positions

Bitcoin tumbled below $85,000 on Thursday, a move that helped trigger liquidations and heightened selling pressure.

Reports have disclosed that some losses are tied to highly leveraged positions being forced closed, while other activity appears to come from long-term holders taking profits.

Analysts at Bitfinex called much of the action “actical rebalancing,” saying it does not break long-term adoption or fundamentals.

Binance CEO Richard Teng is reported to have noted that volatility levels are similar across many asset types right now.

Derivatives And Short-Term Shocks

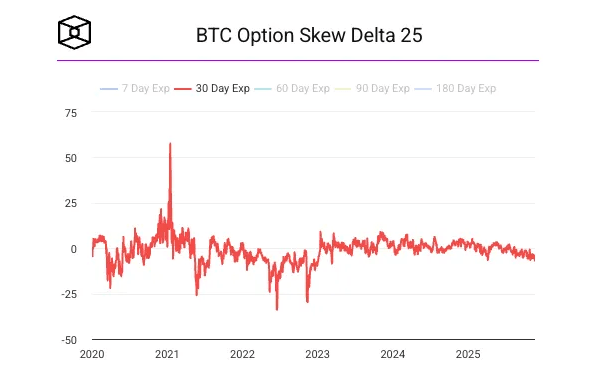

Options positioning can make price action sharper because large contracts push traders to hedge or cover quickly, and hedging activity often shows up as rapid moves in the spot market.

This mechanism was important in the 2021 run and may be at work again as implied volatility climbs.

Traders who watch the volatility surface say early signs of option-driven behavior are visible, even if the current readings are nowhere near the extremes seen in prior cycles.

Fed Betting Adds A Macro Twist

Meanwhile, according to the CME FedWatch tool, the market now sees a 71% chance of a 25-basis point cut in December, up from about 30–40% earlier this week.

Comments from New York Fed President John Williams helped shift those odds by suggesting policy could move toward neutral, while other Fed officials were quoted by Reuters as taking more cautious stances.

A rate cut, if it happens, could give risk assets some lift; a no-show might keep volatility elevated.

Markets Watch December For Clues

Traders are watching December closely for signals that could either calm markets or add fuel to them. Short-Term swings will likely persist until traders see clearer direction from both macro policy and option desks. Some players will wait for volatility to settle; others will trade around it.

Featured image from Unsplash, chart from TradingView