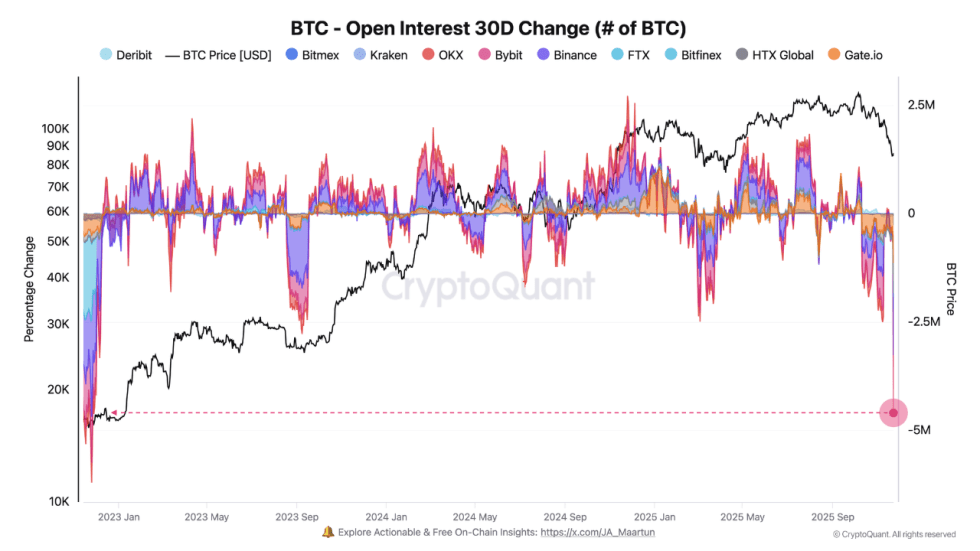

Bitcoin’s ongoing bearish price action is beginning to influence the direction of several key on-chain metrics as the pullback persists. With a robust downward trend in BTC’s price, the Open Interest (OI) has now shifted toward a negative zone, reflecting the intensity of the current volatile phase.

A Great Bitcoin Unwind As Open Interest Sinks Sharply

After a prolonged period of downside Bitcoin price performance, its Open Interest has officially followed suit, experiencing a significant drop not seen in years. Darkfost, a market expert and CryptoQuant author, reported the notable drop, which implies that BTC derivatives traders are facing a crucial moment.

In the quick-take post, the market expert highlighted that the drop in BTC open interest marks the sharpest 30-day decline of the entire cycle. With cascading liquidations and retreating speculative bets changing the short-term outlook for Bitcoin, the abrupt unwinding of leveraged positions indicates that traders are quickly de-risking.

Data shared by Darkfost shows that Binance, the largest centralized exchange, accounts for most of the move, recording a drop of around 1.3 million BTC. According to the expert, a drop of this magnitude on Binance is normal as the platform oversees the largest trading volumes in the market.

Darkfost noted that the last time the market experienced such a massive drop in open interest was during the 2022 bear market, highlighting the dramatic nature of the current correction. While the decline is likely to lead to the continuation of the pullback in price, it may also mark the fresh start required for Bitcoin’s next major decision.

The correction of the Bitcoin price has been on for multiple weeks and continues to trigger several liquidations. During the correction, several investors were observed taking positions against the trend, mechanically fueling the drop in open interest. It is worth noting that part of the contraction was also caused by investors who prefer to capitulate and either close their investments or lower their risk exposure.

Is A Bottom On The Horizon?

This sharp decrease in open interest is not entirely bad for the market. Historically, Darkfost stated that these cleansing stages have frequently played a crucial role in creating a strong bottom and laying the groundwork for a fresh bullish trend. A steady drop in speculative exposure, forced closures of overly optimistic positions, and deleveraging all aid in rebalancing the market.

An interesting part of this cycle is that it has been strongly driven by leverage and record futures activity. As a result, BTC’s open interest surged to a new all-time high of $47.5 billion, indicating how aggressively positioned traders were before the drop.

Darkfost claims that such high levels of speculative intensity are rarely a sign of a healthy market environment. This is because when liquidity changes, it fosters an environment that is conducive to excess, instability, and sharp corrections, which aligns with the current trend of the market.