On-chain data shows exchange inflows related to Bitcoin and Ethereum have shot up alongside the recent downturn in the market.

Bitcoin & Ethereum Have Seen High Exchange Inflows During Past Week

In a new post on X, on-chain analytics firm CryptoQuant has discussed about the latest trend in the Exchange Inflow for Bitcoin and Ethereum. The “Exchange Inflow” here refers to an indicator that measures the total amount of a given asset (in USD) that’s entering into the wallets connected to centralized exchanges.

When the value of this metric is high, it means investors are making large deposits to these platforms. Generally, holders transfer their coins to exchanges when they want to use one of the services that they provide, which can include selling. As such, a sharp spike in the metric can be an indication that there is demand for trading away the asset.

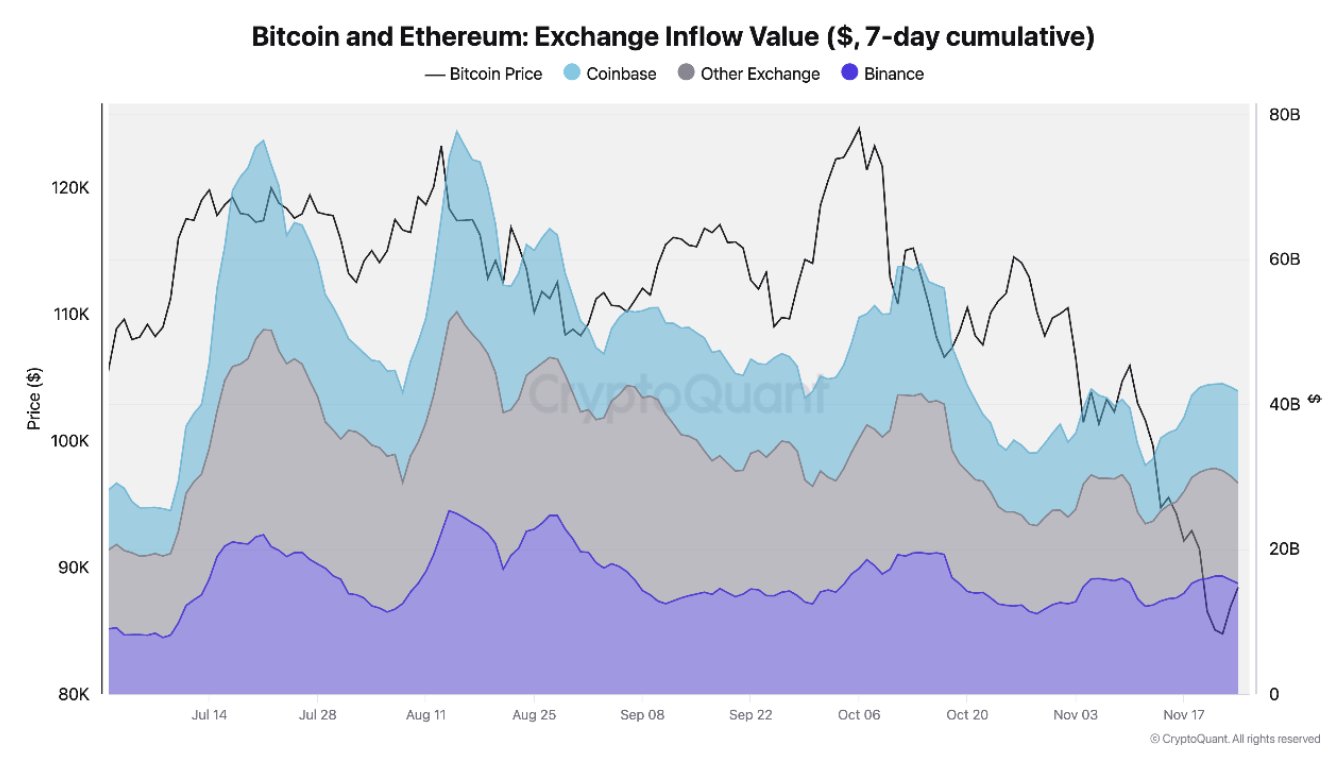

Now, here is the chart shared by CryptoQuant that shows the trend in the combined 7-day cumulative Exchange Inflow for Bitcoin and Ethereum over the last few months:

As displayed in the above graph, the Bitcoin and Ethereum Exchange Inflow has seen its 7-day cumulative value surge above $40 billion recently. Given the price action of the past week, these deposits were likely made for distribution and contributed to the crash.

BTC and ETH aren’t the only cryptocurrencies that have seen inflows recently, however; stablecoins have also entered into exchange-associated addresses. Unlike BTC and ETH, though, these fiat-pegged coins haven’t witnessed a uniform trend across the different platforms.

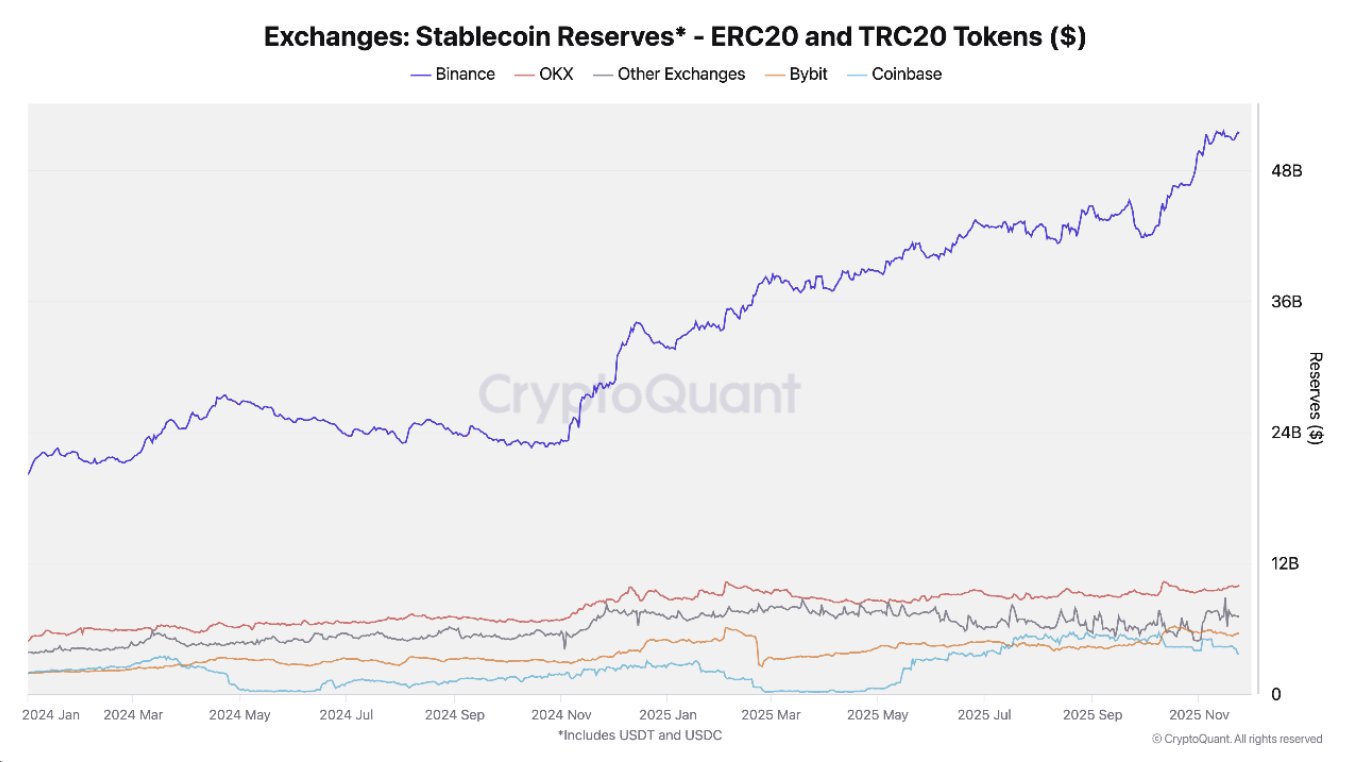

In the above chart, data for the stablecoin Exchange Reserve is shown for the different centralized exchanges. This indicator keeps track of the total amount of stables that are currently sitting in exchange wallets.

It would appear that this metric has broken away from the rest for Binance recently, implying investors have been choosing to deposit their coins to the platform over any other. “Binance’s stablecoin reserves just hit a record $51.1B, the highest in its history,” noted the analytics firm.

Like for BTC and ETH, stablecoin exchange deposits also suggest that there is demand for trading away the assets, but in their case, the implication for the market is a bit different. Traders often deploy these tokens on exchanges when they want to swap them for a volatile cryptocurrency like BTC.

Thus, while Bitcoin and Ethereum inflows can be bearish for the market, stablecoin deposits can be a positive sign instead.

BTC Price

At the time of writing, Bitcoin is trading around $90,000, up more than 2% over the last week.