The post Pump.fun (PUMP) Price Prediction 2025-2030: Will PUMP Lead Solana’s DeFi Boom? appeared first on Coinpedia Fintech News

Story Highlights

- The Live Price Of Pump.fun is $ 0.00311512

- PUMP price surged 180% in 30 days, fueled by Binance US listing and massive buybacks.

- Technical charts show a double-bottom breakout targeting $0.01.

- Long-term forecast sees PUMP reaching $0.22 by 2030 in a moderate scenario.

Pump.fun’s native token PUMP has quickly become one of the most talked-about memecoins in the Solana ecosystem. Built as a creator-first launchpad, Pump.fun lets communities directly back their favorite creators while sharing in their success.

With its viral “no-code” model, Pump.fun aims to disrupt traditional Web2 social platforms and carve a dominant role in Solana’s DeFi landscape.As of writing, the PUMP price has proven to be a bigger attraction after showing fantastic price action in Q3 2025. As a result, the token has surged in popularity across exchanges and social media, and many experts are raising questions about its potential to climb even higher in the coming years.

Pump.fun Price Today

| Cryptocurrency | Pump.fun |

| Token | PUMP |

| Price | $0.0031 |

| Market Cap | $ 1,102,750,998.00 |

| 24h Volume | $ 143,177,707.5260 |

| Circulating Supply | 354,000,000,000.00 |

| Total Supply | 1,000,000,000,000.00 |

| All-Time High | $ 0.0121 on 12 July 2025 |

| All-Time Low | $ 0.0011 on 10 October 2025 |

Table of contents

Major Developments That Fueled PUMP’s Rally

The Q3 saw many altcoin’s rally including PUMP, this happened with a trigger from Binance US listing. It turned out as a major catalyst for the surge in PUMP price, accompanied by a 350 million PUMP reward campaign that caught traders’ attention. In September alone, PUMP gained over 180% to $0.00899 creating a new ATH before a pullback.

Meanwhile, Pump.fun has been using more than 98% of its platform revenue to buy back tokens, directly supporting price action. This aggressive strategy has turned Pump.fun into one of the most profitable DeFi projects on Solana, boosting trader confidence.

PUMP.Fun Price Analysis For November 2025

From a technical perspective focused on the short term, the PUMP price chart demonstrated considerable strength in both Q3 and Q4, following a breakout from a slanted double-bottom pattern. This bullish trend effectively propelled the price to an All-Time High (ATH) of $0.00899 by mid-September.

After reaching the ATH, a phase of profit-taking commenced, which was significantly intensified, causing the price to hit July’s swing low support around $0.002500 in November. Given that this area has strong demand, late November witnessed bullish price activity, leading to a 25% increase over the week. This price movement also initiated the formation of a falling wedge, which is now poised to test the pattern’s upper boundary located around $0.0035.

If a daily close above this level is achieved, a breakout would likely occur, and we can anticipate higher prices toward $0.0050 in December and a retest of the ATH of $0.0089 by the first half of 2026. Conversely, if this pattern fails to initiate a breakout, it is likely to continue its sideways movement throughout the month, and if another wave of profit-taking occurs, dipping to new lows could also be a possibility for PUM/USD.

Pump.fun (PUMP) On-Chain & Supply Dynamics Analysis

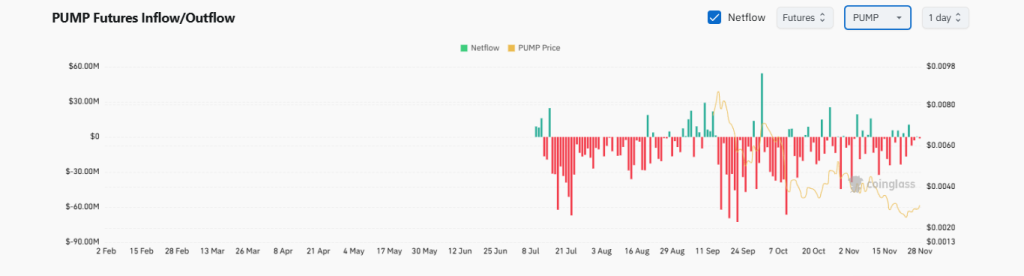

The recent technical price action may suggest a bearish trend, as outflows have been prominent; however, the data from CoinGlass indicates a notable decrease in bearish dominance.

While it is true that outflows have not yet ceased entirely, it is encouraging to observe a significant reduction in these outflows. Given the improving bullish conditions, there is an increasing likelihood that daily PUMP net flows will soon shift to a positive trajectory.

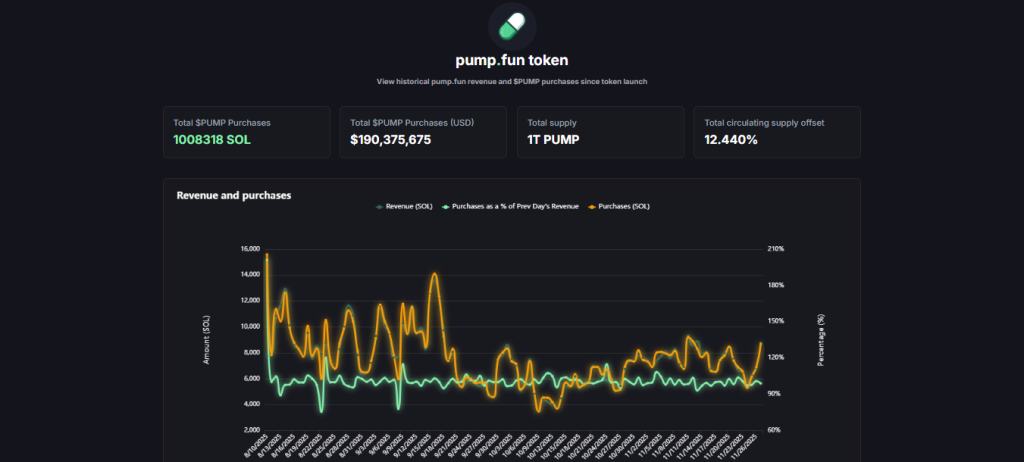

Amidst market fluctuations, Pump.fun is actively reinvesting a substantial portion of its platform revenue to repurchase PUMP tokens each day. To date, this commitment has led to the buyback of an impressive $190.37 million worth of PUMP tokens, resulting in a meaningful reduction of 12.44% in the total circulating supply.

Despite recent market volatility, its dedication to daily buybacks has remained in the 95-103% range compared to the previous day’s purchases. This consistent reduction in available supply lays a solid foundation for potential price appreciation.

Long-Term PUMP Price Prediction (2025–2030)

| Year | low | average | high |

| 2026 | $0.0120 | $0.0190 | $0.0230 |

| 2027 | $0.0250 | $0.0370 | $0.0440 |

| 2028 | $0.0450 | $0.0680 | $0.0810 |

| 2029 | $0.0650 | $0.0950 | $0.1300 |

| 2030 | $0.1000 | $0.1500 | $0.2200 |

If platform adoption accelerates and buybacks continue, PUMP could challenge the $0.01 mark in 2025 and aim for $0.22 by 2030 under an average growth scenario.

This table provides a framework for understanding the potential PUMP price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

For 2025, if current momentum and buybacks continue, PUMP could challenge the $0.01 mark. End-of-year predictions often range higher, but depend heavily on broader market trends.

Short-term, PUMP is testing key resistance near $0.009. A successful breakout could see it challenge the $0.01 psychological level, while support sits around $0.0078.

Reaching $1 is highly ambitious, requiring a market cap of over $350 billion. This is unlikely in the near future given current crypto market sizes, making more conservative targets more realistic.

Long-term forecasts suggest an average price of $0.15 by 2030. Its growth depends on platform adoption, continued token buybacks, and overall crypto market conditions.

PUMP has a future based on its unique utility; it’s the backbone of a profitable platform that actively supports its price through revenue buybacks, giving it more substance than a typical memecoin.