The flow of capital into spot Bitcoin and Ethereum ETFs has started to adjust again after weeks of steady redemptions. New data shows that both asset classes have recorded their first net-positive inflow week since October, and this might be an early sign that institutional appetite may be stabilizing after a difficult month for the leading cryptocurrencies and their ETF products.

On the other hand, inflow data shows that the recently launched Solana and XRP ETF products continue to attract steady institutional capital.

Bitcoin And Ethereum ETFs Break Their Outflow Streak

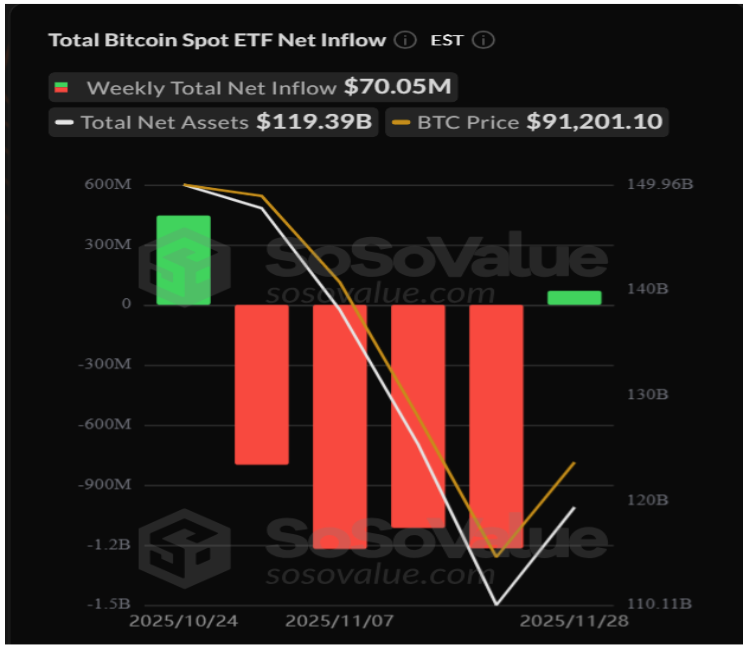

Spot Bitcoin ETFs quietly reversed their month-long downturn with roughly $70 million in net inflows during the final week of November. According to data from SoSoValue, this is the first positive inflow week since late October, putting an end to a four-week streak of redemptions that had removed about $4.35 billion worth of outflows from those funds.

Notably, most days of the just-concluded week were defined by low activity in Bitcoin ETFs, but the $71.37 million inflows on November 28 were enough to make the week a positive close.

The return of net-positive flows, even on a moderate scale, indicates that some institutional desks may be rebuilding exposure to Bitcoin.

Total Bitcoin Spot ETF Net Inflow. Source: SoSoValue

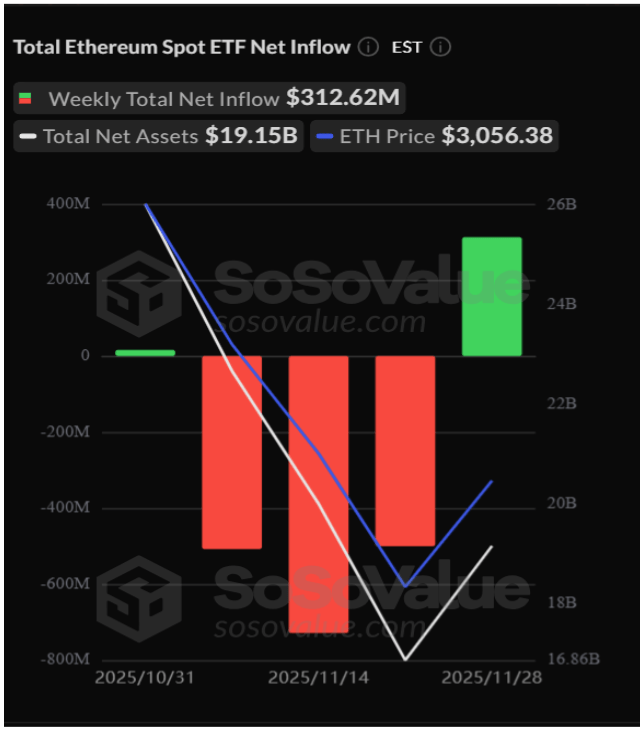

Ethereum saw an even more notable change in flow numbers. Net inflows into Spot Ethereum ETFs climbed to about $312.62 million in the just-concluded week, ending a three-week stretch of redemptions that had drained more than $1.74 billion from issuers.

The size of Ethereum’s rebound stands out because the price of the leading altcoin had been under more intense pressure than Bitcoin throughout most of November. The fresh inflows point to a noticeable change in sentiment, especially among institutions that had previously paused ETH accumulation.

Total Ethereum Spot ETF Net Inflow. Source: SoSoValue

Solana And XRP ETFs Maintain Positive Run

Even as Bitcoin and Ethereum struggled through weeks of outflows, the newly introduced Solana and XRP ETFs never lost momentum. Spot Solana ETFs are now on a five-week inflow streak, with a further $108.34 million inflow last week.

Interestingly, Spot Solana ETFs experienced $8.1 million in outflows on Wednesday to end a 21-day inflow streak, but this was insufficient to cause a net outflow week.

Spot XRP ETFs, though launched more recently, have followed a similar trajectory. They are now on a three-week run of consistent inflows, with another $243.95 million added last week, its highest weekly inflow so far.

Another Spot XRP ETF is set to go live soon, as 21Shares recently confirmed that its US Spot XRP ETF has secured SEC approval and will begin trading on Monday, December 1. This builds upon the increasing appetite from investors looking for more crypto exposure outside of Bitcoin and Ethereum.

Featured image from Unsplash, chart from TradingView