The post Why Solana Price Fell Harder Than Bitcoin During the Recent Market Crash? Will it Hit $100? appeared first on Coinpedia Fintech News

In less than a fortnight, the Bitcoin price crashed below $86,000 as the bid-side liquidity dried up causing massive volatility and liquidation. A ripple effect caused the Ethereum price to plunge close to $2800 while a deeper correction was seen with the Solana price. The token dropped below $130 for the second time, raising alarms for the upcoming price action.

Solana’s sharp decline alongside the broader crypto market caught traders off guard, but on-chain data shows the network was already signaling weakness well before the downturn. While Bitcoin’s drop was driven by liquidity gaps, Solana’s slide was rooted in fading on-chain momentum, shrinking user activity, and slower ecosystem flows, all of which left SOL vulnerable the moment macro pressure arrived.

Active Users and Transactions Began to Cool Off

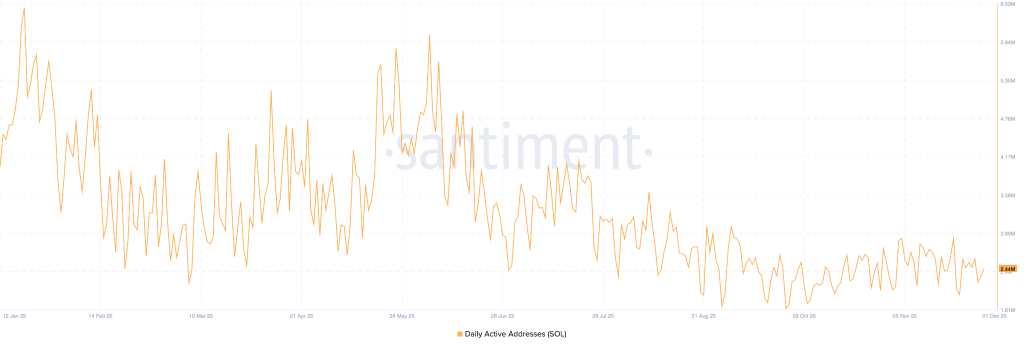

The active address count is an important indicator that sheds light on the overall health of the platform. As it suggests, the total number of addresses interacting with the platform to perform a buy/sell or a swap trade. If the levels rise, it suggests more demand for the crypto, increased utility and more on-chain movement. However, there has been a massive downfall in the active address and has remained consistently below 3 million since July 2025.

Since early 2025, Solana’s on-chain activity has gradually decreased. The daily active addresses, which were between 7 and 9 million, had dropped to 3 to 4 million by midyear. Since then, levels have remained stagnant around the range, slowing transaction growth as well. As a high-throughput network, the decline in user engagement and fading speculative activity indicated weakened momentum.

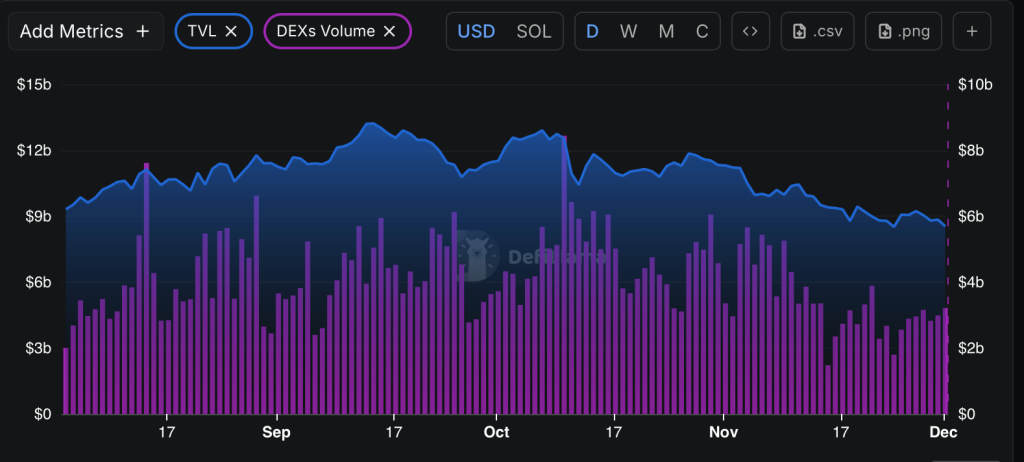

Consistent Drop in DEX Volume & TVL

The rise of memecoins was one of the reasons behind the bull run earlier. Moreover, the Solana-based memecoins have made a huge impact in recent times. As these were hype-driven, they had to fade, which has been reflected in the Solana DEX volumes as well. Solana’s explosive activity earlier this month was fueled largely by high-frequency memecoin trading. But as volatility settled, DEX volumes on platforms like Jupiter and Raydium dropped noticeably.

The data from Defilama shows a consistent drop since the beginning of the fourth quarter, indicating fewer speculative inflows, lower fee burns, and less liquidity rotation into Solana. This shift has played a significant role in weakening the buy-side depth before the recent market crash. A similar trend was seen with the TVL, substantiating the persisting bearish influence over the token as it indicated capital outflow, weakening confidence and reduced usage of the protocol.

Will Solana (SOL) Price Recover?

Similar to the BTC price, the Solana price has also been forming consecutive lower highs and lower lows. This usually reflects the rising bearish influence over the token as seen during the previous bear markets. However, the price is trying to defend the support zone, which has been a strong base since the start of 2024 in the times of extended bearish action. Therefore, if the bulls manage to defend this time, a decent rebound could be imminent.

The SOL bulls are trying to defend the support zone between $121 and $128 for the third week while the volume drained. On the other hand, the weekly RSI is also following the descending trend line, signalling the weakening of the strength of the rally. The current pattern suggests more downturn could be possible, dragging the levels close to $100 or slightly below in the coming days.

Solana generally rebounds quickly when on-chain activity accelerates or if memecoin volume returns or DEX activity rises. For now, the traders are required to keep a close watch on these, as a revival in either of these may revive the Solana ecosystem growth and the SOL price.