US Senator Cynthia Lummis has reignited speculation that the United States could move to materially increase its Bitcoin holdings, after posting a Bitcoin-themed image on X with the caption: “₿ig things coming for Franklin!”

Lummis Revives Strategic Bitcoin Reserve Hype

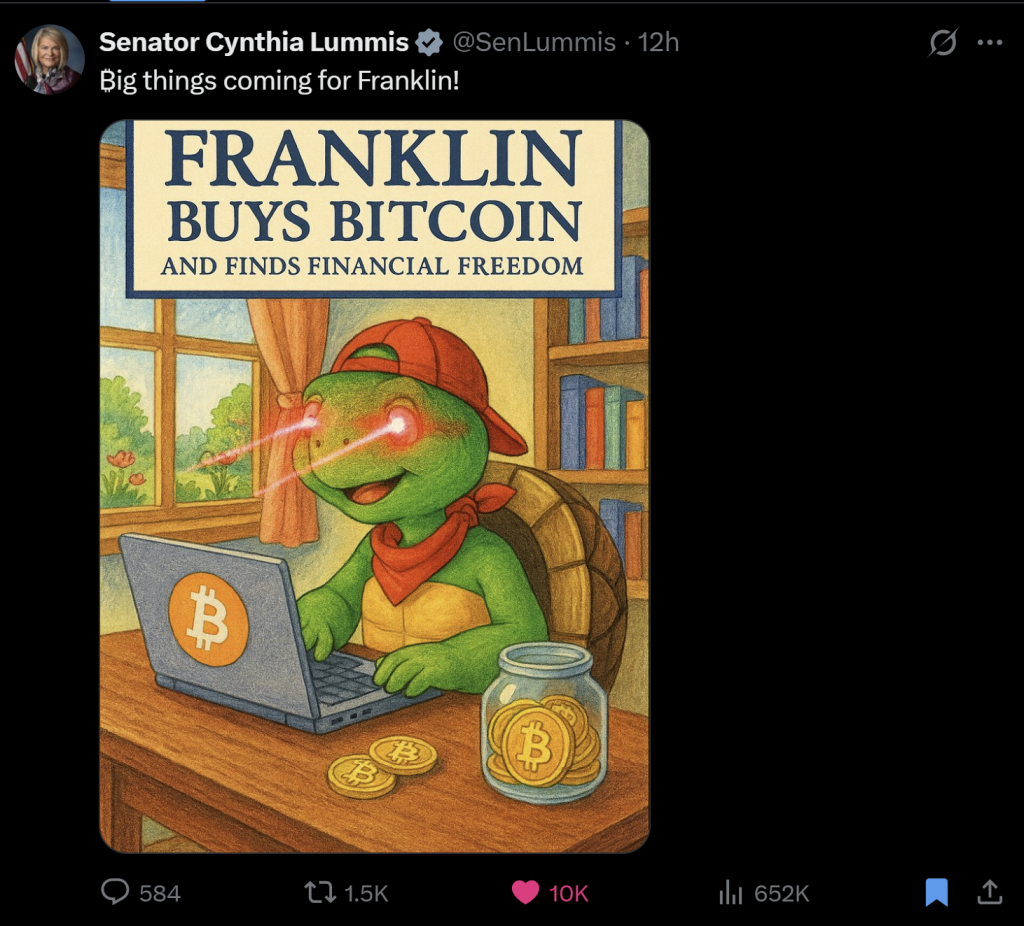

The image is drawn as a children’s book cover titled “FRANKLIN BUYS BITCOIN AND FINDS FINANCIAL FREEDOM.” At the center sits Franklin, a cartoon turtle in a backwards red cap and bandana, seated at a wooden desk. In front of him is a laptop emblazoned with the orange Bitcoin logo, clearly signaling that he is using Bitcoin-related software or services—most obviously, buying or managing BTC. Franklin’s eyes project bright “laser beams” at the screen, echoing the well-known “laser eyes” meme in Bitcoin culture.

On the desk lie physical coins stamped with the Bitcoin symbol, and a glass jar filled with more of these Bitcoin coins. The jar seems to function as a visual metaphor for saving and stacking sats over time. The subtitle “and finds financial freedom” explicitly connects Bitcoin accumulation with the idea of long-term economic sovereignty.

Bitcoin-focused accounts immediately interpreted the post as a policy signal rather than a simple meme. Bitcoin Magazine summarized the moment as: “JUST IN: US Senator Cynthia Lummis hints at buying Bitcoin”. Bitcoin Archive went further, claiming: “JUST IN: US Senator Cynthia Lummis hints at a potential US Bitcoin buy. Senator Lummis has recently submitted legislation to have the US government buy 1 million Bitcoin.”

That reading is consistent with Lummis’ own public rhetoric. On November 5 she wrote via X: “I truly believe the Strategic Bitcoin Reserve is the only solution to offset our national debt. I applaud @POTUS and his administration for embracing the SBR, and I look forward to getting it done.” Her legislation has pushed for a formal US Strategic Bitcoin Reserve and explicitly contemplated the government holding up to 1 million BTC over time.

The meme also lands after President Trump’s executive order from March this year establishing a Strategic Bitcoin Reserve framework. While it has become very quiet around the topic, US Treasury Secretary Scott Bessent recently attended the opening of the Bitcoin bar PubKey in Washington. For many in the market, those developments, combined with Lummis’ latest post, suggest that concrete steps toward expanding US Bitcoin reserves may be progressing quietly in the background.

So far, however, there has been no official confirmation of state-level Bitcoin purchases. For now, Franklin remains a symbolic turtle with laser eyes at a Bitcoin laptop—but in a market hyper-attuned to political signals, Lummis’ image is being read as the clearest hint yet that the United States could one day be the largest sovereign Bitcoin buyer.

At press time, Bitcoin traded at $93,381.