According to interviews with Eric Trump and ABTC Executive Chairman Asher Genoot, American Bitcoin (ABTC) has structured its business around one clear aim: add more Bitcoin to its balance sheet.

The firm says it spends less on big management teams and more on mining and buying Bitcoin so each share holds more Bitcoin over time. That metric — Bitcoin per share — is tracked in the same way public companies track earnings per share, the executives said.

American Bitcoin Tracks Bitcoin Per Share

ABTC’s leaders told investors they treat the number of Bitcoin each share represents as the core performance measure. Genoot said the firm began with a single question: “What do investors actually want from a Bitcoin-focused business?”

Based on reports, the answer they reached was simple — grow the amount of Bitcoin held per share. That amount, they say, should rise each day thanks to mining and occasional purchases when markets look attractive.

Company Adds BTC ‘At A Steep Discount’

Trump told investor Grant Cardone that ABTC adds new Bitcoin to its balance sheet every day at what he described as a steep discount compared to market prices. According To his comments, the firm also plans to keep buying when conditions are favorable.

The approach is straightforward: mine and accumulate rather than chase short-term fiat profits. This strategy is pitched as a way to give shareholders more direct exposure to Bitcoin’s future gains.

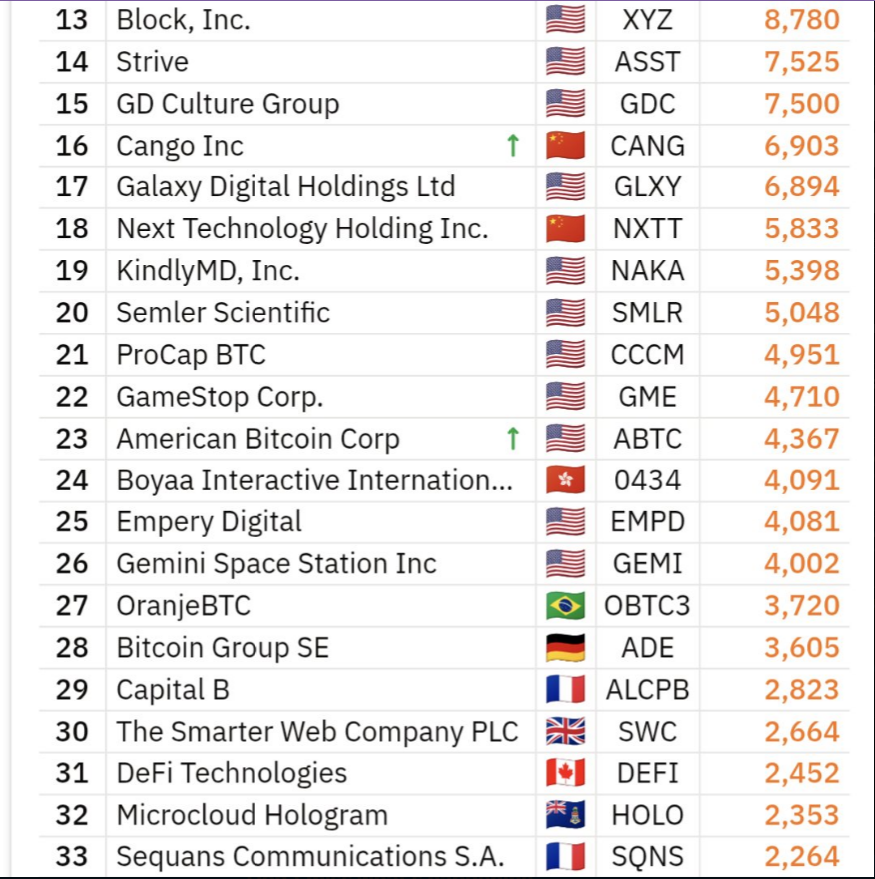

JUST IN: Trump family-backed #Bitcoin miner American Bitcoin Corp increased its holdings by 363 BTC and now holds a total of 4,367 BTC.

Bitcoin 100 Ranking: 23

pic.twitter.com/hSAK9yLd3u

— BitcoinTreasuries.NET (@BTCtreasuries) December 4, 2025

Bullish Price Calls And Timeframes

Trump has made very large price forecasts publicly. He forecast $1 million for Bitcoin in late 2024 and repeated that belief during 2025 at a conference in Hong Kong.

During a recent interview, he projected Bitcoin could trade above $500,000 within the next four years, marking November 2029 as a benchmark date. Those figures underline why ABTC’s model is built on a long-term and highly optimistic outlook for BTC.

Global Demand And Institutional Access

Trump pointed to strong demand in many parts of the world as part of his reasoning. He said he sees interest from governments, family offices, big companies, and wealthy individuals.

Reports have disclosed that regions with weak currencies or high inflation show faster adoption, because people there often want assets that are hard for authorities to seize.

He also noted that mainstream financial firms now offer more ways to get exposure to crypto, which he believes makes it easier for everyday investors to buy in.

Featured image from ABC News, chart from TradingView