The post Bitcoin Whales Quietly Buying the Dip—Is a $120K Rebound Coming? appeared first on Coinpedia Fintech News

The latest on-chain data reveals a striking divergence between whale and retail behaviour during Bitcoin’s recent correction, suggesting that smart money may be positioning for the next major move. While BTC’s pullback from its $126,000 high has unsettled retail traders, large holders appear to be buying aggressively—a pattern historically linked to early-stage trend reversals.

Whale Accumulation Surges to Multi-Year Highs

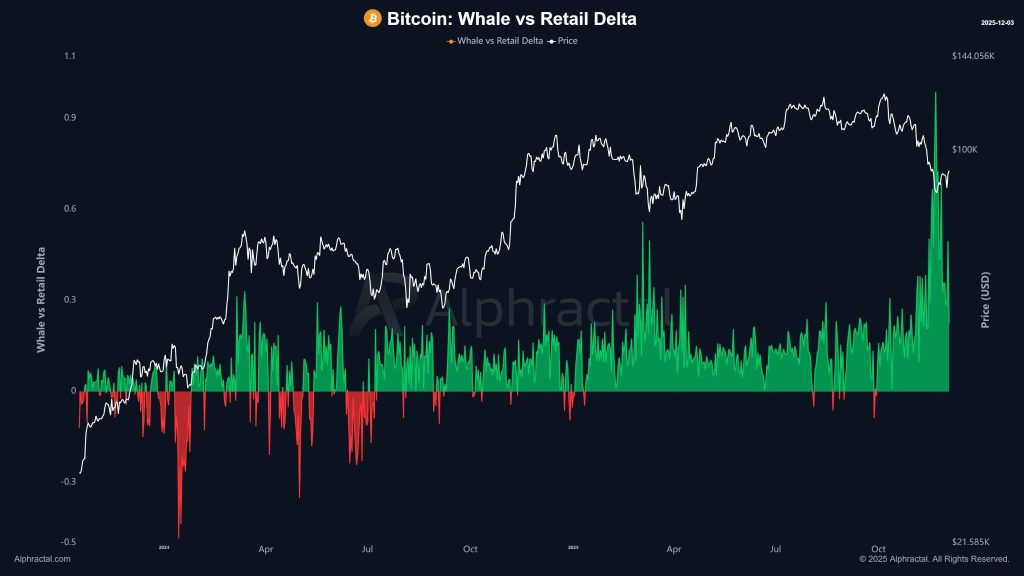

A new Whale vs. Retail Delta chart from Alphatractal shows one of the largest positive spikes in whale accumulation in nearly two years. As retail participants sold into fear during Bitcoin’s decline toward the $100K handle, whales moved into accumulation mode—absorbing liquidity at scale.

This delta shift signals that large holders expect medium-term upside, even as short-term sentiment remains cautious. Historically, such aggressive accumulation has preceded major bullish continuations, including Bitcoin’s breakouts above $40K, $70K, and $140K in previous cycles.

Retail traders, who were overwhelmingly optimistic when BTC hovered above $130K, have flipped defensive following the recent sell-off. The chart shows declining retail participation and weaker buy-side pressure during the dip—the opposite of what occurs when retail attempts to “buy the bottom.”

This divergence often marks periods of mispricing, where fear-driven selling creates opportunities for larger players to accumulate.

Will This Trigger the BTC Price Rally to New Highs?

Ever since, the BTC price has triggered a recovery from the interim lows close to $80,500; the buying pressure is trying to overcome the persisting bearish influence over the token. Although the recovery rate is pretty low, the token is trading within a bullish pattern. Therefore, the BTC price is believed to consolidate along the resistance until a massive influx of buying volume does not help the token to clear the resistance.

The short-term price action highlights the recovery path of the BTC price rally, which is stuck within a rising parallel channel. As the price is constantly trading along the resistance of the channel, there is a huge possibility of a breakout. However, the MACD suggests a small correction, as the RSI has already reached the upper threshold. Hence, the BTC price is believed to trade within the upper bands of the channel and with a rise in volume, a breakout could be imminent.

Conclusion: Bitcoin’s Dip Looks More Like Opportunity Than Exhaustion

The latest on-chain trends suggest that Bitcoin’s recent correction is less a sign of weakness and more a moment of opportunity. With whales accumulating at their strongest pace in nearly two years and retail sentiment cooling, the market appears to be entering a classic early-stage recovery phase. If this accumulation trend holds, Bitcoin could realistically revisit the $105K–$108K range in the short term, with a broader 2025 target zone extending toward $115K–$117K, assuming macro conditions remain supportive.