Ethereum’s Fusaka upgrade is now live on mainnet, marking a major structural change in how the network handles data and scaling. The upgrade was activated at epoch 411392 at 21:49:11 UTC, with the official Ethereum account first signalling “upgrade in progress . . . activating Fusaka @ epoch 411392 // 21:49:11 UTC” and then confirming that “Fusaka is live on Ethereum mainnet!”

In its announcement, the account highlighted three core elements of Fusaka. PeerDAS “now unlocks 8x data throughput for rollups,” substantially expanding the amount of data that rollup-based layer 2 networks can publish to the network. The upgrade also introduces “UX improvements via the R1 curve & pre-confirmations,” and is described as explicit “prep for scaling the L1 with gas limit increase & more.” The project added that community members and core developers will “continue to monitor for issues over the next 24 hrs.”

Why Fusaka Is ‘Significant’ For Ethereum

Vitalik Buterin framed the core of the upgrade in unusually direct terms. “PeerDAS in Fusaka is significant because it literally is sharding,” he wrote. “Ethereum is coming to consensus on blocks without requiring any single node to see more than a tiny fraction of the data. And this is robust to 51% attacks – it’s client-side probabilistic verification, not validator voting.” In other words, the network can now agree on blocks even though no node has to download all of the associated data, relying instead on probabilistic verification on the client side.

Buterin tied this to a long-running research line, noting that “sharding has been a dream for Ethereum since 2015, and data availability sampling since 2017,” and linking back to early research work on data availability and erasure coding. With Fusaka, that architecture is no longer just a roadmap concept but a live mechanism securing Ethereum’s data layer.

At the same time, Buterin was clear that Fusaka does not complete the sharding roadmap. He stressed that “there are three ways that the sharding in Fusaka is incomplete.” First, he argued that “we can process O(c^2) transactions (where c is the per-node compute) on L2s, but not on the ethereum L1,” adding that “if we want to scaling to benefit the ethereum L1 as well, beyond what we can get by constant-factor upgrades like BAL and ePBS, we need mature ZK-EVMs.”

Second, he pointed to the “proposer/builder bottleneck,” where “the builder needs to have the whole data and build the whole block,” and said “it would be amazing to have distributed block building.” Third, he noted bluntly: “We don’t have a sharded mempool. We still need that.”

Despite those caveats, Buterin called Fusaka “a fundamental step forward in blockchain design.” He argued that “the next two years will give us time to refine the PeerDAS mechanism, carefully increase its scale while we continue to ensure its stability, use it to scale L2s, and then when ZK-EVMs are mature, turn it inwards to scale ethereum L1 gas as well.”

He closed by sending “big congrats to the Ethereum researchers and core devs who worked hard for years to make this happen,” underscoring that for the Ethereum community, Fusaka is not a routine protocol update but the arrival of a long-promised sharding era on mainnet.

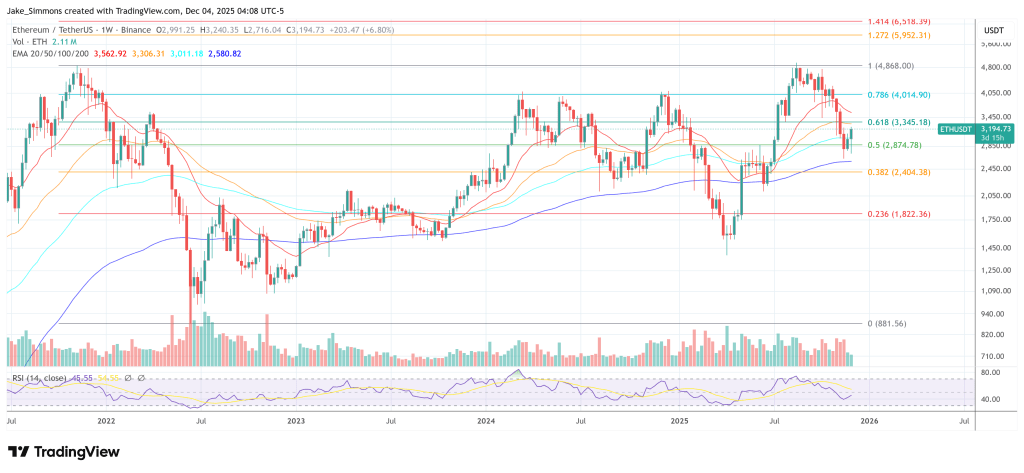

At press time, ETH traded at $3,194.