Data shows distribution on the Bitcoin network has dropped off, with both the largest of whales and small retail hands taking to accumulation.

Bitcoin Accumulation Trend Score Shows Shift Toward Buying

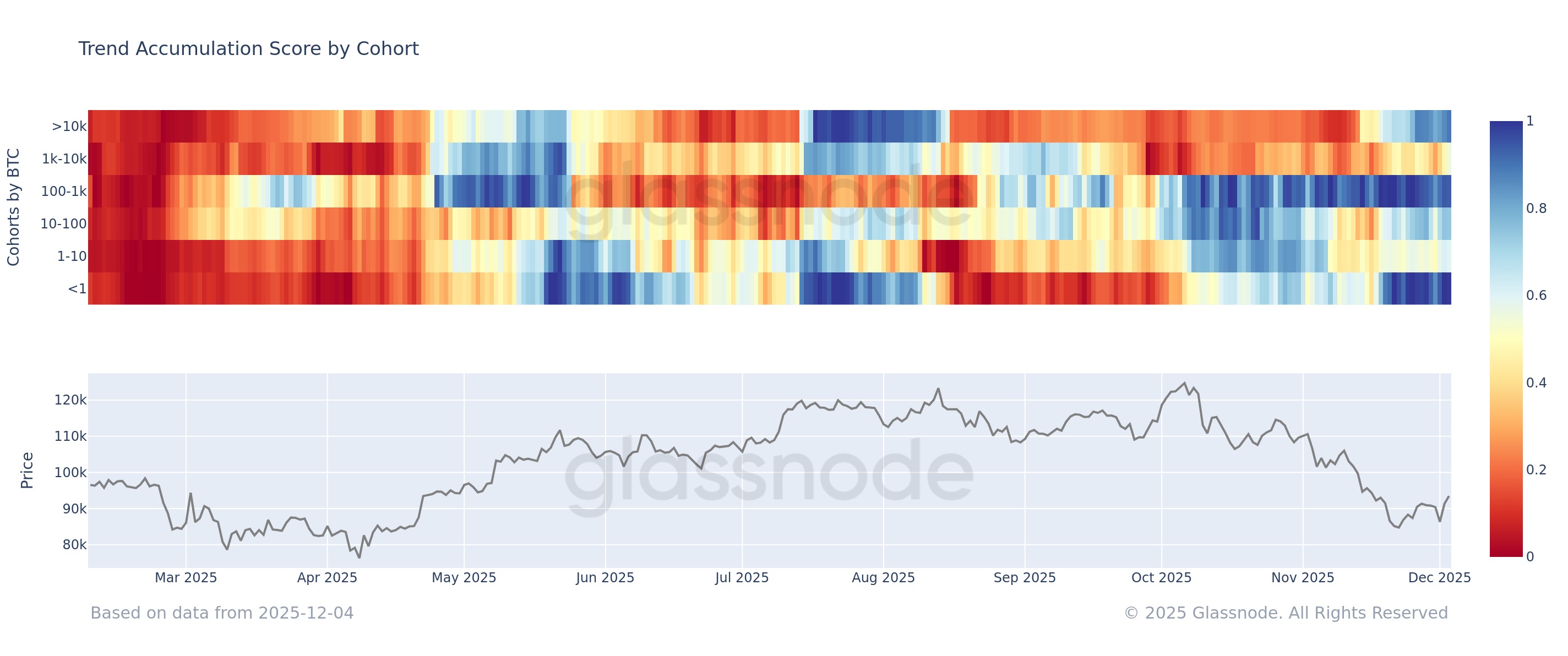

As explained by Glassnode analyst Chris Beamish in an X post, Bitcoin investors have been showing a lot less distribution at the recent price levels. The on-chain indicator of relevance here is the “Accumulation Trend Score,” which tells us about whether BTC holders are buying or selling.

The metric tracks investor behavior using not just the changes happening in their wallet balance, but also accounting for the size of their wallets. This means that larger entities have a higher influence on the score.

When the value of the Accumulation Trend Score is greater than 0.5, it means the investors are displaying a net trend of accumulation. On the other hand, it being under the threshold suggests the dominance of distribution.

Now, here is the chart shared by Beamish that shows how the Accumulation Trend Score has changed for the different Bitcoin investor segments over the last few years:

As displayed in the above graph, the Bitcoin Accumulation Trend Score has reflected a varied behavior for the different investor segments during the last couple of months, but very recently, a uniform picture has started to develop.

The smallest of investors in the market, those holding less than 1 BTC, started participating in aggressive accumulation around the time of BTC’s low in November and have since maintained the indicator nearly at a perfect value of 1. This suggests that retail investors have been buying the dip.

Meanwhile, the 100 to 1,000 BTC traders, popularly called the sharks, have been accumulating throughout the drawdown that has followed since the early October peak, indicating that these investors haven’t lost conviction despite the deep decline.

The story is a bit different for the whale cohorts, however. The 10,000+ BTC holders, corresponding to the largest of hands on the network, were in a phase of distribution between August and November, but they have finally started accumulating since the price low, although the Accumulation Trend Score isn’t as high as the retail investors in their case.

The 1,000 to 10,000 BTC whale group didn’t stop distributing even after the bottom, but very recently, their score has just breached the 0.5 mark. With this, a uniform behavior has begun to appear on the Bitcoin blockchain, with investors as a whole opting to expand their wallet balance.

It now remains to be seen how long this trend of accumulation will continue.

BTC Price

Bitcoin has faced a drop of more than 3% over the last 24 hours that has taken its price to $89,300.