Shiba Inu has just logged its most intense burst of large-holder activity in half a year, raising questions over whether fresh volatility – and potentially renewed selling pressure – is around the corner.

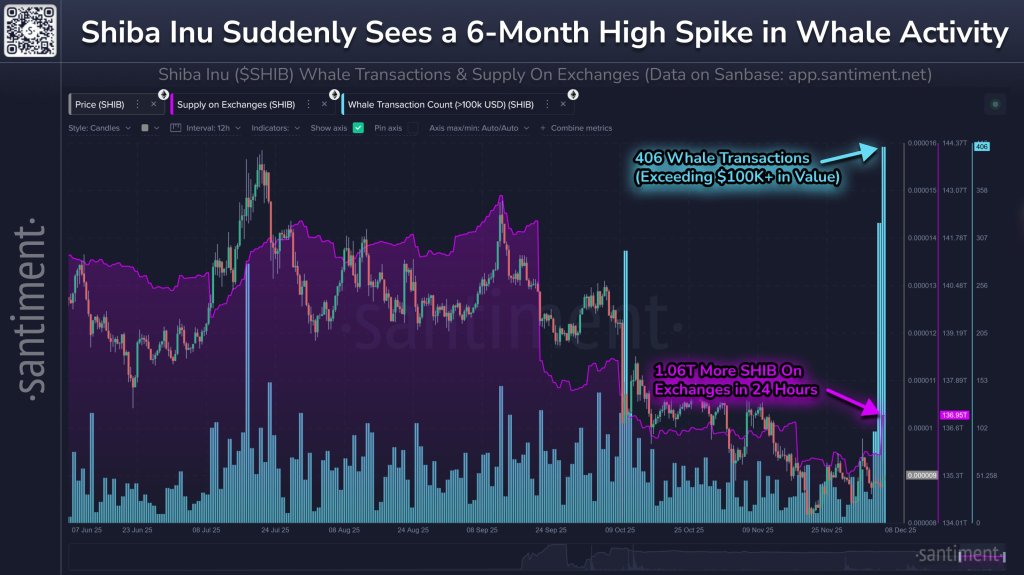

On-chain analytics firm Santiment reported the move on X, highlighting a six-month chart of Shiba Inu’s price, exchange balances and large transfers. According to the firm, “Shiba Inu has seen the highest amount of whale transfers since June 6th today, happening in tandem with a +1.06T net change to the amount of SHIB on exchanges. The #24 market cap in crypto is likely to see high volatility in the coming days.”

What Does This Mean For The Shiba Inu Price?

The chart shows 406 individual transactions exceeding $100,000 in value within a single day, the highest reading since early June. The second-highest peak occurred during the October 10 market meltdown, when roughly 300 SHIB whales were active, and the third came in mid-July, as more than 280 whales executed transfers.

These “whale” transfers represent activity from large holders, trading desks and liquidity providers whose moves can materially affect market liquidity and order-book depth.

At the same time, Shiba Inu’s exchange supply has jumped. Santiment’s overlay of “Supply on Exchanges (SHIB)” reveals a clear, abrupt uptick, annotated as “1.06T More SHIB On Exchanges in 24 Hours.” This reflects a net inflow of around 1.06 trillion tokens into exchange wallets, meaning more SHIB is now sitting in venues where it can be traded immediately.

In market-structure terms, the combination of record recent whale activity and a sharp rise in exchange balances creates conditions that often precede significant price swings. Moving coins from self-custody to exchanges does not guarantee that they will be sold, but it increases the portion of circulating supply that is “sale-ready” and able to hit the order books at short notice.

Whether that translates into an outright dump is not yet visible on-chain. The same footprint could reflect whales preparing to sell, to arbitrage across venues, to supply liquidity, or to rebalance positions in anticipation of broader market moves. Santiment itself stops short of a directional call, limiting its guidance to the expectation that the Shiba Inu token “is likely to see high volatility in the coming days.”

For now, the data point is clear: Shiba Inu’s largest holders have become more active than at any time since early June, and over a trillion additional tokens have shifted onto exchanges in just 24 hours. The direction of the next major move will depend on how that newly mobile supply is deployed.

At press time, SHIB traded at $0.00000859.