On-chain sleuth, Zachxbt, has struck again with a thread on Logan Paul and his alleged litany of shady dealings within the crypto space.

In the thread, the pseudonymous detective revealed some of the possible scams Logan Paul has allegedly been involved in based on his transaction records.

1/ A thread on @LoganPaul and his sketchy track record in the Web 3 space thus far. pic.twitter.com/wNmyw5TyFb

— ZachXBT (@zachxbt) May 13, 2022

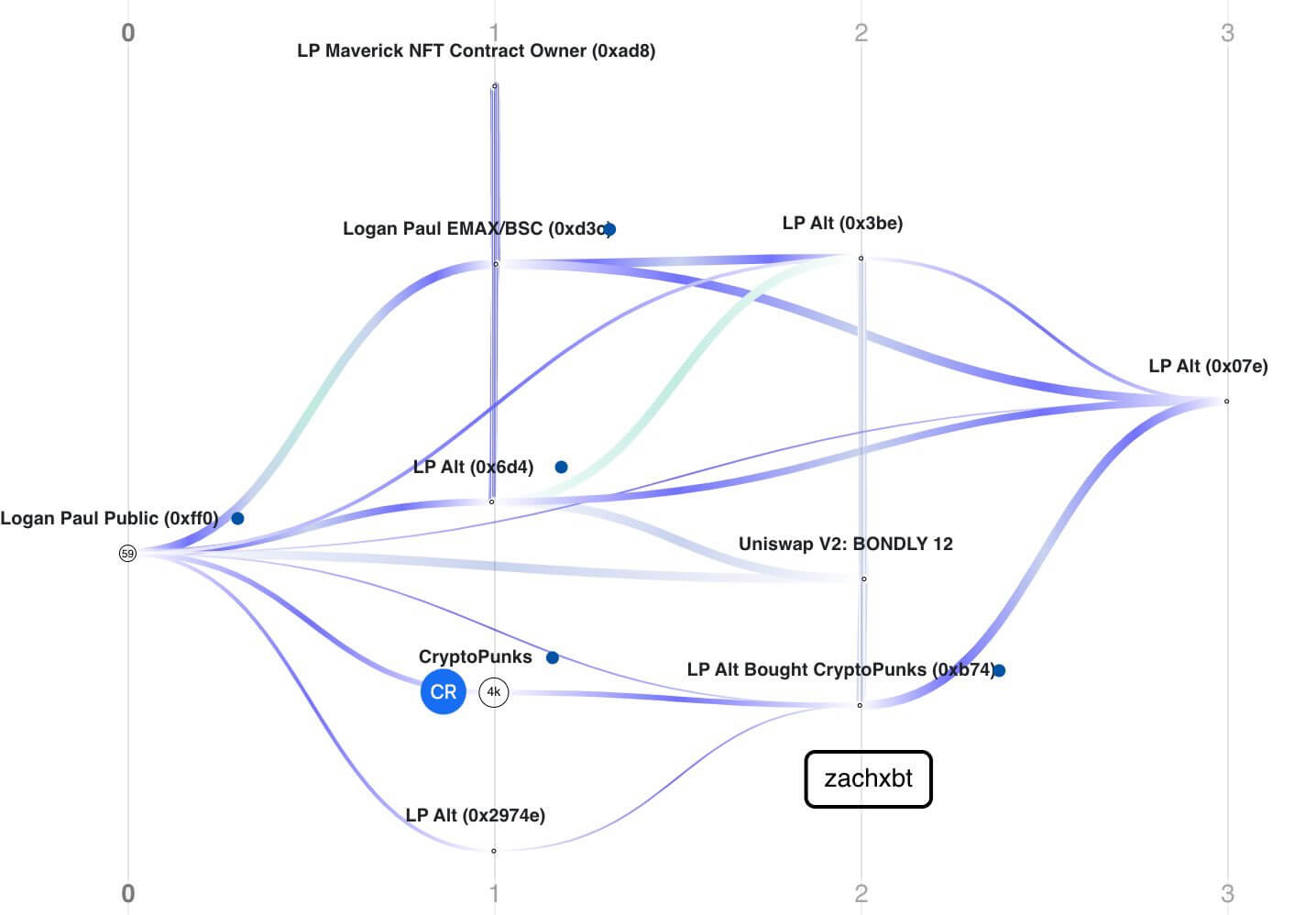

He was able to do this using Paul’s public address, 0xff0, from which he mapped out how funds were moved in and out from several other addresses. For example, 0xb74 transferred several NFTs, including 3 CryptoPunks, to the main public address.

Zachxbt wrote that Logan Paul had promoted several pumps and dump schemes over the course of a year. The first is the ELON token which he hyped in a leak video from his page.

The video leaked on May 10, 2021, and by May 17, blockchain records show Logan had sold his allocation of the tokens. He made $112k off the sale.

In what appears to be an obsession with the Tesla CEO, the next project Logan promoted was $FUCKELON. It seemed he bought it right before tweeting that the coin is mooning. Then he dumped the tokens, making $116k from the sale.

6/ Case 2: On 5/17/21 Logan promotes another pump and dump. His buys happen right before the Tweet and dump 12 hrs later for a $116k profit in total.

The Twitter account for the coin hasn’t tweeted since 5/27. pic.twitter.com/b3gGqfuKmV

— ZachXBT (@zachxbt) May 13, 2022

Logan Paul also promoted the Ethereum Max token in his boxing match with Floyd Mayweather. He got free tokens from the project and cashed them out for $71.8k.

The same token got promotions from other celebrities like Mayweather and Kim Kardashian. Those who bought the tokens are currently suing the developers and promoters for the failed project.

Another pump and dump scheme he got involved in was the failed DinkDoink crypto project. Again, he hyped the coin with videos and tweets, but it turned out that the coin was his creation.

Beyond the crypto pumps and dumps schemes, the influencer also milked his followers with non-fungible tokens (NFT) projects. One of them was the CryptoZoo project which was Adobe stock pictures with nose photoshop.

9/ Logan’s other crypto project CryptoZoo blacklisted holders when they migrated contracts.

In an interview with The Block, Logan claimed the initial team was problematic but it is all rectified.

People like Bagsy still haven’t received anything despite following instructions pic.twitter.com/57KeVEr68H

— ZachXBT (@zachxbt) May 13, 2022

While the generic nature of the art is less of a problem, the project had blacklisted holders after migrating contracts. Logan Paul, however, claimed that this was a technical problem that has been rectified, but many investors are yet to receive their NFTs.

If the allegations are true, it would mean Logan Paul represents the crop of crypto influencers who capitalize on the trust of their followers to shill worthless tokens and make money.

The post Zachxbt alleges Logan Paul is behind multiple crypto “pump and dump” schemes appeared first on CryptoSlate.