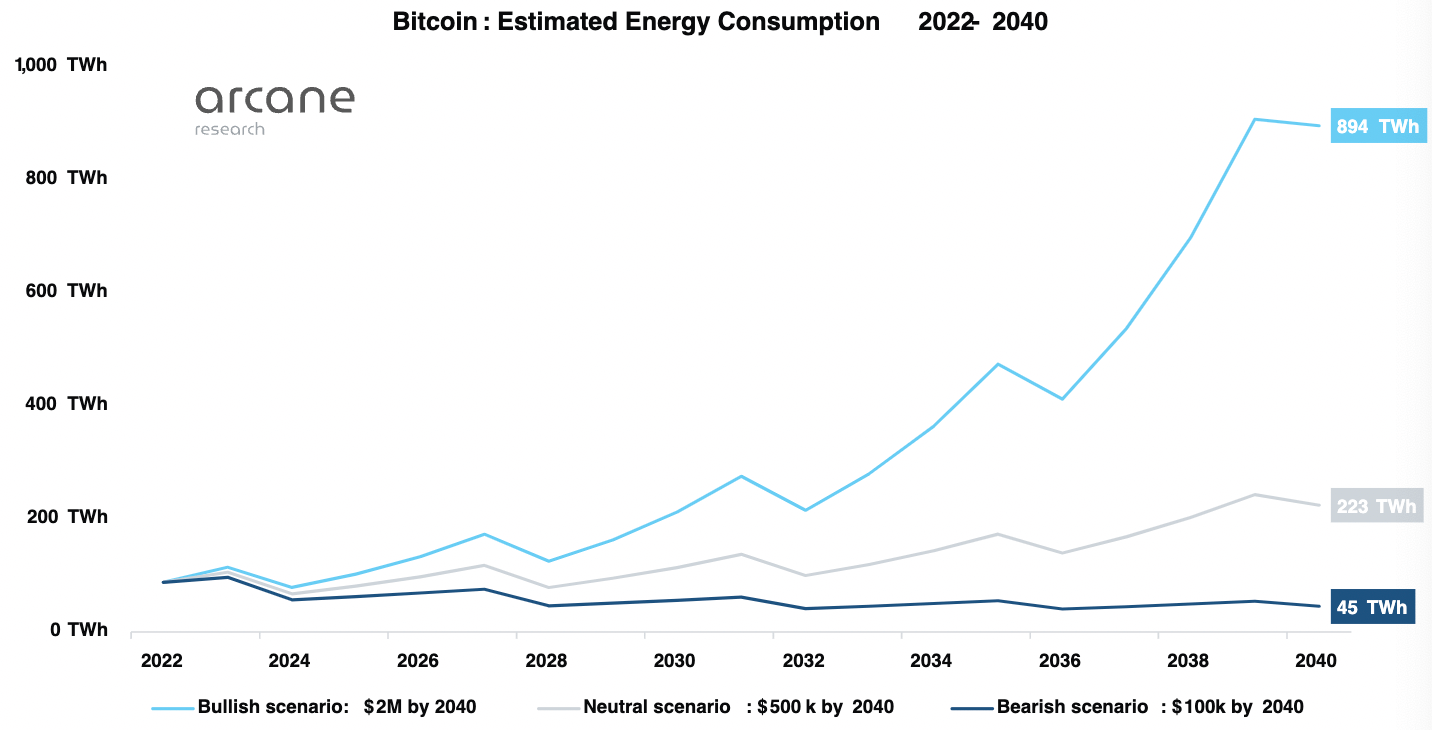

Bitcoin (BTC) mining’s energy consumption will rise 10x and hit 894 Terawatt-hours (TWh) annually if the flagship crypto’s price reaches $2 million by 2040, according to an Arcane Research report published Aug. 22.

The report calculated BTC’s future energy consumption based on bullish, bearish and neutral future scenarios.

If the prices follow a bearish trajectory and reach only $100,000 by 2040, the energy consumption will halve from present levels and decrease to 45 TWh — equating to 0.02% of the global energy consumption in 2040 by estimation.

In the neutral scenario, where the prices reach $500,000 by 2040, the energy consumption levels are estimated to be around 223 TWh.

Bitcoin Halving limits energy consumption

The effects of halving are observable in bearish and neutral scenarios. The bearish scenario implies a 4x increase in the prices. While it would be logical for the energy consumption levels to increase, the estimated consumption levels are lower than present-day levels.

Similarly, the costs increase 20x in the neutral scenario, while consumption levels will be around 2x higher than current levels.

The block subsidy halves every 210,000 blocks, roughly every four years. Due to this, mining’s energy consumption levels will gradually weaken as time passes. The report states:

“Bitcoin’s energy consumption will only increase if the bitcoin price increases at a faster rate than the block subsidy declines. The block subsidy halves every fourth year, and the bitcoin price must double every fourth year to offset this effect.”

The report added:

“In this case, the bitcoin price must be around $650k in 2040 for its energy consumption to be higher than the current.”

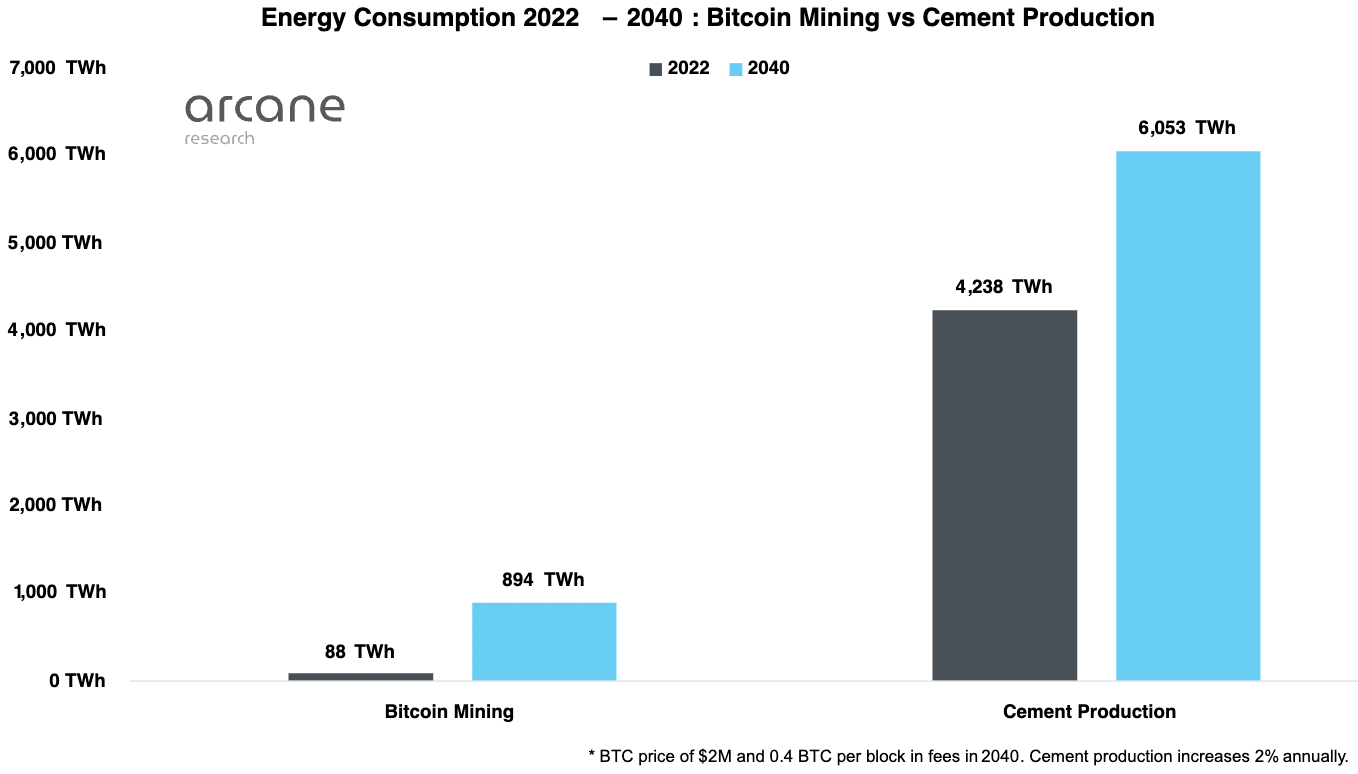

The report also compares Bitcoin’s energy production with cement production to highlight the decreasing need for energy.

The chart above assumes that the most energy-consuming scenario to come true. If the Bitcoin price reaches $2 million by 2040 and the annual energy consumption reaches 894 TWh, the annual Bitcoin energy demand will equate to 0.36% of the global energy consumption.

While this is a drastic increase from the current 0.05%, it remains low compared to cement production, which consumes 2% of global energy.

Green Bitcoin mining

In addition to its decreasing energy need, the crypto community is growing bullish on sustainable energy. The community has been finding ways to utilize solar power, wind, hydropower, geothermal, tidal power, and waste energy.

Various partnerships have been arising from the crypto community, especially since the end of 2021. In May 2022, Block, Blockstream, and Tesla partnered to create a green mining farm using solar power.

In April, Marathon Digital decided to replace its energy sources with carbon-neutral ones. On the other hand, Kenya started a nationwide initiative to allow mining companies to use surplus geothermal powers.

Recent studies also reflect the growing trend of sustainable power in crypto mining. A Bitcoin Mining Council (BMC) report from October 2021 showed that the mining industry’s sustainable energy usage was 57.7%.

BMC’s following report was released in May 2022 and calculated that sustainable energy usage had grown to over 74%.

The post Bitcoin mining energy consumption estimated to rise 10x if price hits $2M – Arcane Research appeared first on CryptoSlate.